Question: Common stock value Variable growth Newman Manufacturing is considering a cash purchase of the stock of Gripe Tool During the year completed, Grips samed 53

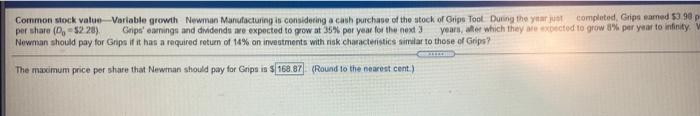

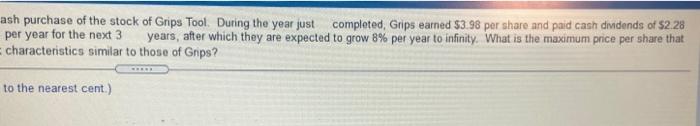

Common stock value Variable growth Newman Manufacturing is considering a cash purchase of the stock of Gripe Tool During the year completed, Grips samed 53 98 p per share (0, $228) Grips' earnings and dividends are expected to grow at 35% per year for the next years, wer which they are expected to grow 1% per year to infinity Newman should pay for Grips if it has a required return of 14% on investments with risk characteristics similar to those of Grips? The macimum price per share that Newman should pay for Grips is $168.87 (Round to the nearest cent) ash purchase of the stock of Grips Tool. During the year just completed, Grips earned $3.98 por share and paid cash dividends of 52.28 per year for the next 3 years, after which they are expected to grow 8% per year to infinity. What is the maximum price per share that characteristics similar to those of Grips? to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts