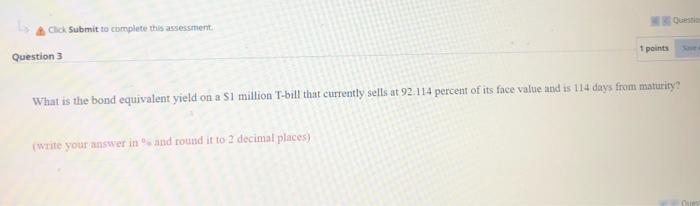

Question: Click Submit to complete this assessment 1 points Question 3 What is the bond equivalent yield on a $1 million T-bill that currently sells at

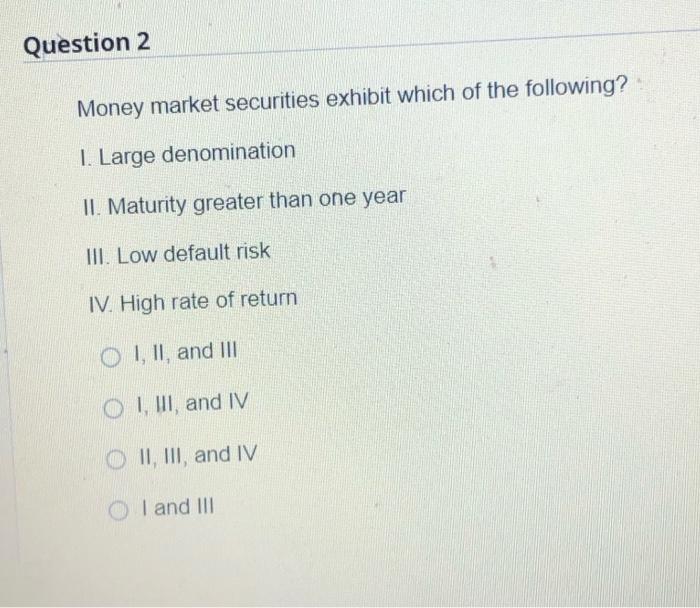

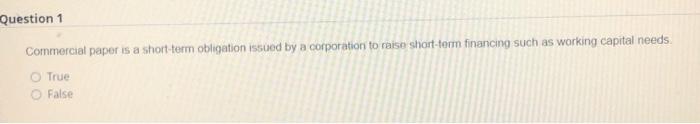

Click Submit to complete this assessment 1 points Question 3 What is the bond equivalent yield on a $1 million T-bill that currently sells at 92.114 percent of its face value and is 114 days from maturity? (write your answer in and round it to 2 decimal places) Question 2 Money market securities exhibit which of the following? I. Large denomination II. Maturity greater than one year III. Low default risk IV. High rate of return O I, II and III OT, WI and IV O II, III, and IV O I and III Question 1 Commercial paper is a short-term obligation issued by a corporation to raise short-term financing such as working capital needs. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts