Question: Question 4 7 points Save Answer You like to buy two bonds. Both bonds have a coupon rate of 8 percent, a face value of

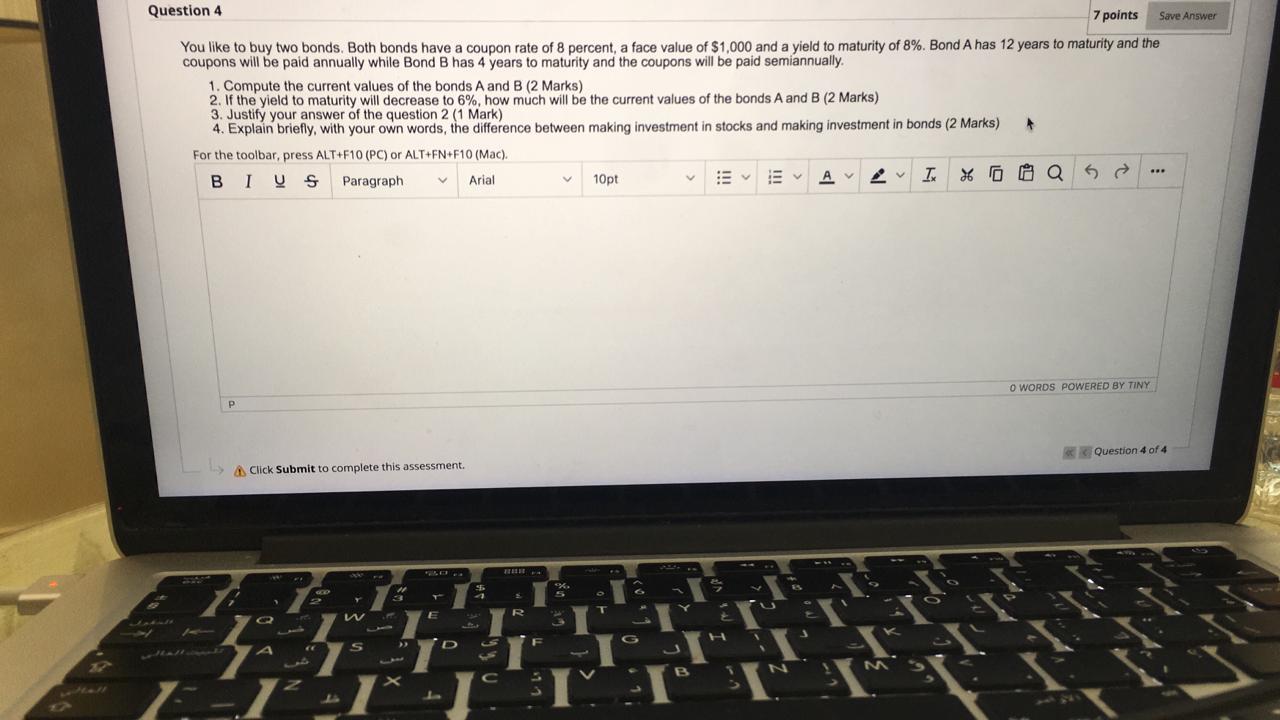

Question 4 7 points Save Answer You like to buy two bonds. Both bonds have a coupon rate of 8 percent, a face value of $1,000 and a yield to maturity of 8%. Bond A has 12 years to maturity and the coupons will be paid annually while Bond B has 4 years to maturity and the coupons will be paid semiannually. 1. Compute the current values of the bonds A and B (2 Marks) 2. If the yield to maturity will decrease to 6%, how much will be the current values of the bonds A and B (2 Marks) 3. Justify your answer of the question 2 (1 Mark) 4. Explain briefly, with your own words, the difference between making investment in stocks and making investment in bonds (2 Marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI V Paragraph Arial 10pt 2 In Go HQ a se .. O WORDS POWERED BY TINY P Question 4 of 4 Click Submit to complete this assessment. S Y 3 R T Y W E A S D N X C 7-11 LI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts