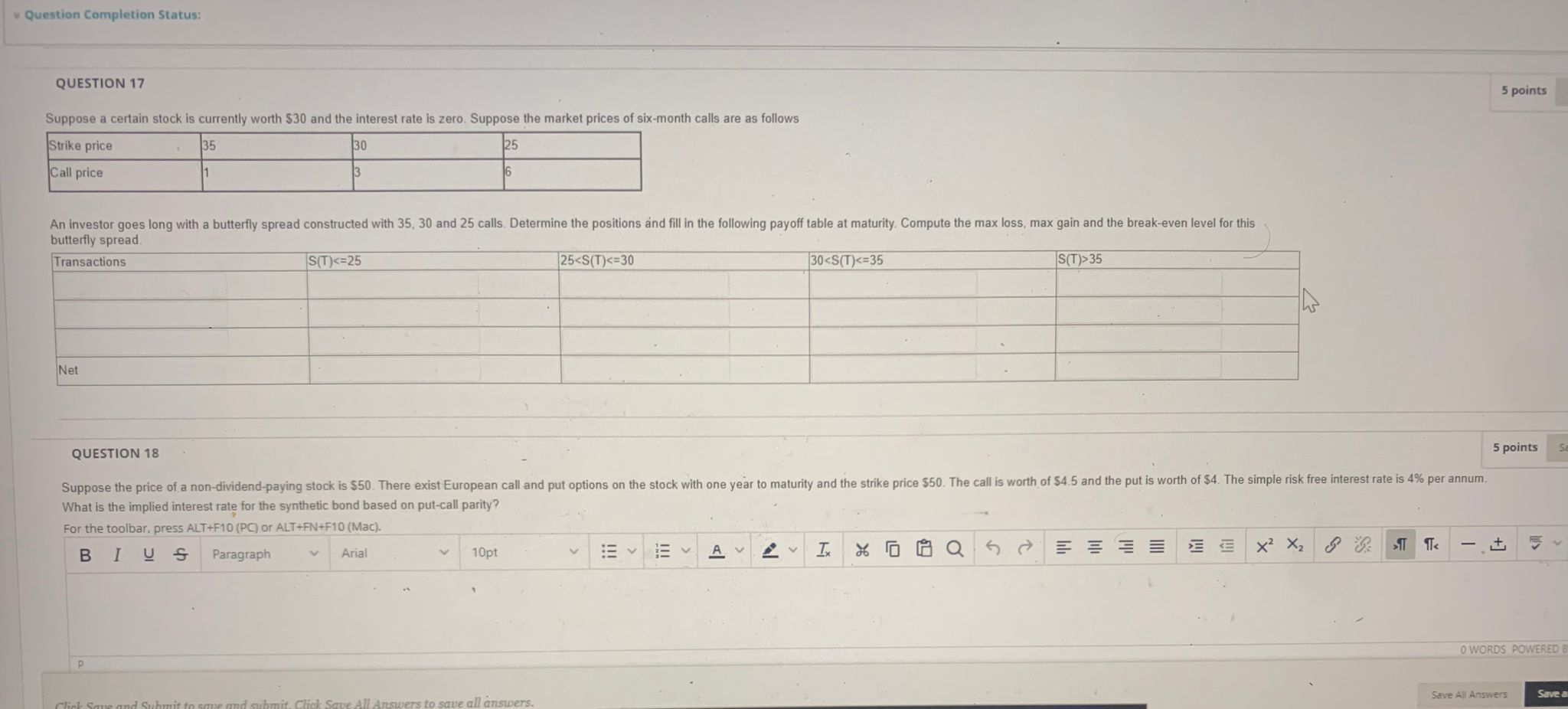

Question: Question Completion Status: QUESTION 17 5 points Suppose a certain stock is currently worth $30 and the interest rate is zero. Suppose the market prices

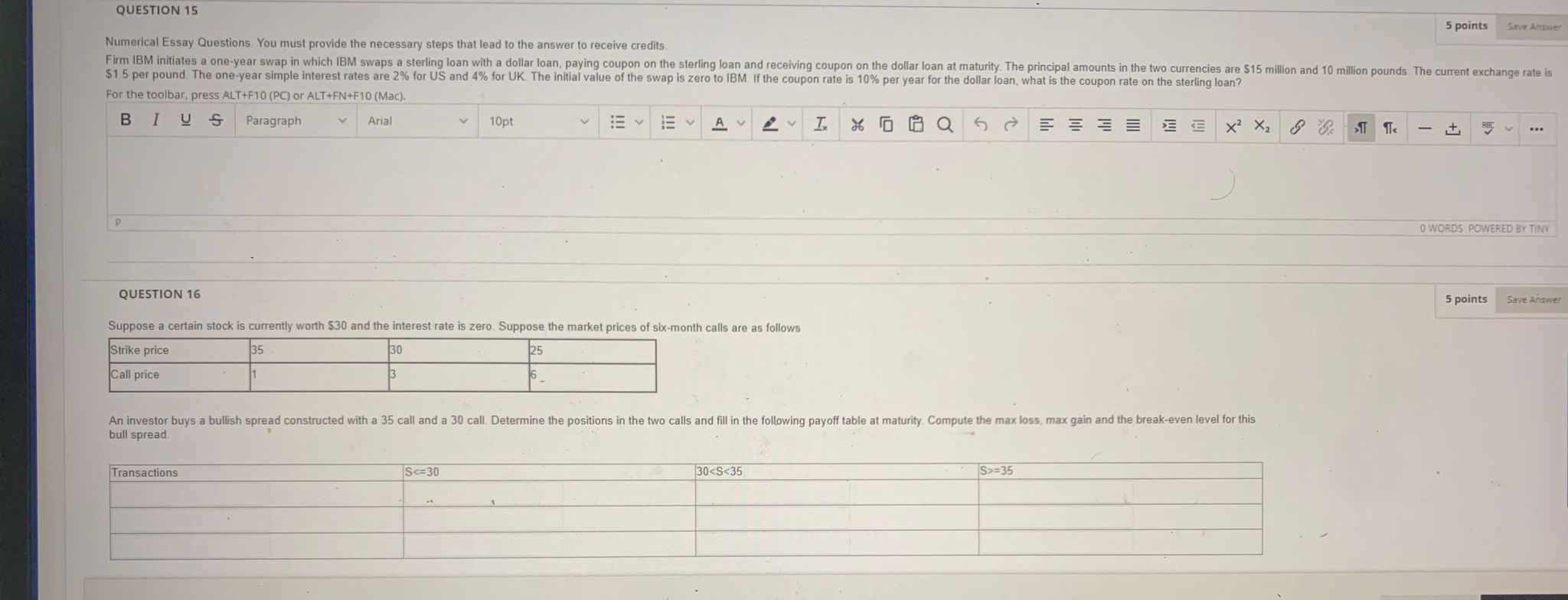

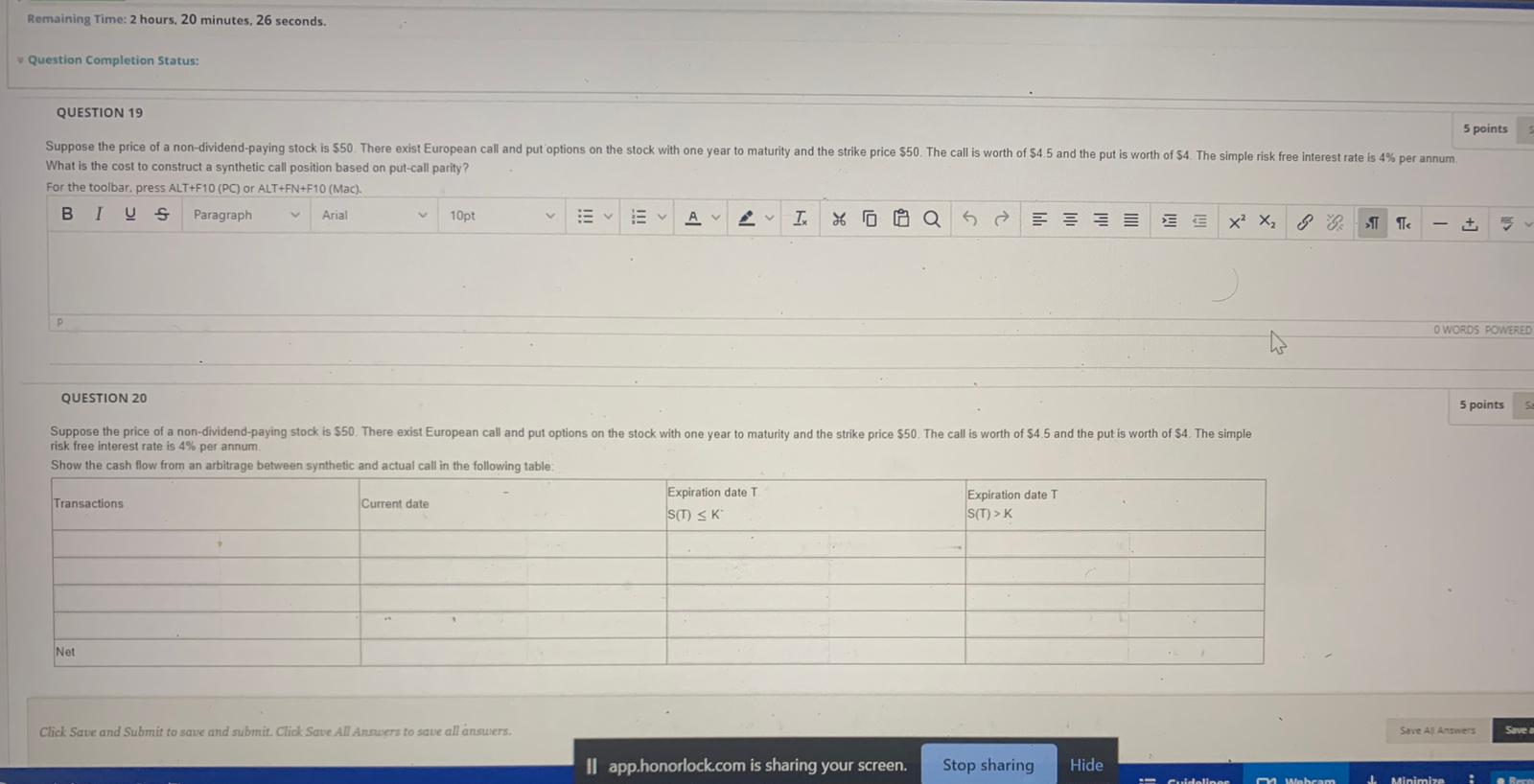

Question Completion Status: QUESTION 17 5 points Suppose a certain stock is currently worth $30 and the interest rate is zero. Suppose the market prices of six-month calls are as follows Strike price 135 30 25 Call price An investor goes long with a butterfly spread constructed with 35, 30 and 25 calls. Determine the positions and fill in the following payoff table at maturity. Compute the max loss, max gain and the break-even level for this butterfly spread. Transactions S(T)35 Net QUESTION 18 5 points Suppose the price of a non-dividend-paying stock is $50. There exist European call and put options on the stock with one year to maturity and the strike price $50. The call is worth of $4.5 and the put is worth of $4. The simple risk free interest rate is 4% per annum. What is the implied interest rate for the synthetic bond based on put-call parity? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt V E x2 X2 -t O WORDS POWERED Save All Answers Save aQUESTION 15 5 points Save Answer Numerical Essay Questions. You must provide the necessary steps that lead to the answer to receive credits. Firm IBM initiates a one-year swap in which IBM swaps a sterling loan with a dollar loan, paying coupon on the sterling loan and receiving coupon on the dollar loan at maturity. The principal amounts in the two currencies are $15 million and 10 million pounds. The current exchange rate is $1.5 per pound. The one-year simple interest rates are 2% for US and 4% for UK. The initial value of the swap is zero to IBM. If the coupon rate is 10% per year for the dollar loan, what is the coupon rate on the sterling loan? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt A v X2 X2 The - t REE ... P O WORDS POWERED BY TINY QUESTION 16 5 points Save Answer Suppose a certain stock is currently worth $30 and the interest rate is zero. Suppose the market prices of six-month calls are as follows Strike price 35 30 25 Call price 6_ An investor buys a bullish spread constructed with a 35 call and a 30 call. Determine the positions in the two calls and fill in the following payoff table at maturity. Compute the max loss, max gain and the break-even level for this bull spread. Transactions S =35Remaining Time: 2 hours, 20 minutes, 26 seconds. Question Completion Status: QUESTION 19 5 points Suppose the price of a non-dividend-paying stock is $50. There exist European call and put options on the stock with one year to maturity and the strike price $50. The call is worth of $4.5 and the put is worth of $4. The simple risk free interest rate is 4% per annum. What is the cost to construct a synthetic call position based on put-call parity? For the toolbar. press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph V Arial 10pt Ev Ev EEXX + O WORDS POWERED QUESTION 20 5 points Suppose the price of a non-dividend-paying stock is $50. There exist European call and put options on the stock with one year to maturity and the strike price $50. The call is worth of $4.5 and the put is worth of $4. The simple risk free interest rate is 4% per annum Show the cash flow from an arbitrage between synthetic and actual call in the following table; Expiration date T Expiration date T Transactions Current date SM) SK S(T) > K Net Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save II app.honorlock.com is sharing your screen. Stop sharing Hide

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts