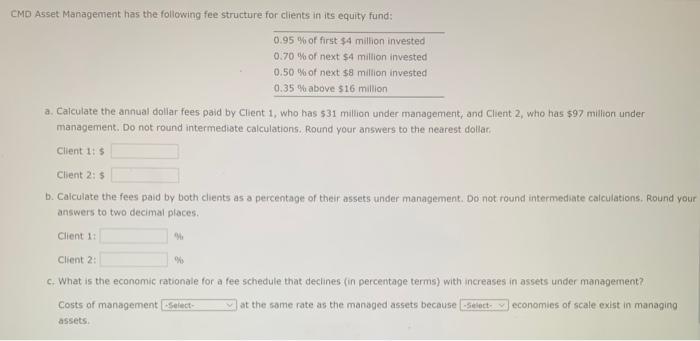

Question: CMD Asset Management has the following fee structure for clients in its equity fund: 0.95 % of first $4 million invested 0.70% of next $4

CMD Asset Management has the following fee structure for clients in its equity fund: 0.95 % of first $4 million invested 0.70% of next $4 million invested 0.50 % of next $8 million invested 0.35% above $16 million a. Calculate the annual dollar fees paid by Client 1, who has 531 million under management, and Client 2, who has $97 million under management. Do not round intermediate calculations. Round your answers to the nearest dollar Client : $ Client 2: $ b. Calculate the fees paid by both clients as a percentage of their assets under management. Do not round intermediate calculations, Round your answers to two decimal places Client : Client 2: 9 c. What is the economic rationale for a fee schedule that declines (in percentage terms) with increases in assets under management? Costs of management Select at the same rate as the managed assets because Select economies of scale exist in managing assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts