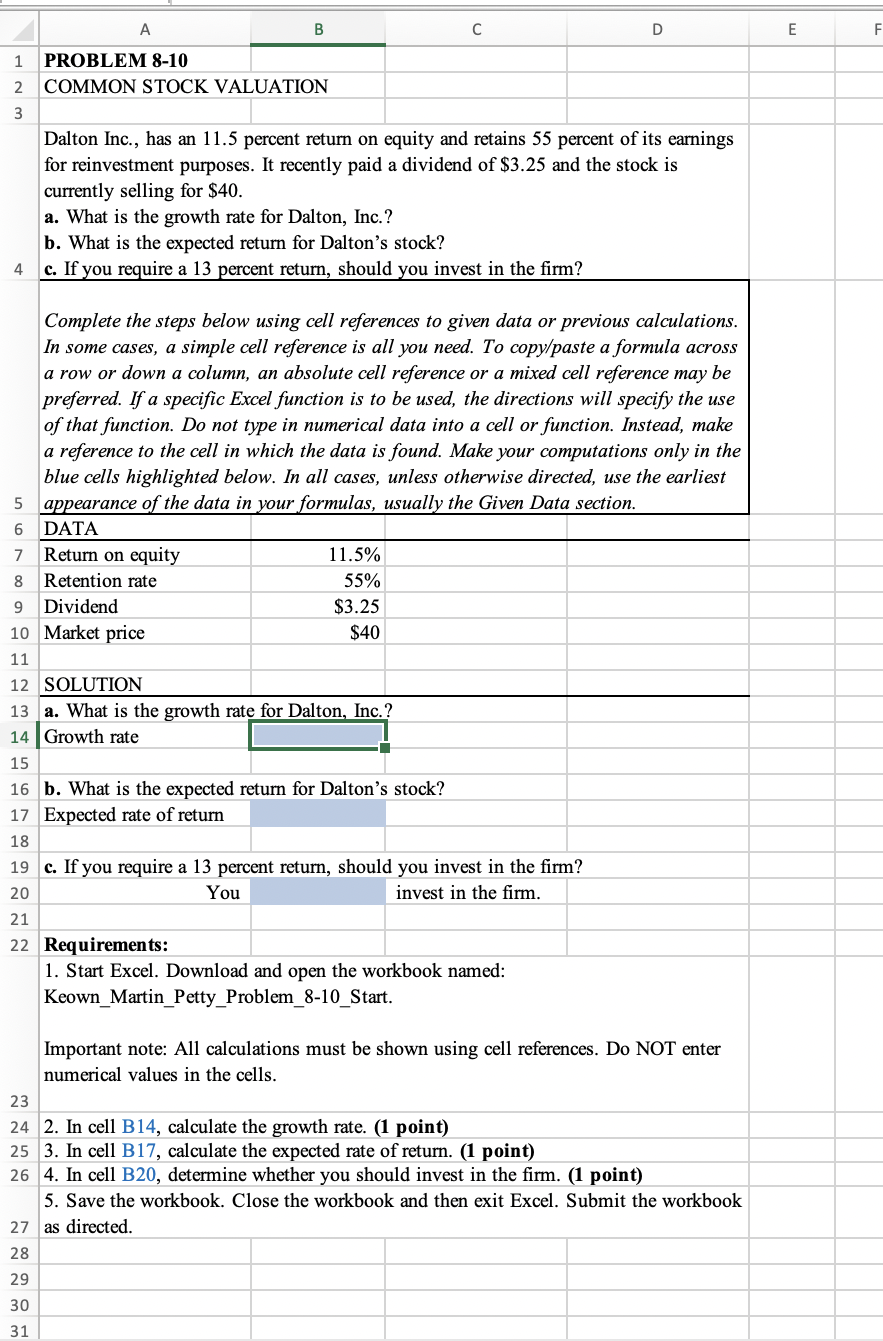

Question: COMMON STOCK VALUATION b. What is the expected return for Dalton's stock? Expected rate of return c. If you require a 13 percent return, should

COMMON STOCK VALUATION

b. What is the expected return for Dalton's stock? Expected rate of return c. If you require a 13 percent return, should you invest in the firm? \begin{tabular}{l|l} 20 & \\ 21 & \\ 22 & Requirements: \end{tabular} 1. Start Excel. Download and open the workbook named: Keown_Martin_Petty_Problem_8-10_Start. Important note: All calculations must be shown using cell references. Do NOT enter numerical values in the cells. 2. In cell B14, calculate the growth rate. (1 point) 3. In cell B17, calculate the expected rate of return. (1 point) 4. In cell B20, determine whether you should invest in the firm. (1 point) 5. Save the workbook. Close the workbook and then exit Excel. Submit the workbook 27 as directed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts