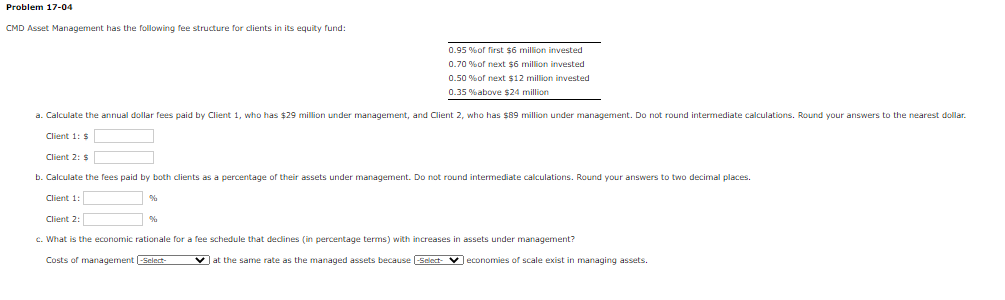

Question: Problem 17-04 CMD Asset Management has the following fee structure for clients in its equity fund: 0.95%of first $6 million invested 0.70%of next $6 million

Problem 17-04 CMD Asset Management has the following fee structure for clients in its equity fund: 0.95%of first $6 million invested 0.70%of next $6 million invested 0.50 %of next $12 million invested 0.35 %above $24 million a. Calculate the annual dollar fees paid Client 1, who has $29 million under management, and Client 2, who has $89 million under management. Do not round intermediate calculations. Round your answers to the nearest dollar. Client 1: $ Client 2: $ b. Calculate the fees paid by both clients as a percentage of their assets under management. Do not round intermediate calculations. Round your answers to two decimal places. Client 1: Client 2: c. What is the economic rationale for a fee schedule that declines (in percentage terms) with increases in assets under management? Costs of management -Select- at the same rate as the managed assets because Select Veconomies of scale exist in managing assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts