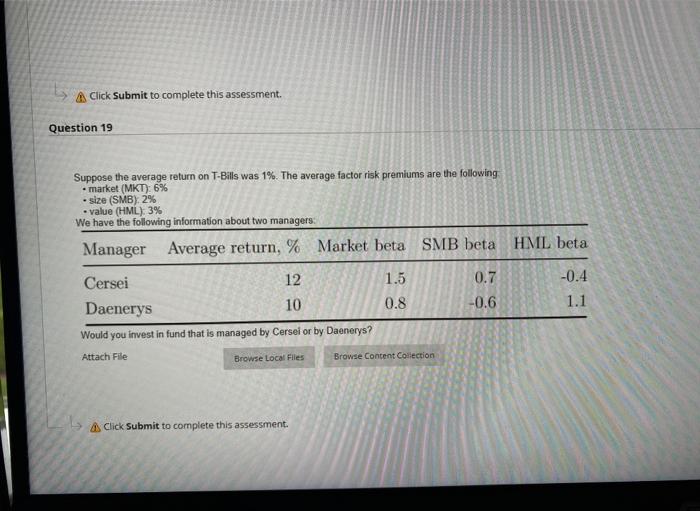

Question: Click Submit to complete this assessment. Question 19 Suppose the average return on T-Bills was 1%. The average factor risk premiums are the following .market

Click Submit to complete this assessment. Question 19 Suppose the average return on T-Bills was 1%. The average factor risk premiums are the following .market (MKT): 6% size (SMB) 2% value (HML): 3% We have the following information about two managers: Manager Average return, % Market beta SMB beta HML beta 0.7 -0.6 -0.4 1.1 Cersei 12 1.5 Daenerys 10 0.8 Would you invest in fund that is managed by Cersei or by Daenerys? Attach File Browse Local Files Browse Content Collection Click Submit to complete this assessment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock