Question: Colsen Communications is trying to estimate the first-year net operating cash flow (at Year 1) for a proposed project. The financial staff has collected the

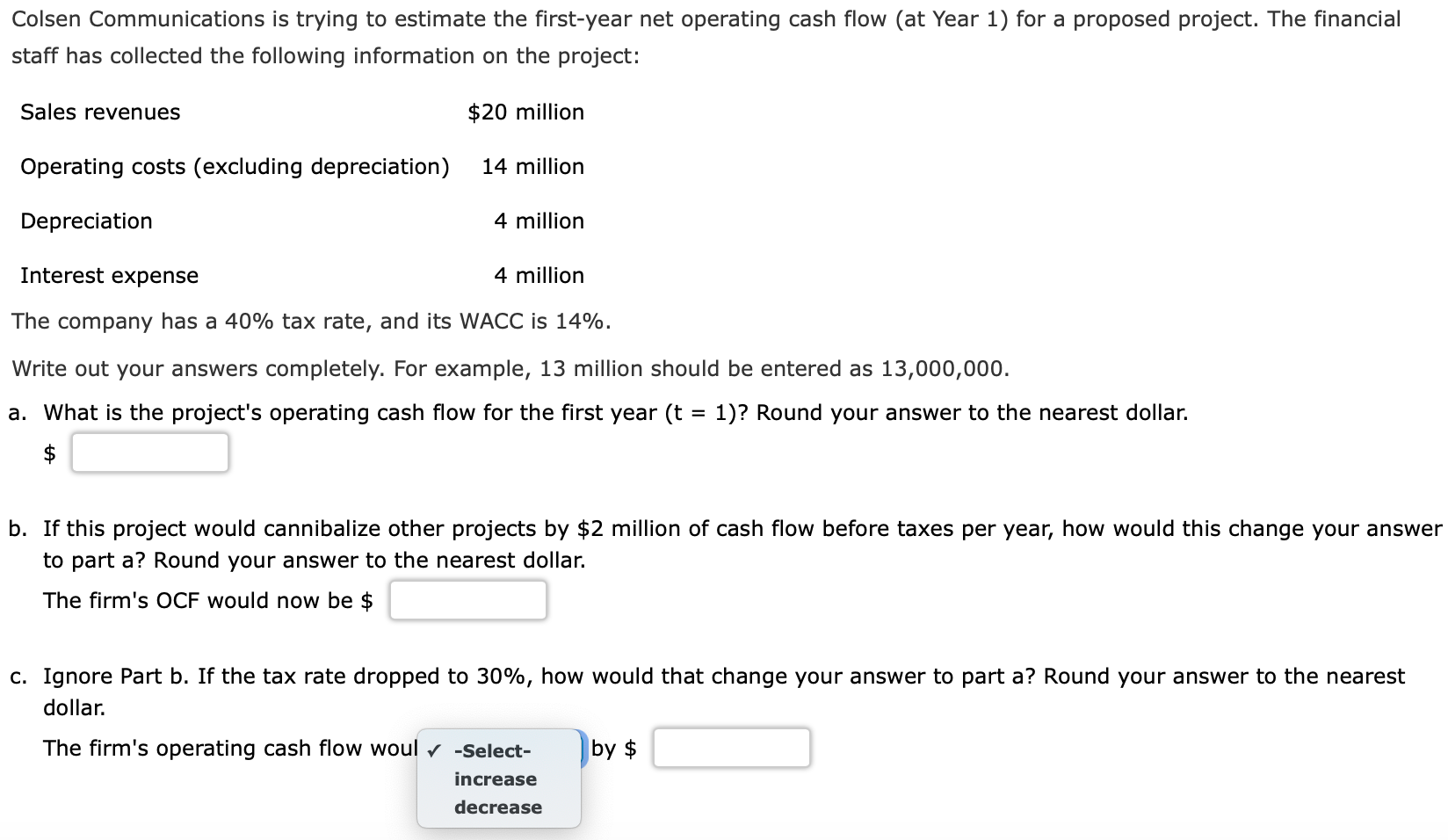

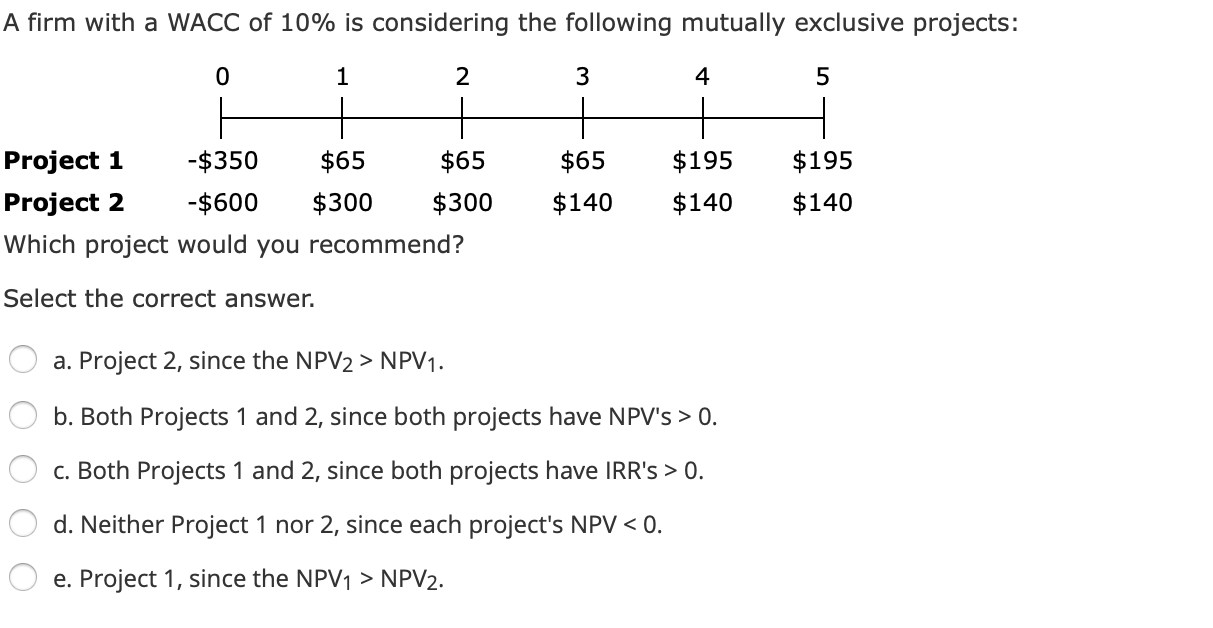

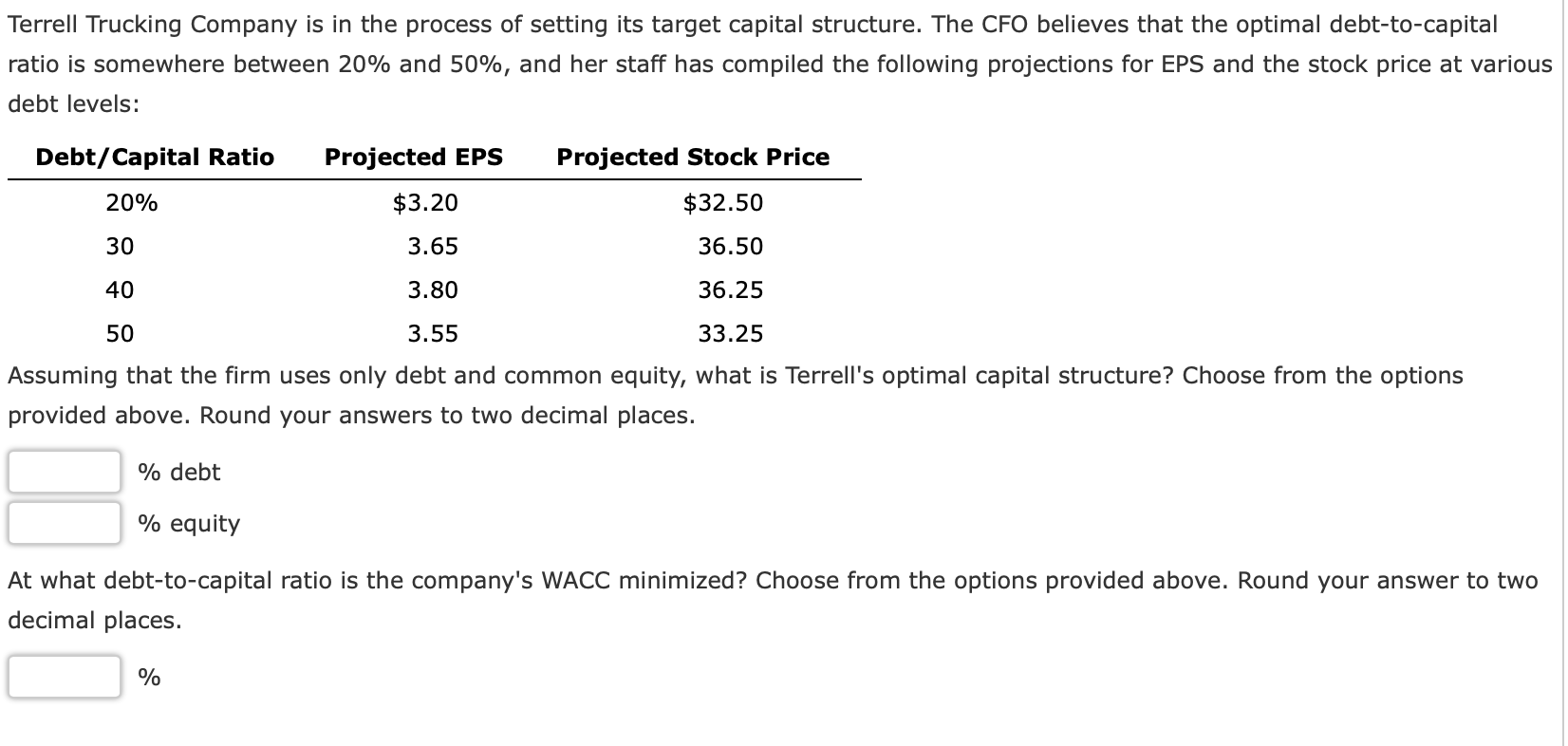

Colsen Communications is trying to estimate the first-year net operating cash flow (at Year 1) for a proposed project. The financial staff has collected the following information on the project: Sales revenues $20 million Operating costs (excluding depreciation) 14 million Depreciation 4 million Interest expense 4 million The company has a 40% tax rate, and its WACC is 14%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. b. If this project would cannibalize other projects by $2 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $ c. Ignore Part b. If the tax rate dropped to 30%, how would that change your answer to part a? Round your answer to the nearest dollar. | by $ The firm's operating cash flow woul -Select- increase decrease A firm with a WACC of 10% is considering the following mutually exclusive projects: 0 1 2 3 4 5 $65 Project 1 -$350 $65 Project 2 -$600 $300 $300 Which project would you recommend? $65 $140 $195 $140 $195 $140 Select the correct answer. a. Project 2, since the NPV2> NPV1. b. Both Projects 1 and 2, since both projects have NPV's > 0. c. Both Projects 1 and 2, since both projects have IRR's > 0. d. Neither Project 1 nor 2, since each project's NPV NPV2. Terrell Trucking Company is in the process of setting its target capital structure. The CFO believes that the optimal debt-to-capital ratio is somewhere between 20% and 50%, and her staff has compiled the following projections for EPS and the stock price at various debt levels: Debt/Capital Ratio Projected EPS Projected Stock Price 20% $3.20 $32.50 30 3.65 36.50 40 3.80 36.25 50 3.55 33.25 Assuming that the firm uses only debt and common equity, what is Terrell's optimal capital structure? Choose from the options provided above. Round your answers to two decimal places. % debt % equity At what debt-to-capital ratio is the company's WACC minimized? Choose from the options provided above. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts