Question: Cocoabeanprocessingdivisionoptions (8marks) a) (4 marks) Based on the information provided by the cocoa bean processing division manager from Exhibit 7, assess the total gross profits

Cocoabeanprocessingdivisionoptions(8marks)

a) (4 marks)

Based on the information provided by the cocoa bean processing division manager from Exhibit 7, assess the total gross profits and total gross margin percentage of each of the following options (include total joint costs in your calculation, but do not allocate the joint costs to individual products):

i) Current sales of cocoa butter and cocoa cakes

ii) Proposed sales of cocoa butter and canned, powdered baking cocoa

iii) Proposed sales of chocolate liquor

Comment on which of the three options is most desirable for the company to pursue and why (consider other non-financial concerns that should also be taken into consideration).

b) (4 marks)

Allocate joint costs using the following options and methods:

i) Based on the current sales of cocoa butter and cocoa cakes, use the sales value at split-off method.

ii) Based on the proposed sales of cocoa butter and canned, powdered baking cocoa, use the net realizable method.

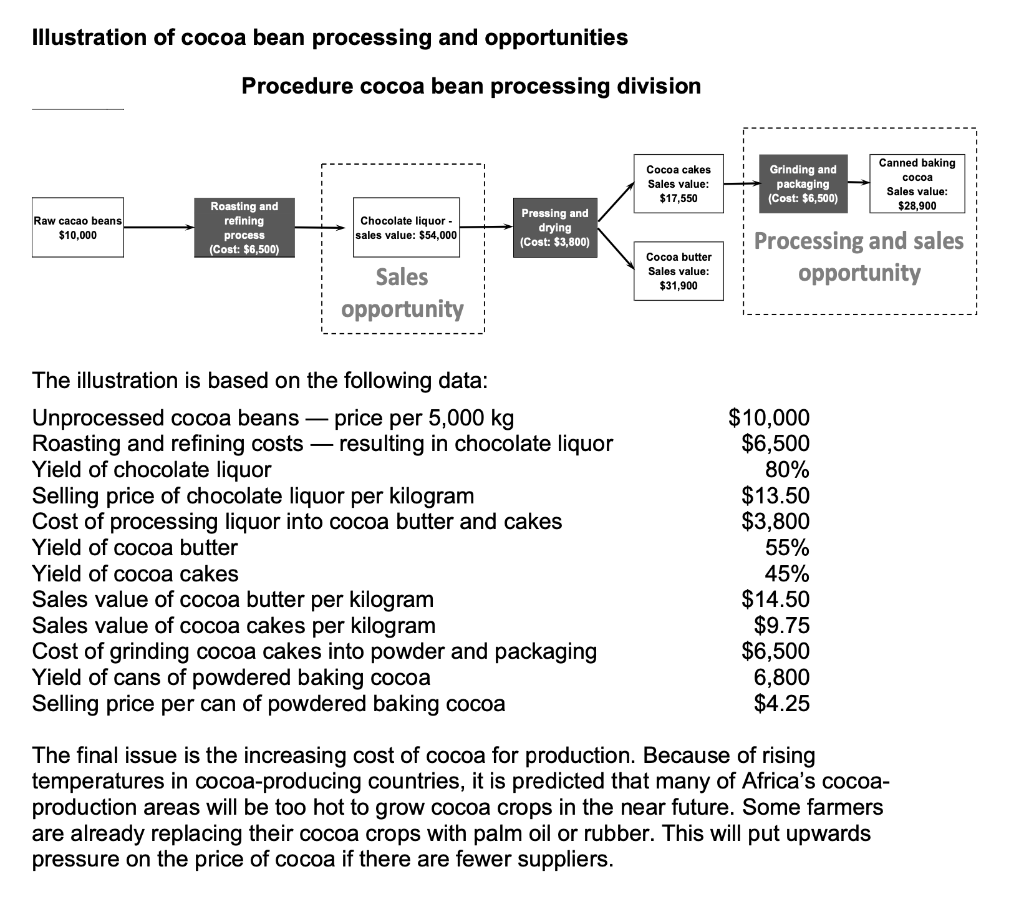

Exhibit 7 Cocoa bean processing division options The cocoa bean processing division receives unprocessed beans and processes them. A portion of the output comes to the chocolate bar division at the cocoa bean process division's cost plus a small profit. The cocoa bean processing division is able to satisfy both the external and internal demand for its products. The manager of the bean processing division has asked that an analysis be done on the best way to process and package products given the following information. Additional information on cocoa bean processing The job in the cocoa bean processing division is to process raw cocoa beans through fermentation and roasting, and processing the chocolate nibs into chocolate liquor, cocoa butter, and cocoa cakes. The cocoa cakes are what is left of the chocolate liquor after the cocoa butter is removed. The original purpose was to process the beans for the chocolate bar division; however, there is enough capacity to process more beans and sell the intermediate products to outside customers. The questions are the profitability of the products currently being sold to outside customers and the opportunities for a new product. Currently, the chocolate liquor, which is the first saleable product in the bean processing division, is processed further into cocoa butter and cocoa cakes. The cocoa butter is sold to a plant that processes it for skin cream and the cocoa cakes are packaged in bulk and sold to other manufacturers to include in baking products. One option to consider is to grind the cocoa cakes into powder and package the final product into cans to be sold to retail grocery stores as baking chocolate. However, there is also a market for chocolate liquor. An illustration including the proposed process follows. The company needs advice on the following: 1. Is it profitable to process cocoa cakes further into a powder, package it in cans, and sell it as baking cocoa? 2. Is it still profitable to process chocolate liquor into cocoa cakes and cocoa butter? 3. Using the most profitable method of processing cocoa beans, how should the joint cost be allocated? Illustration of cocoa bean processing and opportunities Procedure cocoa bean processing division Cocoa cakes Sales value: $17,550 Grinding and packaging (Cost: $6,500) Canned baking cocoa Sales value: $28,900 Raw cacao beans $10,000 Roasting and refining process (Cost: $6,500) Chocolate liquor - sales value: $54,000 Pressing and drying (Cost: $3,800) Cocoa butter Sales value: $31,900 Processing and sales opportunity Sales opportunity The illustration is based on the following data: Unprocessed cocoa beans - price per 5,000 kg Roasting and refining costs resulting in chocolate liquor Yield of chocolate liquor Selling price of chocolate liquor per kilogram Cost of processing liquor into cocoa butter and cakes Yield of cocoa butter Yield of cocoa cakes Sales value of cocoa butter per kilogram Sales value of cocoa cakes per kilogram Cost of grinding cocoa cakes into powder and packaging Yield of cans of powdered baking cocoa Selling price per can of powdered baking cocoa $10,000 $6,500 80% $13.50 $3,800 55% 45% $14.50 $9.75 $6,500 6,800 $4.25 The final issue is the increasing cost of cocoa for production. Because of rising temperatures in cocoa-producing countries, it is predicted that many of Africa's cocoa- production areas will be too hot to grow cocoa crops in the near future. Some farmers are already replacing their cocoa crops with palm oil or rubber. This will put upwards pressure on the price of cocoa if there are fewer suppliers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts