Question: 3. Factor Models. Suppose a factor model is appropriate to describe the returns on a stock. The current expected return on the stock is 10.5

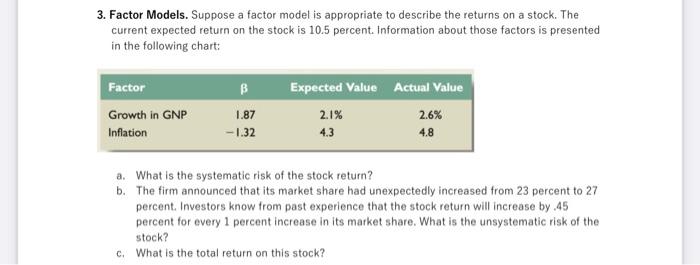

3. Factor Models. Suppose a factor model is appropriate to describe the returns on a stock. The current expected return on the stock is 10.5 percent. Information about those factors is presented in the following chart: a. What is the systematic risk of the stock return? b. The firm announced that its market share had unexpectedly increased from 23 percent to 27 percent. Investors know from past experience that the stock return will increase by . 45 percent for every 1 percent increase in its market share. What is the unsystematic risk of the stock? c. What is the total return on this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts