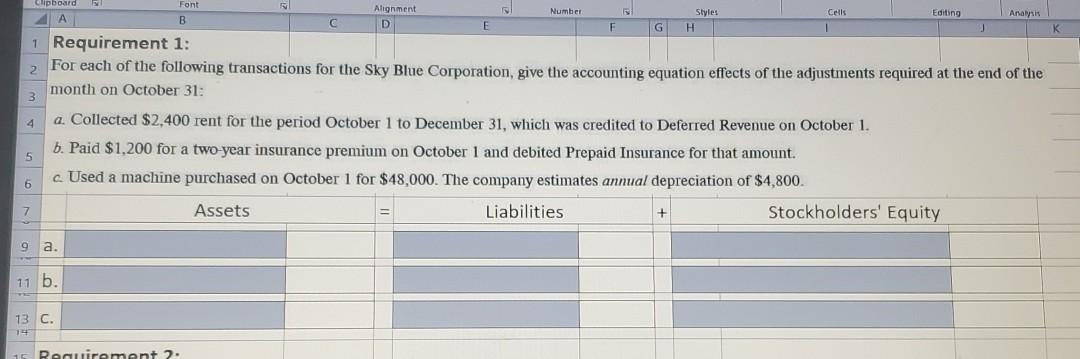

Question: Clipboard Font B Number Cells Editing Analysis Styles G Alignment AI D 1 Requirement 1: 2 For each of the following transactions for the Sky

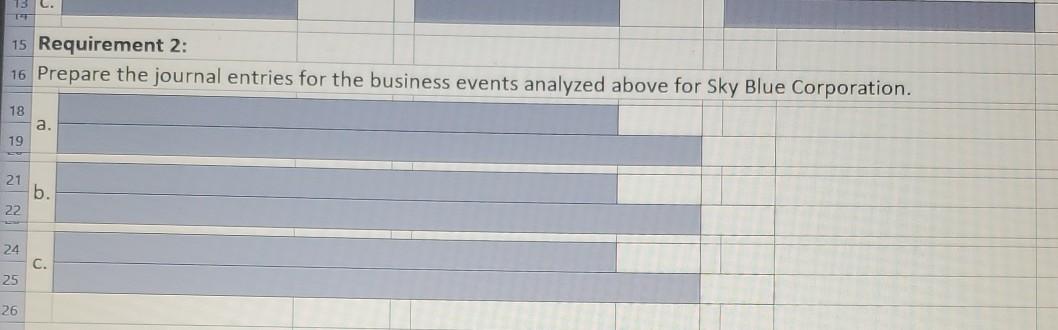

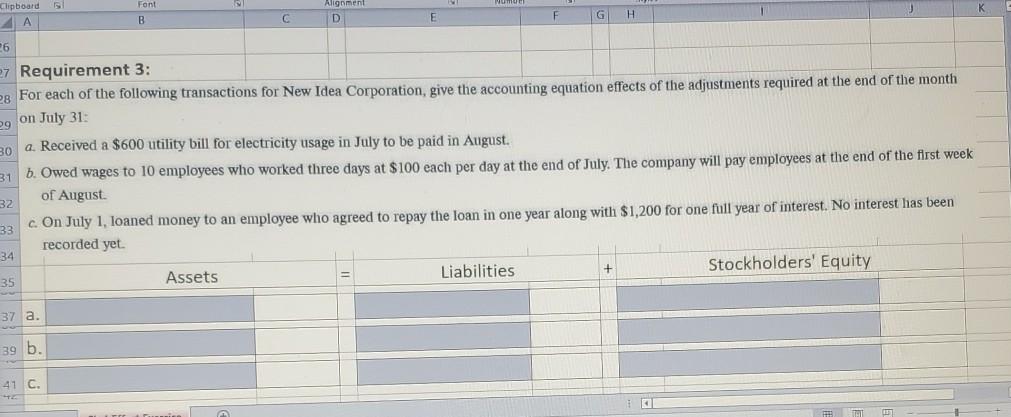

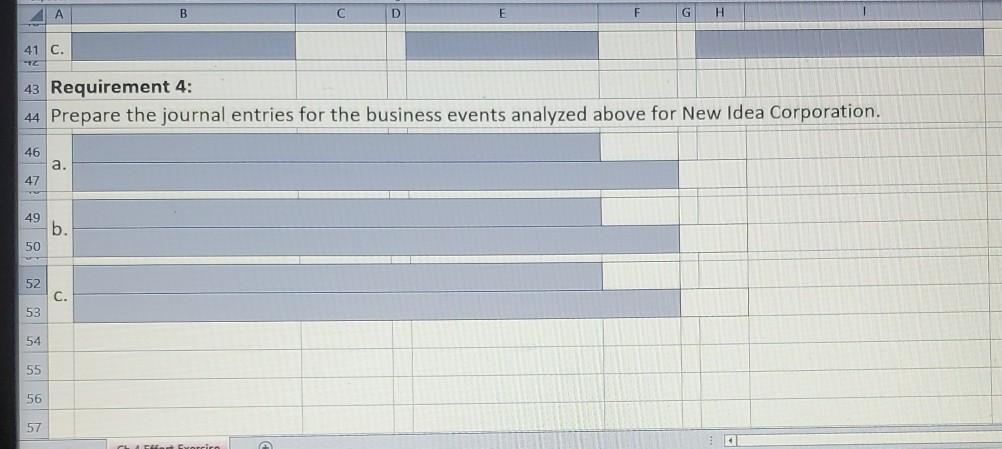

Clipboard Font B Number Cells Editing Analysis Styles G Alignment AI D 1 Requirement 1: 2 For each of the following transactions for the Sky Blue Corporation, give the accounting equation effects of the adjustments required at the end of the month on October 31: 3 4 5 a. Collected $2,400 rent for the period October 1 to December 31, which was credited to Deferred Revenue on October 1. b. Paid $1,200 for a two-year insurance premium on October 1 and debited Prepaid Insurance for that amount. c Used a machine purchased on October 1 for $48,000. The company estimates annual depreciation of $4,800. Assets Liabilities Stockholders' Equity 6 7 + 9 a. 11 b. 13 C. Recuirement 2. 13 1. 15 Requirement 2: 16 Prepare the journal entries for the business events analyzed above for Sky Blue Corporation. 18 a. 19 21 b 22 24 C. 25 26 K Clipboard AA Font B D G H 26 27 Requirement 3: 28 For each of the following transactions for New Idea Corporation, give the accounting equation effects of the adjustments required at the end of the month 29 on July 31: 30 a Received a $600 utility bill for electricity usage in July to be paid in August. 31 6. Owed wages to 10 employees who worked three days at $100 each per day at the end of July. The company will pay employees at the end of the first week of August. 32 33 c. On July 1, loaned money to an employee who agreed to repay the loan in one year along with $1,200 for one full year of interest. No interest has been recorded yet. 34 35 Assets Liabilities Stockholders' Equity 37 a. 39 b. 41 C. A B C D G H 41 C -TC 43 Requirement 4: 44 Prepare the journal entries for the business events analyzed above for New Idea Corporation. 46 a. 47 49 b. 50 52 C. 53 54 55 56 57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts