Question: Coles Group Ltd is an entity that must prepare general purpose financial reports (GPFR) and apply AASB112 Income Taxes . Required: Using the information for

Coles Group Ltd is an entity that must prepare general purpose financial reports (GPFR) and apply AASB112 Income Taxes.

Required: Using the information for Coles Group Ltd 2019 below:

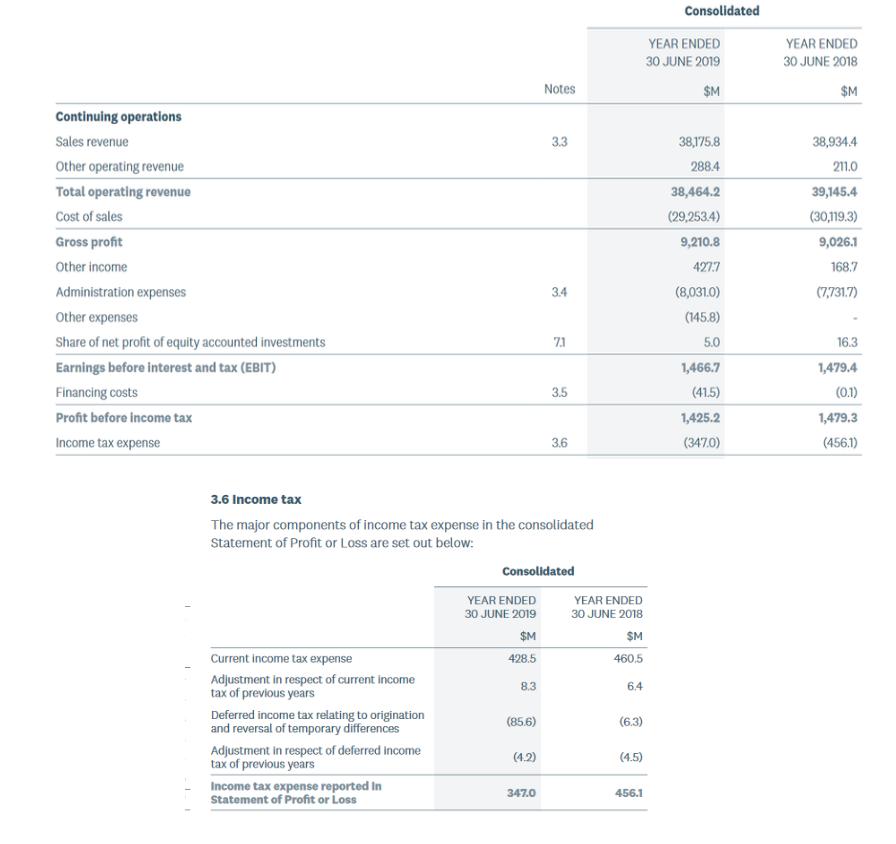

- Show how Coles have arrived at the total income tax expense for 2019 of $347 million.

- (ii) Calculate the 2019 Profit for the Period (after tax).

- (iii) From the list of accounting revenue and expenses below, identify how these items are treated under income tax rules (eg, Interest expense: the amount deductible for tax is equal to cash paid on interest):

- Royalty revenue

- Depreciation expense on equipment

- Bad debts expense

Continuing operations Sales revenue Other operating revenue Total operating revenue Cost of sales Gross profit Other income Administration expenses Other expenses Share of net profit of equity accounted investments Earnings before interest and tax (EBIT) Financing costs Profit before income tax Income tax expense 1 Current income tax expense Adjustment in respect of current income tax of previous years Deferred income tax relating to origination and reversal of temporary differences Adjustment in respect of deferred income tax of previous years Income tax expense reported in Statement of Profit or Loss 3.6 Income tax The major components of income tax expense in the consolidated Statement of Profit or Loss are set out below: YEAR ENDED 30 JUNE 2019 $M 428.5 8.3 (85.6) Notes (4.2) 3.3 347.0 3.4 Consolidated 7.1 3.5 3.6 YEAR ENDED 30 JUNE 2018 $M 460,5 6.4 (6.3) (4.5) 456.1 Consolidated YEAR ENDED 30 JUNE 2019 $M 38,175.8 288.4 38,464.2 (29,253.4) 9,210.8 427.7 (8,031.0) (145.8) 5.0 1,466.7 (41.5) 1,425.2 (347.0) YEAR ENDED 30 JUNE 2018 $M 38,934.4 211.0 39,145.4 (30,119.3) 9,026.1 168.7 (7,731.7) 16.3 1,479.4 (0.1) 1,479.3 (456.1)

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

i How arrived at the total income tax expenses for 2... View full answer

Get step-by-step solutions from verified subject matter experts