Question: Close Window Moving to another question will save this response Son of Question 2 spots You are considering investment in two mutually exclusive projects Project

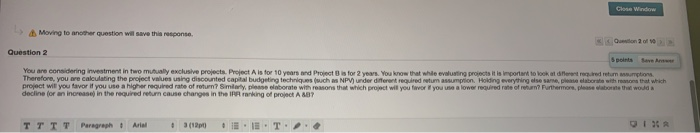

Close Window Moving to another question will save this response Son of Question 2 spots You are considering investment in two mutually exclusive projects Project A is for 10 years and Project is for 2 years. You know that while evaluating projects it is important to look at det er retumsumption Therefore, you are calculating the project values using discounted capital budgeting techniques such as NPV) under different required retum assumption. Holding everything else aborte with that which project will you favor if you use a higher required rate of return? Similarly, please elaborate with reasons that which project will you for you use a lower required rate of rem? Furthermore, please both woda decline for an increase in the required return cause changes in the ranking of project A MO Paragraph Ariel 43 EJET DI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts