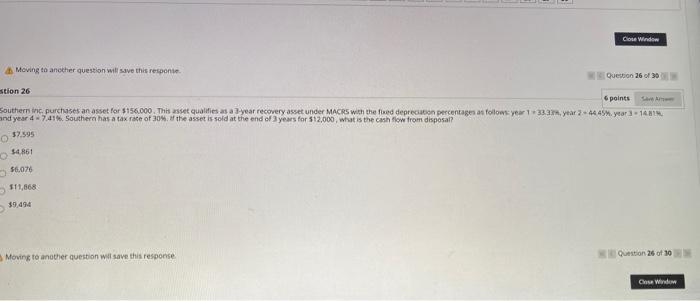

Question: Close Window Moving to another question will save this response Question 26 of stion 26 points Southern inc. purchases an asset for $156.000. This asset

Close Window Moving to another question will save this response Question 26 of stion 26 points Southern inc. purchases an asset for $156.000. This asset qualifies as a 3-year recovery asset under MACRS with the feed depreciation percentages as follows.year 1.333, year 2-44 45.ytara-14 and year 4-7.41%. Southern has a tax rate of 30% of the asset is sold at the end of 3 years for $12,000, what is the cash flow from disposal? 17.595 S4861 $6.070 Moving to another question will save this response Question 26 of 10 Case Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts