Question: Orange Construction Inc. has poor internal control. Recently, Evan Midas, the owner, has suspected the bookkeeper of stealing. Here are some details of the business's

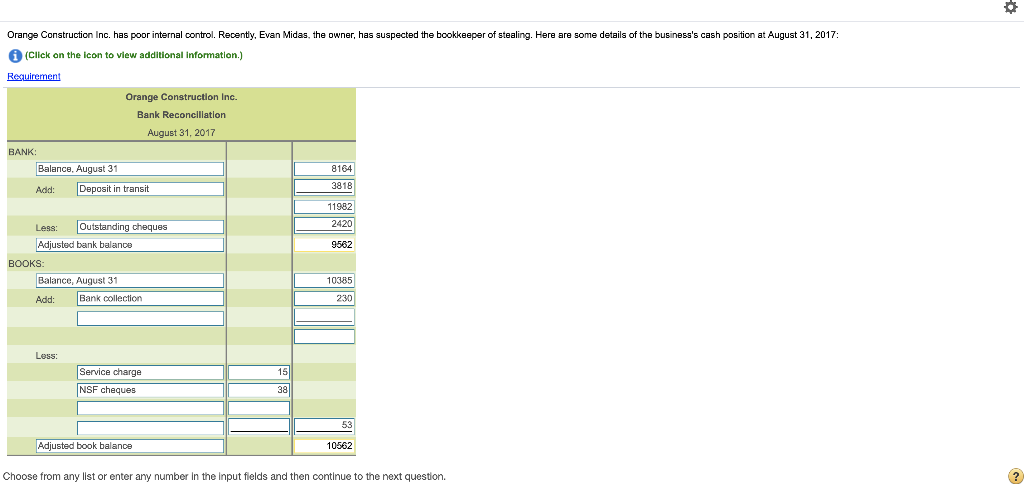

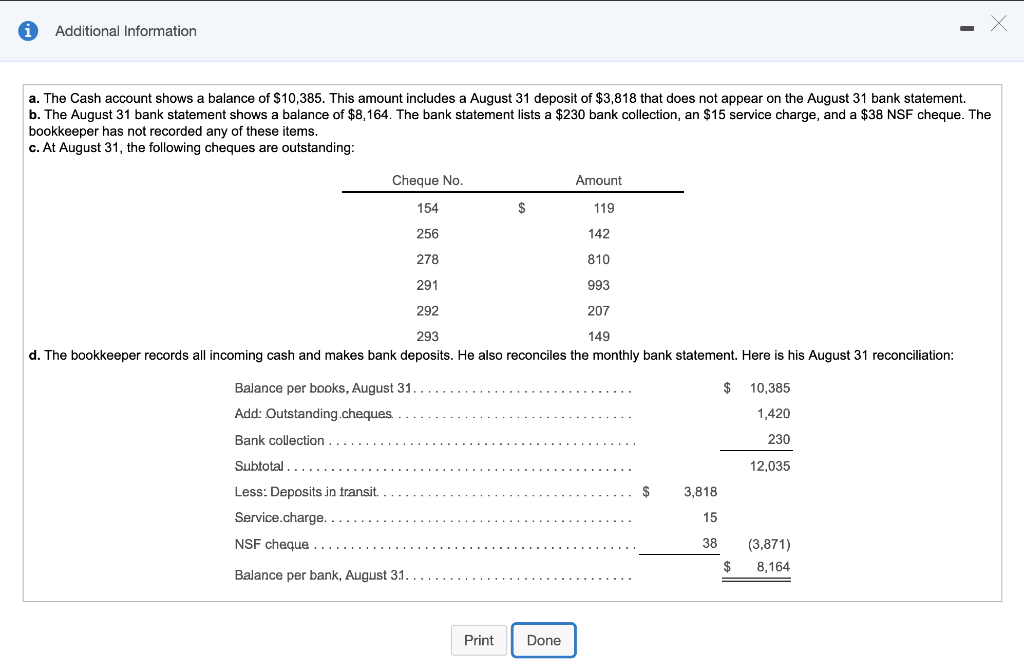

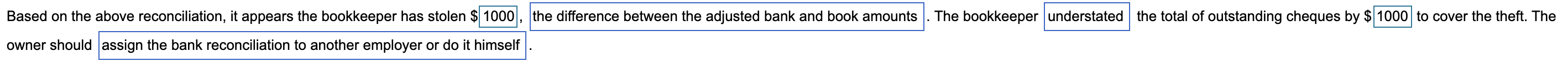

Orange Construction Inc. has poor internal control. Recently, Evan Midas, the owner, has suspected the bookkeeper of stealing. Here are some details of the business's cash position at August 31, 2017: (Click on the icon to view additional Information.) Requirement Orange Construction Inc. Bank Reconciliation August 31, 2017 BANK: Balance, August 31 Add: Deposit in transit 8164 11982 2420 9562 Less: Outstanding cheques Adjusted bank balance BOOKS: Balance, August 31 Add: Bank collection 10385 Less: Service charge NSF cheques 53 Adjusted book balance 10562 Choose from any list or enter any number in the input fields and then continue to the next question. 0 Additional Information a. The Cash account shows a balance of $10,385. This amount includes a August 31 deposit of $3,818 that does not appear on the August 31 bank statement. b. The August 31 bank statement shows a balance of $8,164. The bank statement lists a $230 bank collection, an $15 service charge, and a $38 NSF cheque. The bookkeeper has not recorded any of these items. c. At August 31, the following cheques are outstanding: Cheque No. Amount 119 154 256 142 810 278 291 993 292 207 293 149 d. The bookkeeper records all incoming cash and makes bank deposits. He also reconciles the monthly bank statement. Here is his August 31 reconciliation: $ Balance per books, August 31. ... Add: Outstanding.cheques.. Bank collection... Subtotal. Less: Deposits.in transit..... Service.charge.. NSF cheque .......... 10,385 1,420 230 12,035 3,818 15 38 (3,871) 8,164 $ Balance per bank, August 31. .......... Print Done understated the total of outstanding cheques by $ 1000 to cover the theft. The Based on the above reconciliation, it appears the bookkeeper has stolen $1000, the difference between the adjusted bank and book amounts. The bookkeeper owner should assign the bank reconciliation to another employer or do it himself

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts