Question: (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Consider how

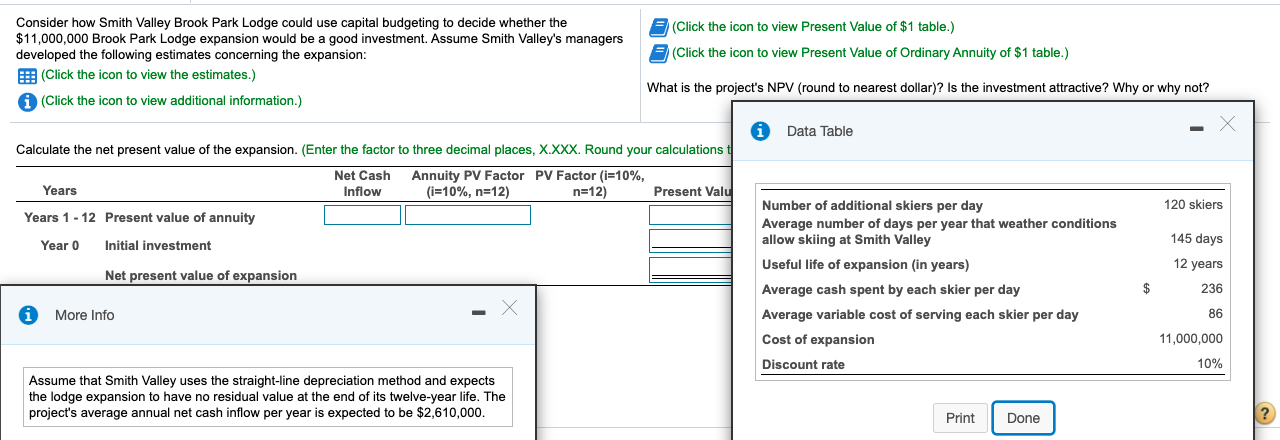

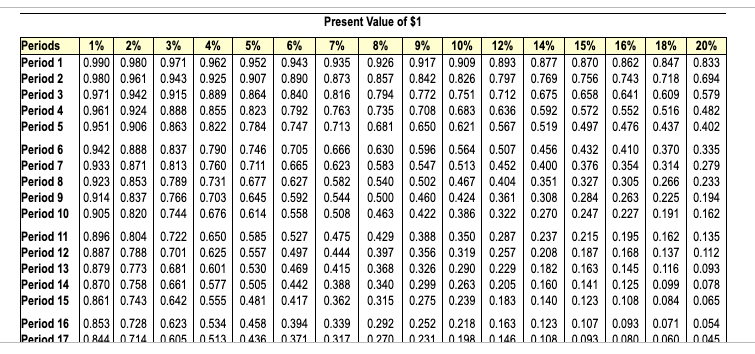

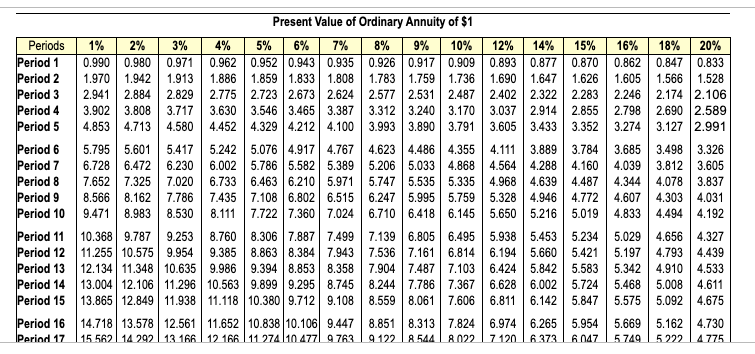

(Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Consider how Smith Valley Brook Park Lodge could use capital budgeting to decide whether the $11,000,000 Brook Park Lodge expansion would be a good investment. Assume Smith Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) i (Click the icon to view additional information.) What is the project's NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Data Table Calculate the net present value of the expansion. (Enter the factor to three decimal places, X.XXX. Round your calculations t Net Cash Annuity PV Factor PV Factor (i=10%, Years Inflow (i=10%, n=12) n=12) Present Valu Years 1 - 12 Present value of annuity 120 skiers Year 0 Initial investment 145 days 12 years Net present value of expansion Number of additional skiers per day Average number days per year that weather conditions allow skiing at Smith Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day Cost of expansion Discount rate $ 236 More Info 86 11,000,000 10% Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have no residual value at the end of its twelve-year life. The project's average annual net cash inflow per year is expected to be $2,610,000. Print Done Done Present Value of $1 6% 0.943 0.890 0.840 0.792 0.747 7% 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 18% 20% 0.847 0.833 0.7180.694 0.609 0.579 0.516 0.482 0.437 0.402 Periods 1% 2% 3% 4% 5% Period 1 0.990 0.980 0.971 0.962 0.952 Period 2 0.980 0.961 0.943 0.925 0.907 Period 3 0.971 0.942 0.915 0.889 0.864 Period 4 0.961 0.924 0.888 0.855 0.823 Period 5 0.951 0.906 0.863 0.822 0.784 Period 6 0.942 0.888 0.837 0.790 0.746 Period 7 0.933 0.871 0.813 0.760 0.711 Period 8 0.923 0.853 0.789 0.731 0.677 Period 9 0.914 0.837 0.766 0.703 0.645 Period 10 0.905 0.820 0.744 0.676 0.614 Period 11 0.896 0.804 0.722 0.650 0.585 Period 12 0.887 0.788 0.701 0.625 0.557 Period 13 0.879 0.773 0.681 0.601 0.530 Period 14 0.870 0.758 0.661 0.577 0.505 Period 15 0.861 0.743 0.642 0.555 0.481 Period 16 0.853 0.728 0.623 0.534 0.458 Period 17 844 0 714 10 05 10 513 0436 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 9% 10% 12% 14% 15% 16% 0.917 0.909 0.893 0.877 0.870 0.862 0.8420.826 0.797 0.769 0.756 0.743 0.772 0.751 0.712 0.675 0.658 0.641 0.708 0.683 0.636 0.592 0.572 0.552 0.650 0.621 0.567 0.519 0.497 0.476 0.596 0.564 0.507 0.456 0.432 0.410 0.547 0.513 0.452 0.400 0.376 0.354 0.502 0.467 0.404 0.351 0.327 0.305 0.460 0.424 0.361 0.308 0.284 0.263 0.422 0.386 0.322 0.270 0.247 0.227 0.388 0.350 0.287 0.237 0.215 0.195 0.356 0.319 0.257 0.208 0.187 0.168 0.326 0.290 0.229 0.182 0.163 0.145 0.299 0.263 0.205 0.160 0.141 0.125 0.275 0.239 0.183 0.140 0.123 0.108 0.252 0.218 0.163 0.123 0.107 0.093 0 231 198 146 0108 093 0080 0.370 0.335 0.314 0.279 0.266 0.233 0.225 0.194 0.191 0.162 0.527 0.497 0.469 0.442 0.417 0.475 0.444 0.415 0.388 0.362 0.429 0.397 0.368 0.340 0.315 0.162 0.135 0.137 0.112 0.116 0.093 0.099 0.078 0.084 0.065 0.394 0 371 0.339 0317 0.292 0270 0.071 0.054 0060 0045 Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 2% 0.990 0.980 1.970 1.942 2.941 2.884 3.902 3.808 4.8534.713 3% 0.971 1.913 2.829 3.717 4.580 Present Value of Ordinary Annuity of $1 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.626 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 5.242 5.076 4.917 4.767 4.623 4.4864.355 4.111 3.889 3.784 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.3284.946 4.772 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.6505.216 5.019 16% 0.862 1.605 2.246 2.798 3.274 18% 20% 0.847 0.833 1.566 1.528 2.174 2.106 2.690 2.589 3.127 2.991 Period 6 Period 7 Period 8 Period 9 Period 10 5.795 5.601 6.728 6.472 7.652 7.325 8.566 8.162 9.471 8.983 5.417 6.230 7.020 7.786 8.530 3.685 4.039 4.344 4.607 4.833 3.498 3.326 3.812 3.605 4.078 3.837 4.303 4.031 4.494 4.192 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 10.368 9.787 9.253 8.760 8.306 7.887 7.499 11.255 10.575 9.954 9.385 8.863 8.384 7.943 12.134 11.348 10.635 | 9.986 9.394 8.853 8.358 13.004 12.106 11.296 10.563 9.899 9.295 8.745 13.865 12.849 11.938 11.118 10.380 9.712 9.108 7.139 6.805 6.495 7.5367.161 | 6.814 7.904 7.487 7.103 8.244 7.786 7.367 8.559 8.061 7.606 5.938 5.453 5.234 6.194 5.660 5.421 6.424 5.842 5.583 6.628 6.002 5.724 6.811 6.142 5.847 5.029 5.197 5.342 5.468 5.575 4.656 4.327 4.793 4.439 4.910 4.533 5.008 4.611 5.092 4.675 14.718 13.578 12.561 11.652 10.838 10.106 9.447 15 5621 14 292 13 166 12 166 | 11 274 110 4771 9 763 8.851 8.313 7.824 9 122 8 544 8022 6.974 6.265 5.954 7 120 16373 6047 5.669 5 749 5.1624.730 5222 4775 (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Consider how Smith Valley Brook Park Lodge could use capital budgeting to decide whether the $11,000,000 Brook Park Lodge expansion would be a good investment. Assume Smith Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) i (Click the icon to view additional information.) What is the project's NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Data Table Calculate the net present value of the expansion. (Enter the factor to three decimal places, X.XXX. Round your calculations t Net Cash Annuity PV Factor PV Factor (i=10%, Years Inflow (i=10%, n=12) n=12) Present Valu Years 1 - 12 Present value of annuity 120 skiers Year 0 Initial investment 145 days 12 years Net present value of expansion Number of additional skiers per day Average number days per year that weather conditions allow skiing at Smith Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day Cost of expansion Discount rate $ 236 More Info 86 11,000,000 10% Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have no residual value at the end of its twelve-year life. The project's average annual net cash inflow per year is expected to be $2,610,000. Print Done Done Present Value of $1 6% 0.943 0.890 0.840 0.792 0.747 7% 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 18% 20% 0.847 0.833 0.7180.694 0.609 0.579 0.516 0.482 0.437 0.402 Periods 1% 2% 3% 4% 5% Period 1 0.990 0.980 0.971 0.962 0.952 Period 2 0.980 0.961 0.943 0.925 0.907 Period 3 0.971 0.942 0.915 0.889 0.864 Period 4 0.961 0.924 0.888 0.855 0.823 Period 5 0.951 0.906 0.863 0.822 0.784 Period 6 0.942 0.888 0.837 0.790 0.746 Period 7 0.933 0.871 0.813 0.760 0.711 Period 8 0.923 0.853 0.789 0.731 0.677 Period 9 0.914 0.837 0.766 0.703 0.645 Period 10 0.905 0.820 0.744 0.676 0.614 Period 11 0.896 0.804 0.722 0.650 0.585 Period 12 0.887 0.788 0.701 0.625 0.557 Period 13 0.879 0.773 0.681 0.601 0.530 Period 14 0.870 0.758 0.661 0.577 0.505 Period 15 0.861 0.743 0.642 0.555 0.481 Period 16 0.853 0.728 0.623 0.534 0.458 Period 17 844 0 714 10 05 10 513 0436 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 9% 10% 12% 14% 15% 16% 0.917 0.909 0.893 0.877 0.870 0.862 0.8420.826 0.797 0.769 0.756 0.743 0.772 0.751 0.712 0.675 0.658 0.641 0.708 0.683 0.636 0.592 0.572 0.552 0.650 0.621 0.567 0.519 0.497 0.476 0.596 0.564 0.507 0.456 0.432 0.410 0.547 0.513 0.452 0.400 0.376 0.354 0.502 0.467 0.404 0.351 0.327 0.305 0.460 0.424 0.361 0.308 0.284 0.263 0.422 0.386 0.322 0.270 0.247 0.227 0.388 0.350 0.287 0.237 0.215 0.195 0.356 0.319 0.257 0.208 0.187 0.168 0.326 0.290 0.229 0.182 0.163 0.145 0.299 0.263 0.205 0.160 0.141 0.125 0.275 0.239 0.183 0.140 0.123 0.108 0.252 0.218 0.163 0.123 0.107 0.093 0 231 198 146 0108 093 0080 0.370 0.335 0.314 0.279 0.266 0.233 0.225 0.194 0.191 0.162 0.527 0.497 0.469 0.442 0.417 0.475 0.444 0.415 0.388 0.362 0.429 0.397 0.368 0.340 0.315 0.162 0.135 0.137 0.112 0.116 0.093 0.099 0.078 0.084 0.065 0.394 0 371 0.339 0317 0.292 0270 0.071 0.054 0060 0045 Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 2% 0.990 0.980 1.970 1.942 2.941 2.884 3.902 3.808 4.8534.713 3% 0.971 1.913 2.829 3.717 4.580 Present Value of Ordinary Annuity of $1 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.626 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 5.242 5.076 4.917 4.767 4.623 4.4864.355 4.111 3.889 3.784 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.3284.946 4.772 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.6505.216 5.019 16% 0.862 1.605 2.246 2.798 3.274 18% 20% 0.847 0.833 1.566 1.528 2.174 2.106 2.690 2.589 3.127 2.991 Period 6 Period 7 Period 8 Period 9 Period 10 5.795 5.601 6.728 6.472 7.652 7.325 8.566 8.162 9.471 8.983 5.417 6.230 7.020 7.786 8.530 3.685 4.039 4.344 4.607 4.833 3.498 3.326 3.812 3.605 4.078 3.837 4.303 4.031 4.494 4.192 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 10.368 9.787 9.253 8.760 8.306 7.887 7.499 11.255 10.575 9.954 9.385 8.863 8.384 7.943 12.134 11.348 10.635 | 9.986 9.394 8.853 8.358 13.004 12.106 11.296 10.563 9.899 9.295 8.745 13.865 12.849 11.938 11.118 10.380 9.712 9.108 7.139 6.805 6.495 7.5367.161 | 6.814 7.904 7.487 7.103 8.244 7.786 7.367 8.559 8.061 7.606 5.938 5.453 5.234 6.194 5.660 5.421 6.424 5.842 5.583 6.628 6.002 5.724 6.811 6.142 5.847 5.029 5.197 5.342 5.468 5.575 4.656 4.327 4.793 4.439 4.910 4.533 5.008 4.611 5.092 4.675 14.718 13.578 12.561 11.652 10.838 10.106 9.447 15 5621 14 292 13 166 12 166 | 11 274 110 4771 9 763 8.851 8.313 7.824 9 122 8 544 8022 6.974 6.265 5.954 7 120 16373 6047 5.669 5 749 5.1624.730 5222 4775

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts