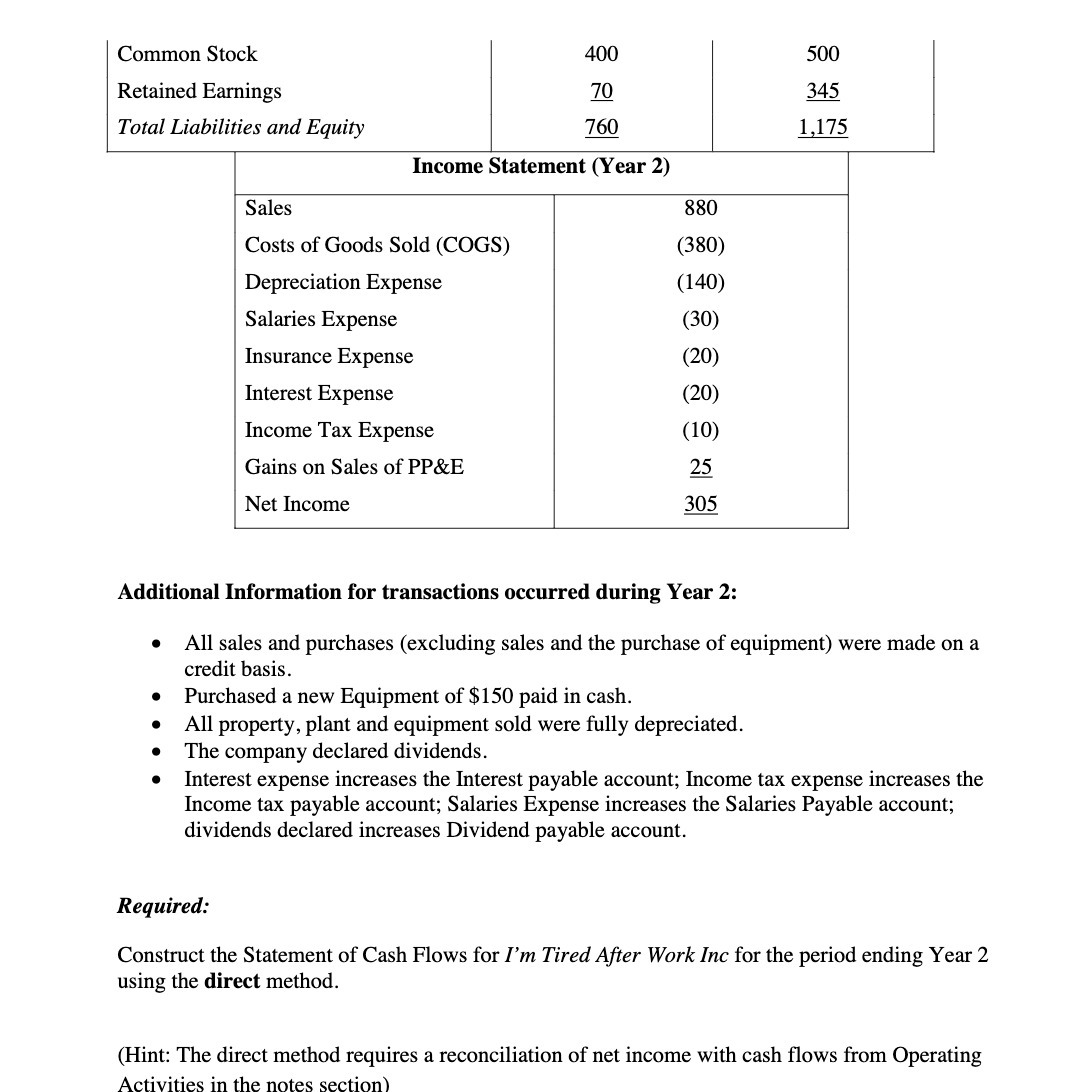

Question: Common Stock 400 500 Retained Earnings E E Total Liabilities and Equity E LE I Income Statement (Year 2) I Sales 880 Costs of Goods

Common Stock 400 500 Retained Earnings E E Total Liabilities and Equity E LE I Income Statement (Year 2) I Sales 880 Costs of Goods Sold (COGS) (380) Depreciation Expense (140) Salaries Expense (30) Insurance Expense (20) Interest Expense (20) Income Tax Expense (10) Gains on Sales of PP&.E g Net Income Additional lnIormation for transactions occurred during Year 2: o All sales and purchases (excluding sales and the purchase of equipment) were made on a credit basis. Purchased a new Equipment of $150 paid in cash. All property, plant and equipment sold were fully depreciated. The company declared dividends. Interest expense increases the Interest payable account; Income tax expense increases the Income tax payable account; Salaries Expense increases the Salaries Payable account; dividends declared increases Dividend payable account. Required: Construct the Statement of Cash Flows for I'm Tired Aer Work Inc for the period ending Year 2 using the direct method. (Hint: The direct method requires a reconciliation of net income with cash flows from Operating Activities in the notes section)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts