Question: (Click on the icon to view additional information.) Requirement 1. Prepare the bank reconciliation. There are no bank or book errors. Begin by preparing the

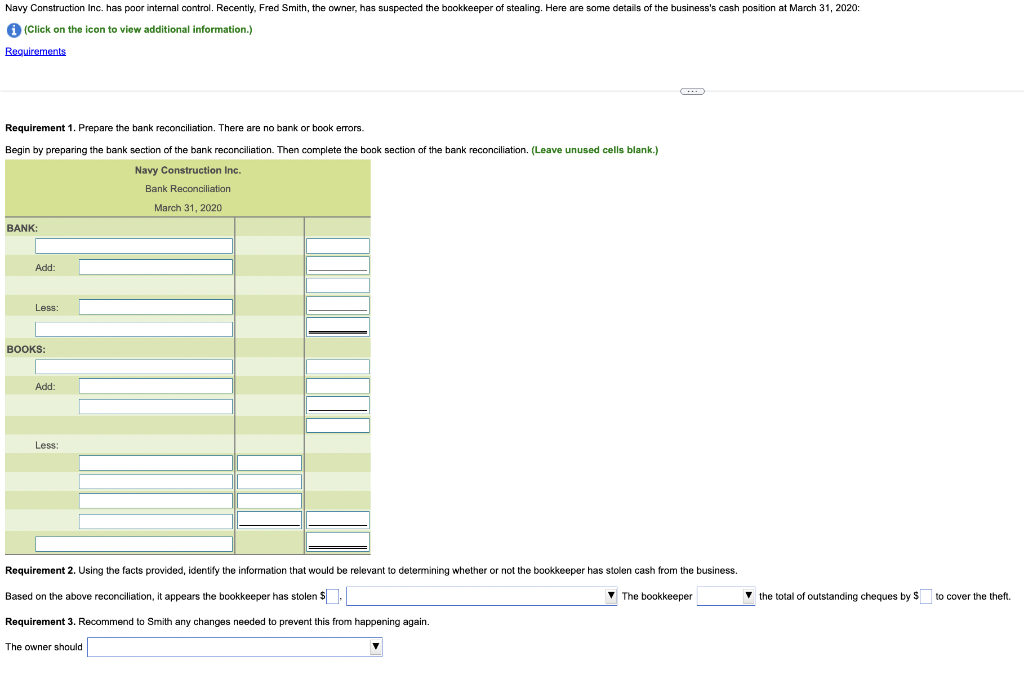

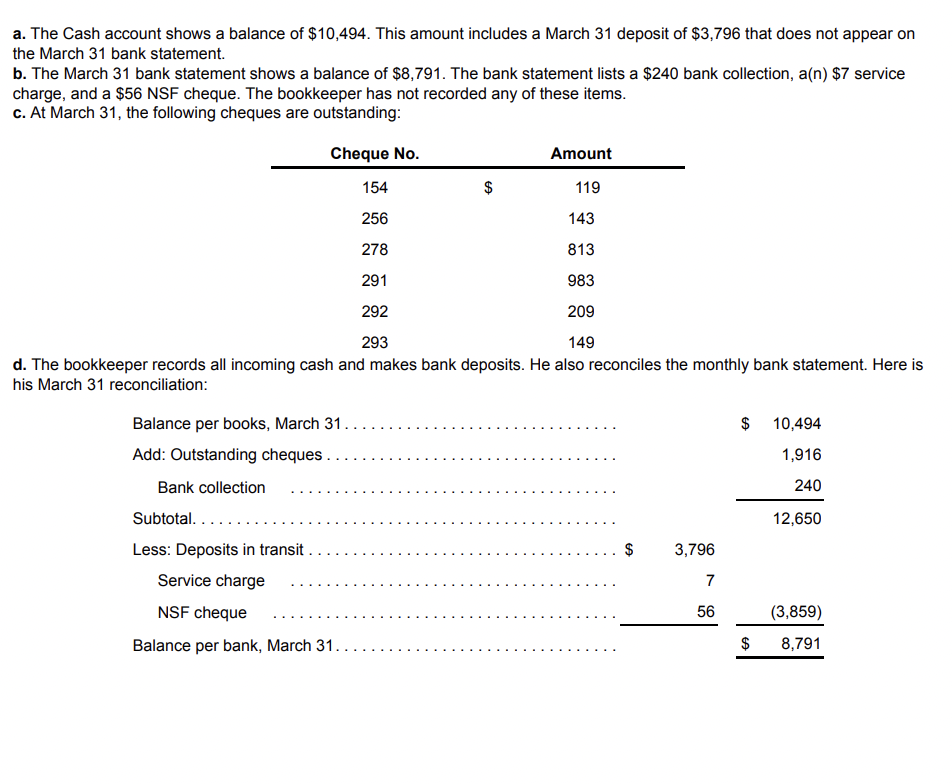

(Click on the icon to view additional information.) Requirement 1. Prepare the bank reconciliation. There are no bank or book errors. Begin by preparing the bank section of the bank reconciliation. Then complete the book section of the bank reconciliation. (Leave unused cells blank.) Based on the above reconciliation, it appears the bookkeeper has stolen! - The bookkeeper the total of outstanding cheques by $ to cover the theft. Requirement 3. Recommend to Smith any changes needed to prevent this from happening again. The owner should a. The Cash account shows a balance of $10,494. This amount includes a March 31 deposit of $3,796 that does not appear on the March 31 bank statement. b. The March 31 bank statement shows a balance of $8,791. The bank statement lists a $240 bank collection, a(n) $7 service charge, and a $56 NSF cheque. The bookkeeper has not recorded any of these items. c. At March 31, the following cheques are outstanding: d. The bookkeeper records all incoming cash and makes bank deposits. He also reconciles the monthly bank statement. Here is his March 31 reconciliation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts