Question: (CO 3) You are attempting to develop a break-even for a capitation contract with a major HMO. Your hospital has agreed to provide all inpatient

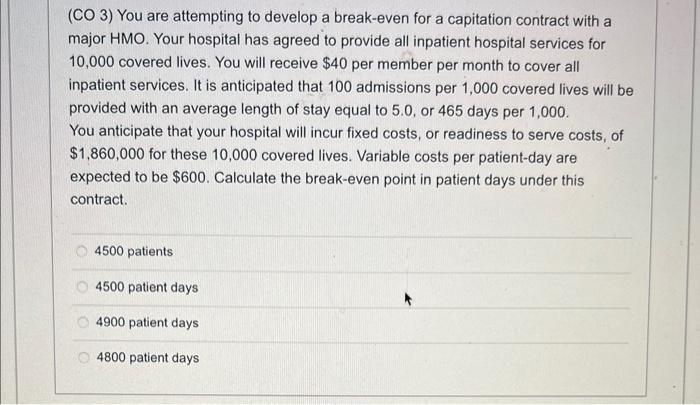

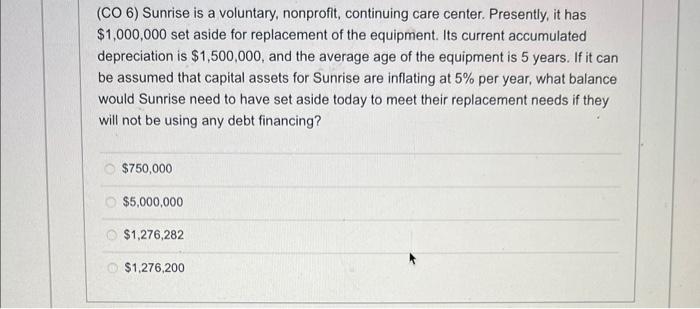

(CO 3) You are attempting to develop a break-even for a capitation contract with a major HMO. Your hospital has agreed to provide all inpatient hospital services for 10,000 covered lives. You will receive $40 per member per month to cover all inpatient services. It is anticipated that 100 admissions per 1,000 covered lives will be provided with an average length of stay equal to 5.0, or 465 days per 1,000 . You anticipate that your hospital will incur fixed costs, or readiness to serve costs, of $1,860,000 for these 10,000 covered lives. Variable costs per patient-day are expected to be $600. Calculate the break-even point in patient days under this contract. 4500 patients 4500 patient days 4900 patient days 4800 patient days (CO 6) Sunrise is a voluntary, nonprofit, continuing care center. Presently, it has $1,000,000 set aside for replacement of the equipment. Its current accumulated depreciation is $1,500,000, and the average age of the equipment is 5 years. If it can be assumed that capital assets for Sunrise are inflating at 5% per year, what balance would Sunrise need to have set aside today to meet their replacement needs if they will not be using any debt financing? $750,000 $5,000,000 $1,276,282 $1,276,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts