Question: Close Window A Moving to another question will save this response. >> Question 35 1 points Save Answer ABC Machine Shop is considering a 5-year

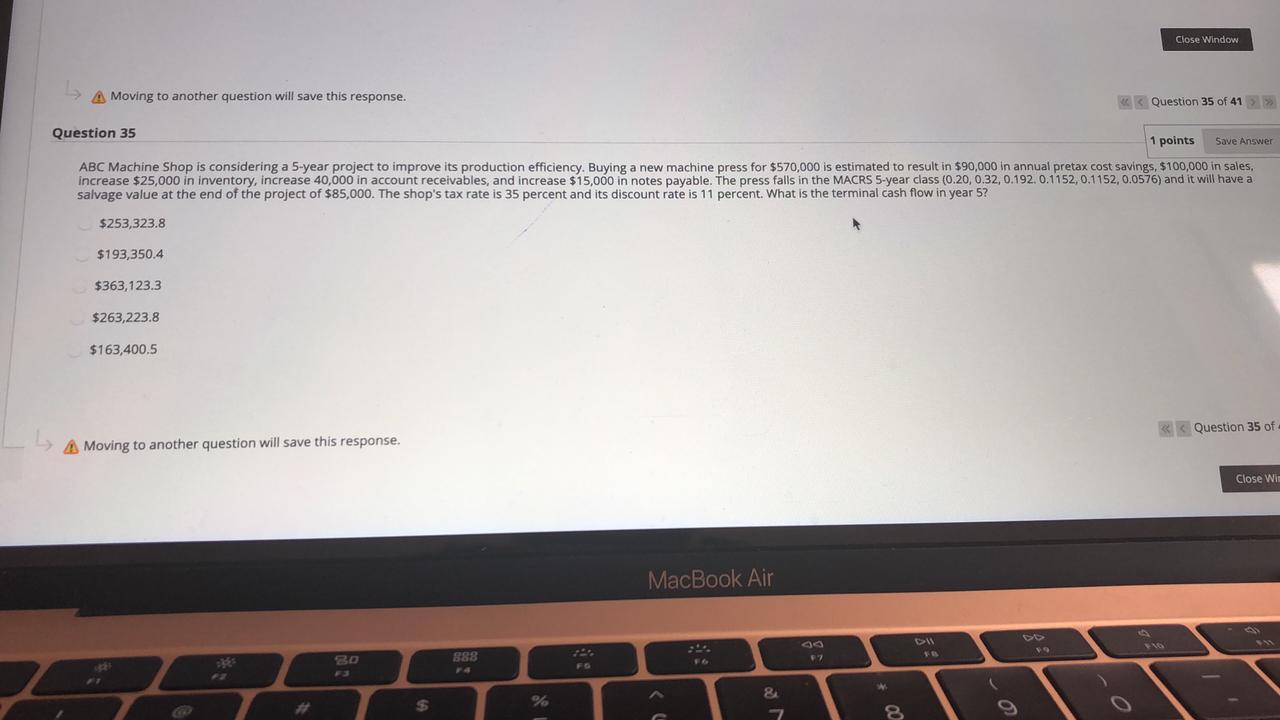

Close Window A Moving to another question will save this response. >> Question 35 1 points Save Answer ABC Machine Shop is considering a 5-year project to improve its production efficiency. Buying a new machine press for $570,000 is estimated to result in $90,000 in annual pretax cost savings, $100,000 in sales, increase $25,000 in inventory, increase 40,000 in account receivables, and increase $15,000 in notes payable. The press falls in the MACRS 5-year class (0.20, 0.32, 0.192.0.1152, 0.1152, 0.0576) and it will have a salvage value at the end of the project of $85,000. The shop's tax rate is 35 percent and its discount rate is 11 percent. What is the terminal cash flow in year 5? $253,323.8 $193,350.4 $363,123.3 $263,223.8 $ 163,400.5 Question 35 of A Moving to another question will save this response. Close Wit MacBook Air GO 17 VO 20 888 FO 8 2 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts