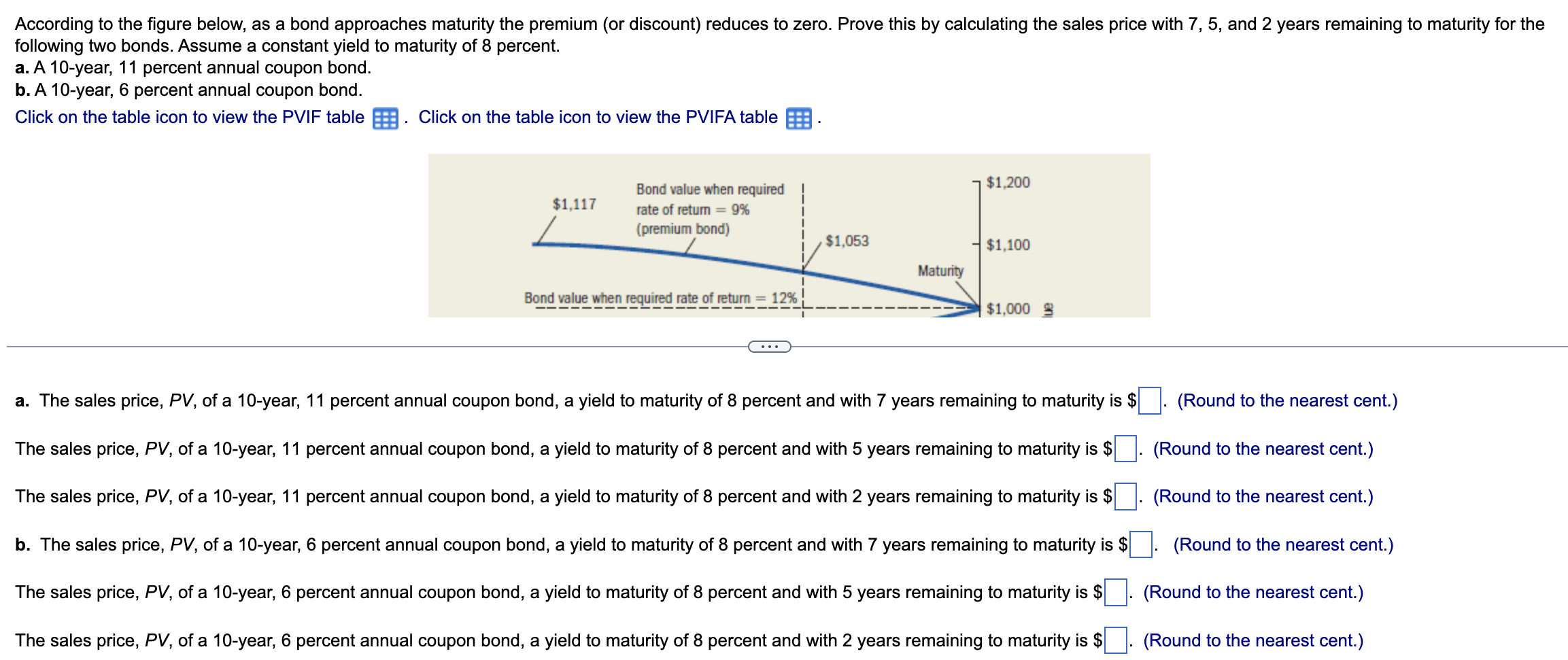

Question: Data table Data table According to the figure below, as a bond approaches maturity the premium (or discount) reduces to zero. Prove this by calculating

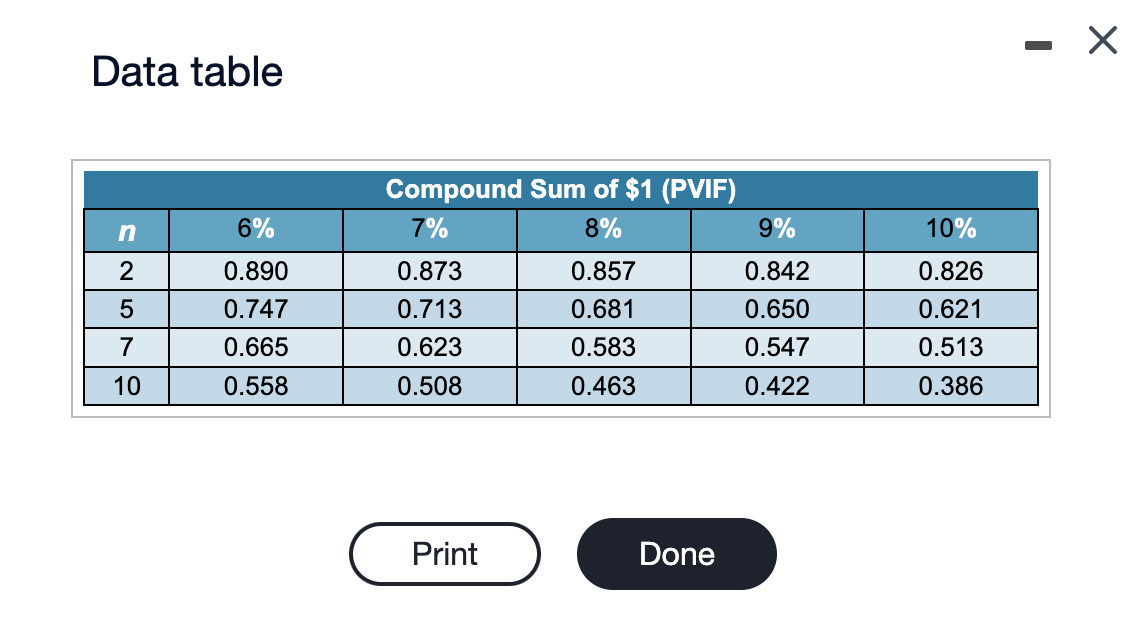

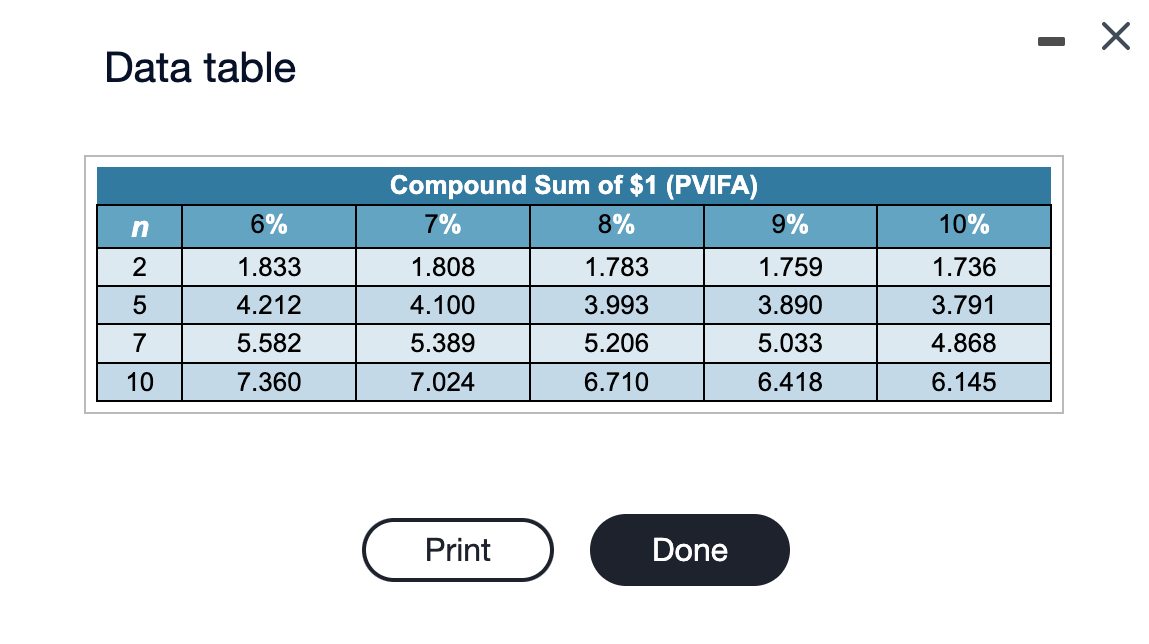

Data table Data table According to the figure below, as a bond approaches maturity the premium (or discount) reduces to zero. Prove this by calculating the sales price with 7,5 , and 2 years remaining to maturity for the following two bonds. Assume a constant yield to maturity of 8 percent. a. A 10 -year, 11 percent annual coupon bond. b. A 10 -year, 6 percent annual coupon bond. Click on the table icon to view the PVIF table Click on the table icon to view the PVIFA table a. The sales price, PV, of a 10 -year, 11 percent annual coupon bond, a yield to maturity of 8 percent and with 7 years remaining to maturity is $ The sales price, PV, of a 10 -year, 11 percent annual coupon bond, a yield to maturity of 8 percent and with 5 years remaining to maturity is $ The sales price, PV, of a 10 -year, 11 percent annual coupon bond, a yield to maturity of 8 percent and with 2 years remaining to maturity is $ b. The sales price, PV, of a 10-year, 6 percent annual coupon bond, a yield to maturity of 8 percent and with 7 years remaining to maturity is $ The sales price, PV, of a 10 -year, 6 percent annual coupon bond, a yield to maturity of 8 percent and with 5 years remaining to maturity is $ The sales price, PV, of a 10 -year, 6 percent annual coupon bond, a yield to maturity of 8 percent and with 2 years remaining to maturity is $ (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) . (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts