Question: Click on the table icon to view the PVIF table Click on the table icon to view the PVIFA table According to the figure

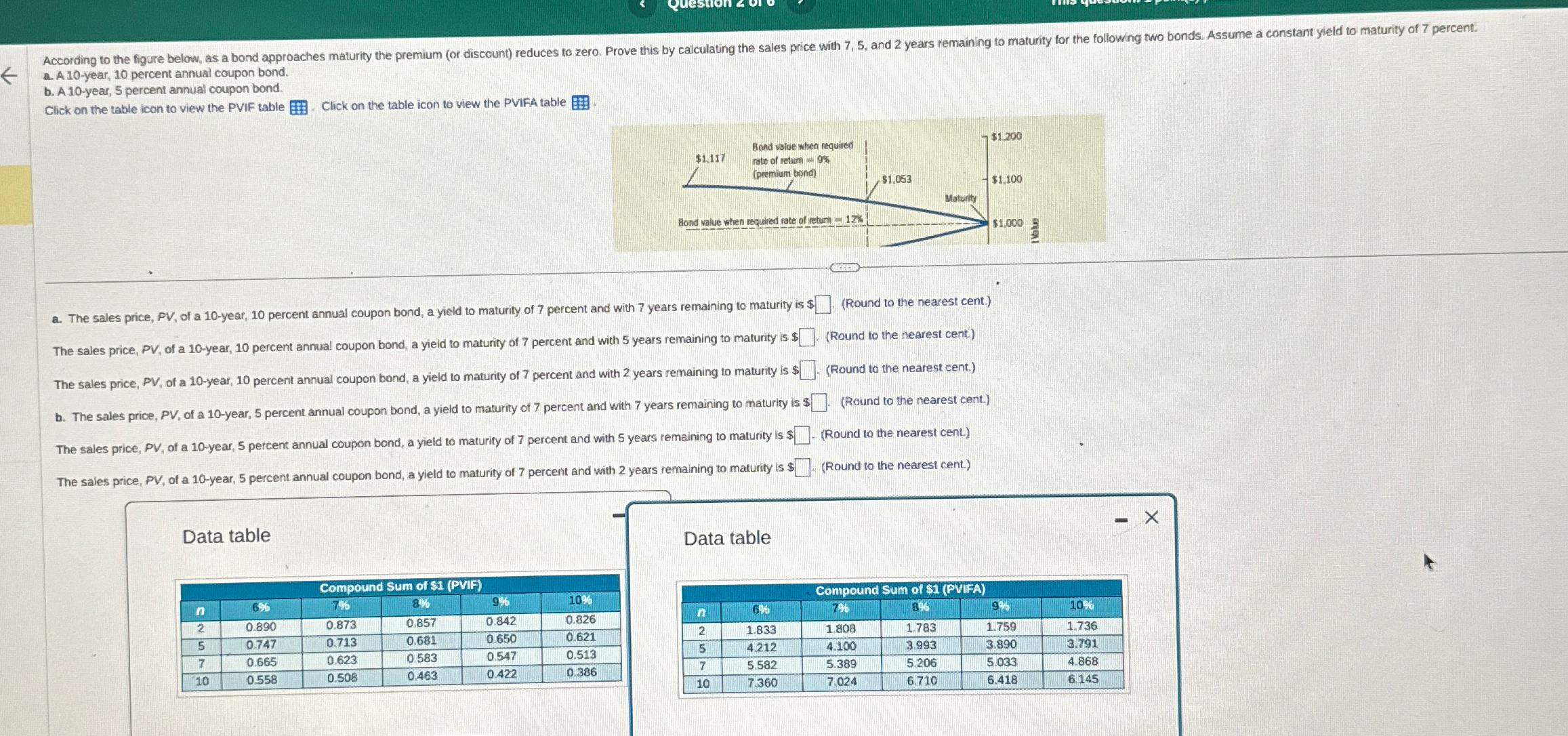

Click on the table icon to view the PVIF table Click on the table icon to view the PVIFA table According to the figure below, as a bond approaches maturity the premium (or discount) reduces to zero. Prove this by calculating the sales price with 7, 5, and 2 years remaining to maturity for the following two bonds. Assume a constant yield to maturity of 7 percent. a. A 10-year, 10 percent annual coupon bond. b. A 10-year, 5 percent annual coupon bond. $1,117 Bond value when required rate of retum-9% (premium bond) Bond value when required rate of return -12% $1,200 $1,053 $1.100 Maturity $1,000 (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) a. The sales price, PV, of a 10-year, 10 percent annual coupon bond, a yield to maturity of 7 percent and with 7 years remaining to maturity is $ The sales price, PV, of a 10-year, 10 percent annual coupon bond, a yield to maturity of 7 percent and with 5 years remaining to maturity is $ The sales price, PV, of a 10-year, 10 percent annual coupon bond, a yield to maturity of 7 percent and with 2 years remaining to maturity is $ b. The sales price, PV, of a 10-year, 5 percent annual coupon bond, a yield to maturity of 7 percent and with 7 years remaining to maturity is $ (Round to the nearest cent.) The sales price, PV, of a 10-year, 5 percent annual coupon bond, a yield to maturity of 7 percent and with 5 years remaining to maturity is $ The sales price, PV, of a 10-year, 5 percent annual coupon bond, a yield to maturity of 7 percent and with 2 years remaining to maturity is $ (Round to the nearest cent.) (Round to the nearest cent.) Data table Data table VORUO Compound Sum of $1 (PVIF) n 6% 796 8% 9% 10% Compound Sum of $1 (PVIFA) 2 0.890 0.873 0.857 0.842 0.826 n 6% 7% 8% 9% 10% 2 1.833 1.808 1.783 1.759 1.736 5 0.747 0.713 0.681 0.650 0.621 7 0.665 0.623 0.583 0.547 0.513 5 4.212 4.100 3.993 3.890 3.791 10 0.558 0.508 0.463 0.422 0.386 7 5.582 5.389 5.206 5.033 4.868 10 7.360 7.024 6.710 6.418 6.145

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts