Question: Collapse O WORDS POWERED BY TINY QUESTION 2 20 points Save Answer A Firm in the Germany is considering an investment in Brazil that has

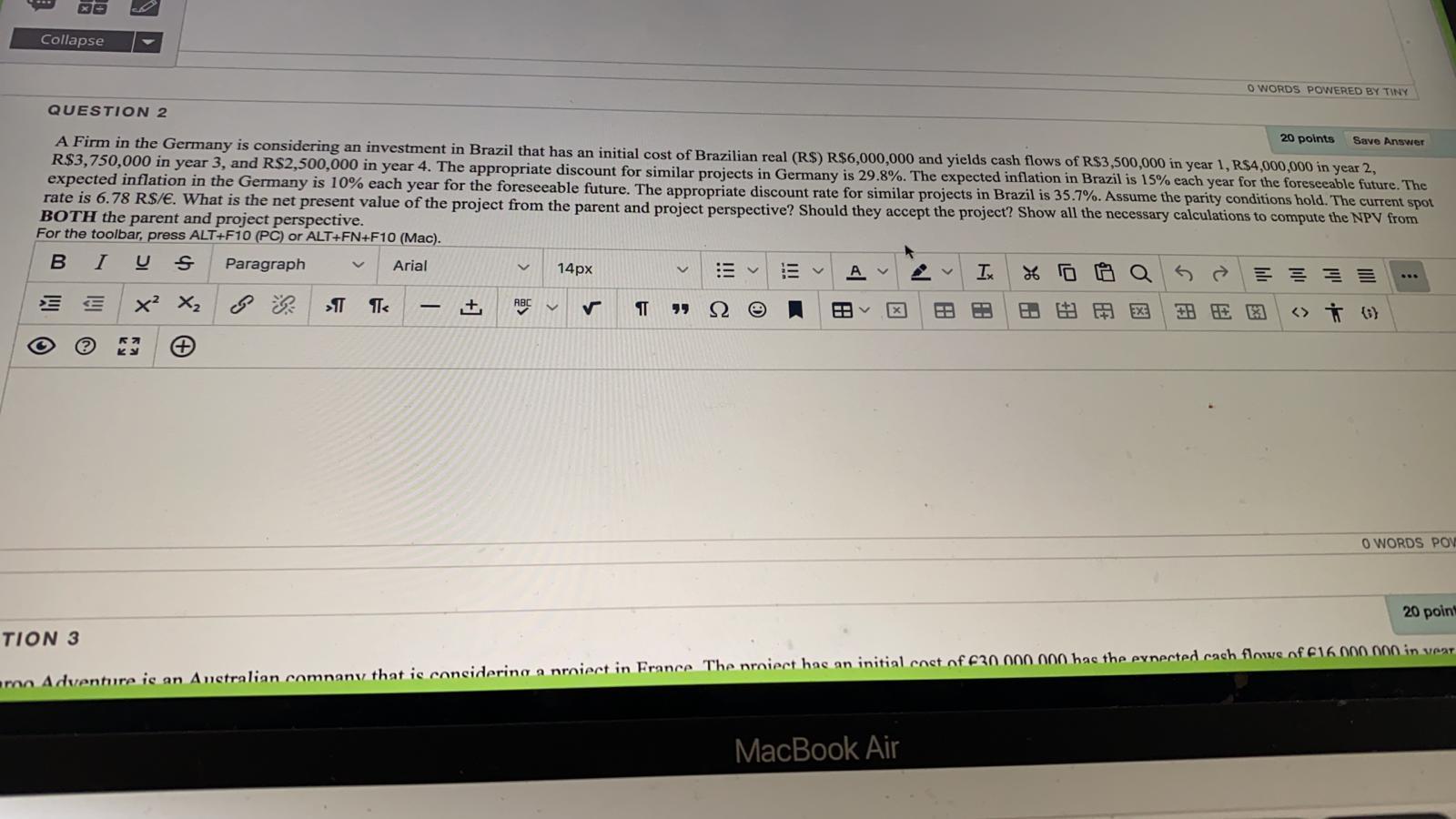

Collapse O WORDS POWERED BY TINY QUESTION 2 20 points Save Answer A Firm in the Germany is considering an investment in Brazil that has an initial cost of Brazilian real (R$) R$6,000,000 and yields cash flows of R$3,500,000 in year 1, R$4,000,000 in year 2, R$3,750,000 in year 3, and R$2,500,000 in year 4. The appropriate discount for similar projects in Germany is 29.8%. The expected inflation in Brazil is 15% each year for the foreseeable future. The expected inflation in the Germany is 10% each year for the foreseeable future. The appropriate discount rate for similar projects in Brazil is 35.7%. Assume the parity conditions hold. The current spot rate is 6.78 R$/. What is the net present value of the project from the parent and project perspective? Should they accept the project? Show all the necessary calculations to compute the NPV from BOTH the parent and project perspective. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I S Paragraph Arial 14px 46 E = = = V V A x X & HAA >TT TI + T 77 . A v EX: + HE O WORDS POV 20 points TION 3 are Adventure is an Australian camnany that is considering a nroiect in France The nroiect has an initial cost of F30 000 000 has the eynected cash flowe of 16.000.000 in veat MacBook Air Collapse O WORDS POWERED BY TINY QUESTION 2 20 points Save Answer A Firm in the Germany is considering an investment in Brazil that has an initial cost of Brazilian real (R$) R$6,000,000 and yields cash flows of R$3,500,000 in year 1, R$4,000,000 in year 2, R$3,750,000 in year 3, and R$2,500,000 in year 4. The appropriate discount for similar projects in Germany is 29.8%. The expected inflation in Brazil is 15% each year for the foreseeable future. The expected inflation in the Germany is 10% each year for the foreseeable future. The appropriate discount rate for similar projects in Brazil is 35.7%. Assume the parity conditions hold. The current spot rate is 6.78 R$/. What is the net present value of the project from the parent and project perspective? Should they accept the project? Show all the necessary calculations to compute the NPV from BOTH the parent and project perspective. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I S Paragraph Arial 14px 46 E = = = V V A x X & HAA >TT TI + T 77 . A v EX: + HE O WORDS POV 20 points TION 3 are Adventure is an Australian camnany that is considering a nroiect in France The nroiect has an initial cost of F30 000 000 has the eynected cash flowe of 16.000.000 in veat MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts