Question: Close Window Moving to another question will save this response Question 23 of 24 Question 23 2 points Save Ans You purchase a 8-year bond

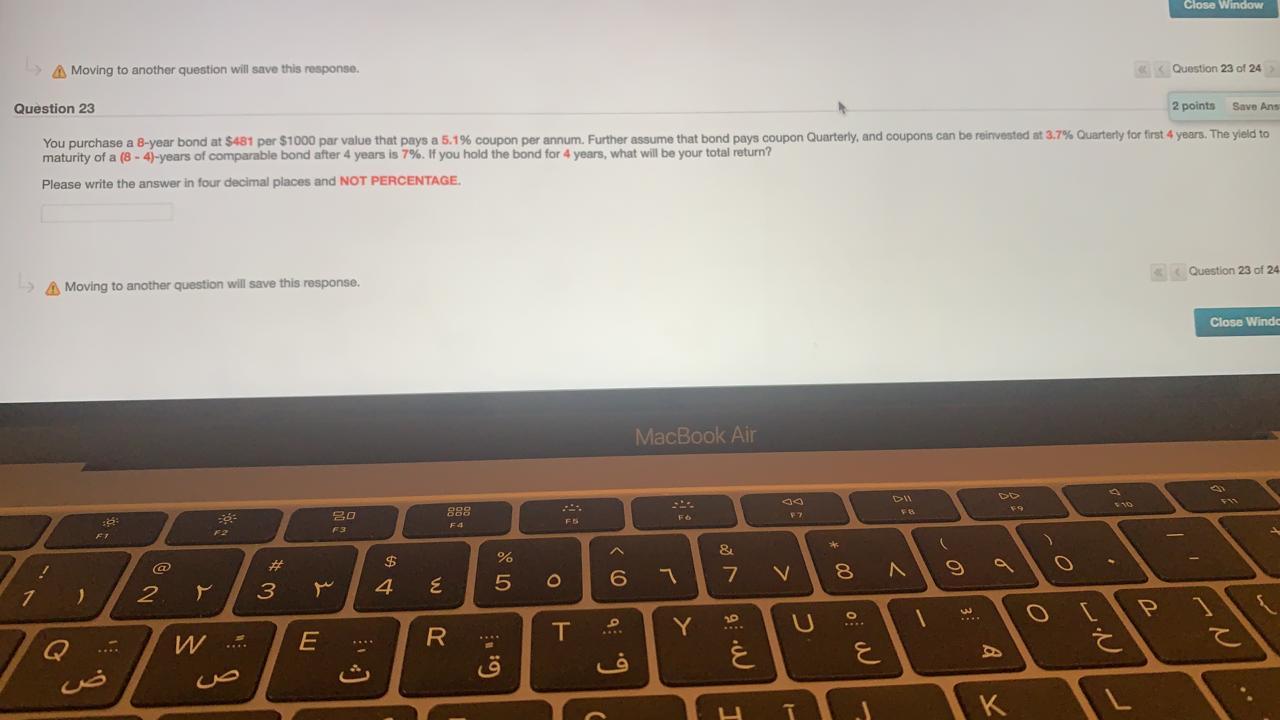

Close Window Moving to another question will save this response Question 23 of 24 Question 23 2 points Save Ans You purchase a 8-year bond at $481 per $1000 par value that pays a 5.1% coupon per annum. Further assume that bond pays coupon Quarterly, and coupons can be reinvented at 3.7% Quarterly for first 4 years. The yield to maturity of a (8 - 45-years of comparable bond after 4 years is 7%. If you hold the bond for 4 years, what will be your total return? Please write the answer in four decimal places and NOT PERCENTAGE, Question 23 of 24 Moving to another question will save this response. Close Wind MacBook Air 110 8 PO 888 F4 $ 4 % 5 & 7 V 00* 9 9 7 O 6 E 7 ) 3 2 O 0 U T Y W E R : 6: 6. co K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts