Question: Question competenta Close Window Moving to another question will save this response Question 25 of 32 Question 25 gbox, Inc. is considering two, mutually exclusive

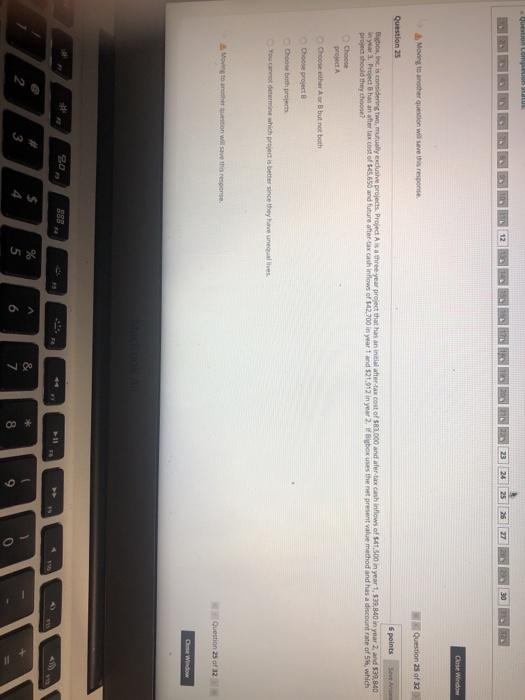

Question competenta Close Window Moving to another question will save this response Question 25 of 32 Question 25 gbox, Inc. is considering two, mutually exclusive projects Project Ais a three year project that has an initial after-tax cost of $82000 and afer-tax cash inflows of $41.500 in year 1.99.840 in year 2, and $319,840 in year 3. Project has an after tax cost of $45.650 and future after tax cash inflows of $42,700 in year 1 and 121.912 in year 2. Figbox uses the net present value method and has a discount rate of 5which project should they choose? project Choose either or but not both Choose project B Choose both projects You cannot determine which project is better since they have unequal lives. Moving to another question will save this response. Question 25 of 32 Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts