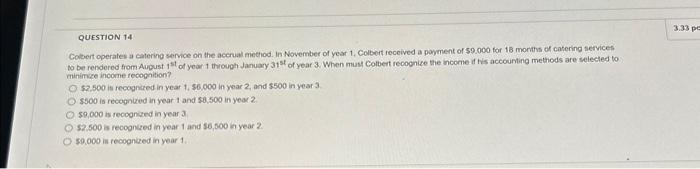

Question: Cobert operates a catering semice on the accrual method. In November of year 1 , Colbert received a poyment of 59.000 for 18 morths of

Cobert operates a catering semice on the accrual method. In November of year 1 , Colbert received a poyment of 59.000 for 18 morths of catering services to be rendered from August 1st of year 1 thiough January 31st of year 3 . When must Colbert recognice the income if tis accounting methods are selected to minimace income recognition? $2,500 is recognited in year 1,56,000 in year 2 , and $500 in year 3 $500 is recognized in year 1 and $8,500 in year 2 . $9,000 is recoonied in year 3 52500 a recogntred in year 1 and 56,500 in year 2 . 50,000 in recogneed in year 1

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock