Question: Collapse QUESTION 1 20 points Save Answer You are asked to evaluate the following project for a Greek company investing Canada. The project has an

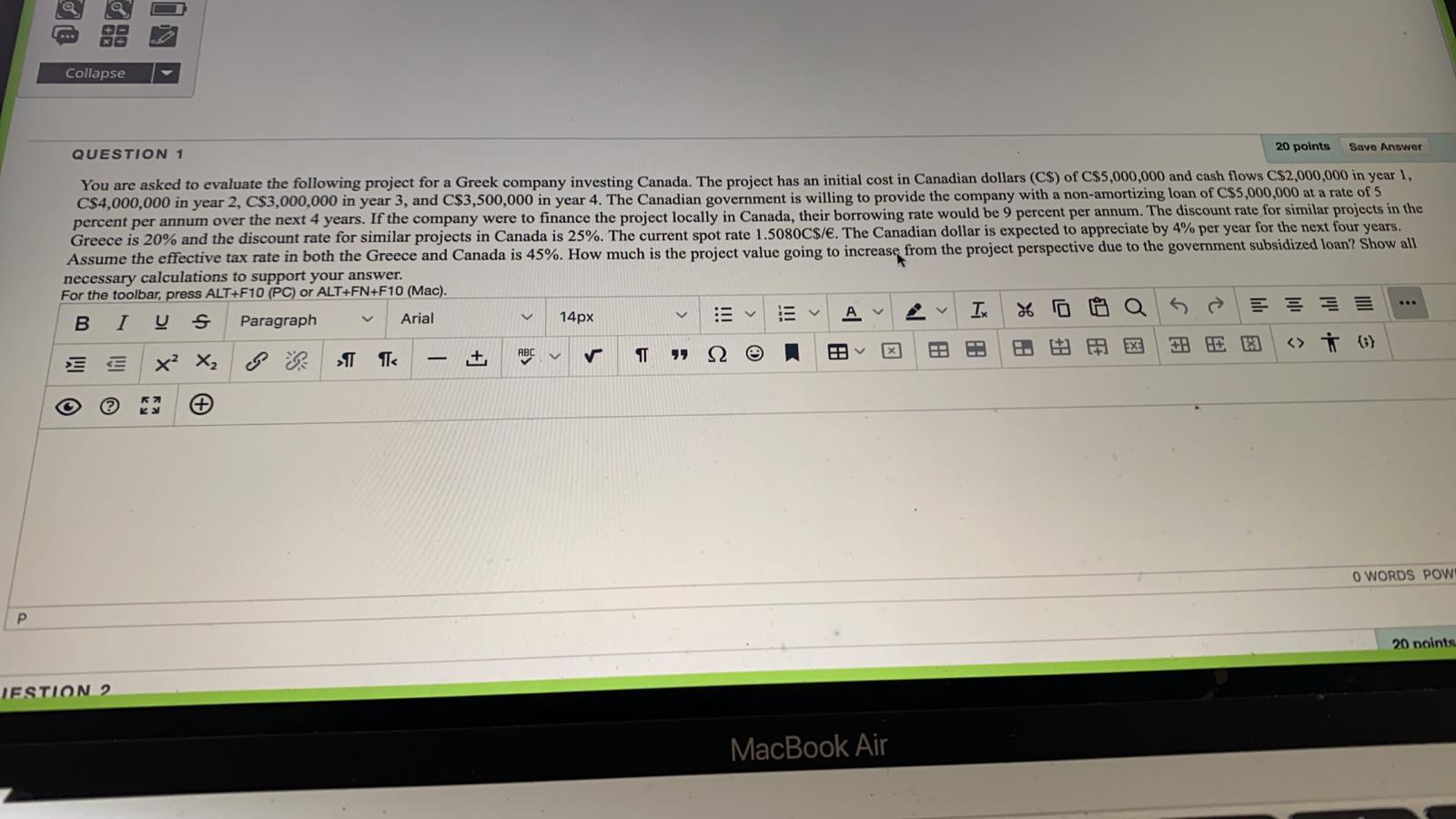

Collapse QUESTION 1 20 points Save Answer You are asked to evaluate the following project for a Greek company investing Canada. The project has an initial cost in Canadian dollars (C$) of C$5,000,000 and cash flows C$2,000,000 in year 1, C$4,000,000 in year 2, C$3,000,000 in year 3, and C$3,500,000 in year 4. The Canadian government willing to provide the company with a non-amortizing loan of C$5,000,000 at a rate of 5 percent per annum over the next 4 years. If the company were to finance the project locally in Canada, their borrowing rate would be 9 percent per annum. The discount rate for similar projects in the Greece is 20% and the discount rate for similar projects in Canada is 25%. The current spot rate 1.5080C$/. The Canadian dollar is expected to appreciate by 4% per year for the next four years. Assume the effective tax rate in both the Greece and Canada is 45%. How much is the project value going to increase from the project perspective due to the government subsidized loan? Show all necessary calculations to support your answer. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I S Paragraph Arial 14px A TX 86 = = = x? X, > Ts TT EX DE E v v HE ABC 5 O WORDS POW! P 20 points JESTION 2 MacBook Air Collapse QUESTION 1 20 points Save Answer You are asked to evaluate the following project for a Greek company investing Canada. The project has an initial cost in Canadian dollars (C$) of C$5,000,000 and cash flows C$2,000,000 in year 1, C$4,000,000 in year 2, C$3,000,000 in year 3, and C$3,500,000 in year 4. The Canadian government willing to provide the company with a non-amortizing loan of C$5,000,000 at a rate of 5 percent per annum over the next 4 years. If the company were to finance the project locally in Canada, their borrowing rate would be 9 percent per annum. The discount rate for similar projects in the Greece is 20% and the discount rate for similar projects in Canada is 25%. The current spot rate 1.5080C$/. The Canadian dollar is expected to appreciate by 4% per year for the next four years. Assume the effective tax rate in both the Greece and Canada is 45%. How much is the project value going to increase from the project perspective due to the government subsidized loan? Show all necessary calculations to support your answer. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I S Paragraph Arial 14px A TX 86 = = = x? X, > Ts TT EX DE E v v HE ABC 5 O WORDS POW! P 20 points JESTION 2 MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts