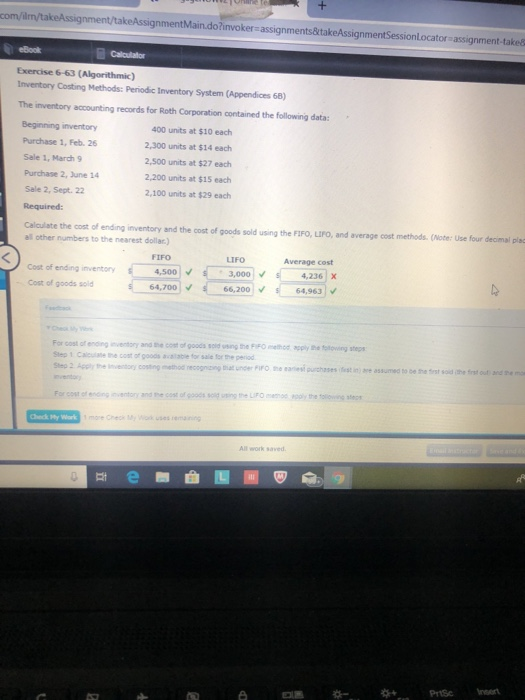

Question: com/lm/takeAssignment/takeAssignmentMaindo?invoker-assignments&takeAssignmentSessionlocato -assignment- take Calculator Exercise 6-63 (Algorithmic) Inventory Costing Methods: Peniodic Inventory System (Appendices 68) The inventory accounting records for Roth Corporation contained the following

com/lm/takeAssignment/takeAssignmentMaindo?invoker-assignments&takeAssignmentSessionlocato -assignment- take Calculator Exercise 6-63 (Algorithmic) Inventory Costing Methods: Peniodic Inventory System (Appendices 68) The inventory accounting records for Roth Corporation contained the following data: Beginning inventory Purchase 1, Feb. 26 Sale 1, March 9 Purchase 2, June 14 Sale 2, Sept. 22 Required: Calculate the cost of ending inventory and the cost of goods sold using the FIFO, LIFO, and average cost methods. (Note: Use four decimal plsc 400 units at $10 each 2,300 units at $14 each 2,500 units at $27 each 2,200 units at $15 each 2,100 units at $29 each al other numbers to the nearest dollar.) FIFO 4,500 64,700 Average cost LIFO 3,000 66,200 Cost of ending inventory 4,236 X Cost of goods sold 64,963 For cost of ending inventory and the cost of goods soid using the FiFO meh apply the fotowing steps Step 1 Caleulae the cost of goods aalable for sale for the period Steo 2 Apply the voy coting method necognising that under Firo the eaes purchases ifest in ae assumed to be the iest soid jthe frst out and the mos uses remaning com/lm/takeAssignment/takeAssignmentMaindo?invoker-assignments&takeAssignmentSessionlocato -assignment- take Calculator Exercise 6-63 (Algorithmic) Inventory Costing Methods: Peniodic Inventory System (Appendices 68) The inventory accounting records for Roth Corporation contained the following data: Beginning inventory Purchase 1, Feb. 26 Sale 1, March 9 Purchase 2, June 14 Sale 2, Sept. 22 Required: Calculate the cost of ending inventory and the cost of goods sold using the FIFO, LIFO, and average cost methods. (Note: Use four decimal plsc 400 units at $10 each 2,300 units at $14 each 2,500 units at $27 each 2,200 units at $15 each 2,100 units at $29 each al other numbers to the nearest dollar.) FIFO 4,500 64,700 Average cost LIFO 3,000 66,200 Cost of ending inventory 4,236 X Cost of goods sold 64,963 For cost of ending inventory and the cost of goods soid using the FiFO meh apply the fotowing steps Step 1 Caleulae the cost of goods aalable for sale for the period Steo 2 Apply the voy coting method necognising that under Firo the eaes purchases ifest in ae assumed to be the iest soid jthe frst out and the mos uses remaning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts