Question: # (Click the icon to view the present value annuity factor table.) # (Click the icon to view the present value factor table.) # (Click

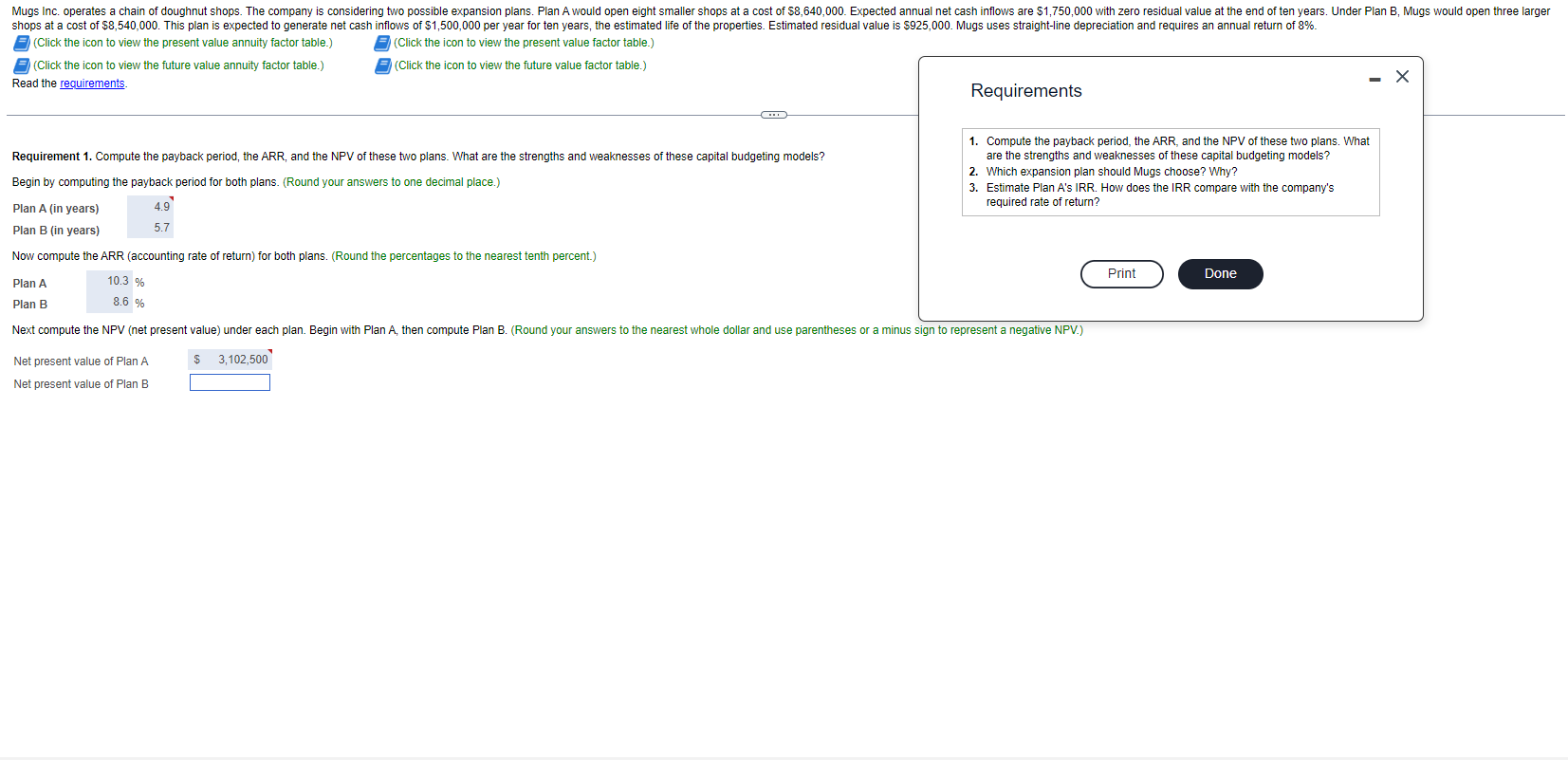

\# (Click the icon to view the present value annuity factor table.) \# (Click the icon to view the present value factor table.) \# (Click the icon to vie Read the requirements. \# (Click the icon to view the future value factor table.) Read the requirements. Requirements 1. Compute the payback period, the ARR, and the NPV of these two plans. What Requirement 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? are the strengths and weaknesses of these capital budgeting models? 2. Which expansion plan should Mugs choose? Why? Begin by computing the payback period for both plans. (Round your answers to one decimal place.) 3. Estimate Plan A's IRR. How does the IRR compare with the company's PlanA(inyears)PlanB(inyears)4.95.7 required rate of return? Now compute the ARR (accounting rate of return) for both plans. (Round the percentages to the nearest tenth percent.) \begin{tabular}{l|r|} Plan A & 10.3% \\ Plan B & 8.6% \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts