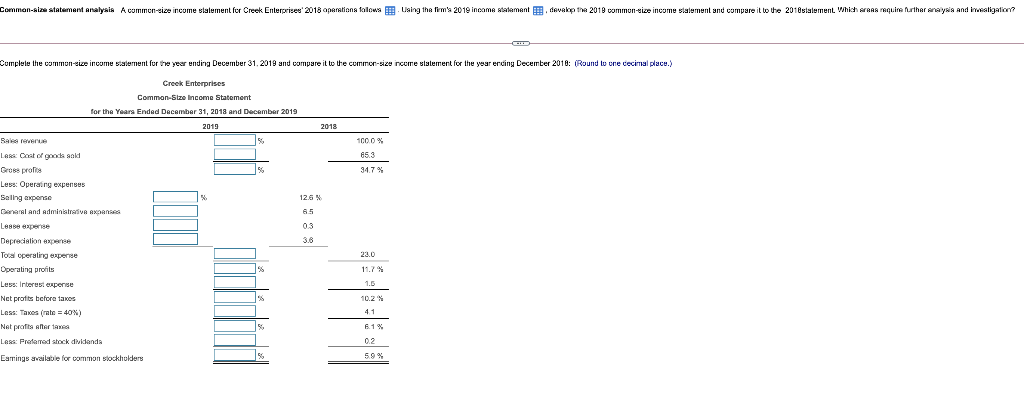

Question: Common-size statement Analysis A common-cize income statement for Creek Enterprise '2018 aparting flows Lising the firm's 2019 income statement develop the 2018 commun-rize income statement

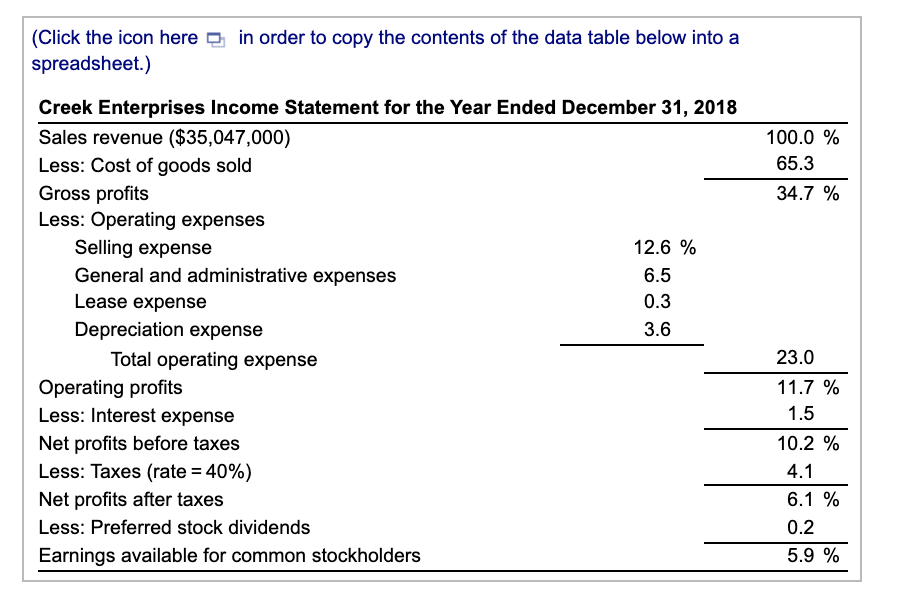

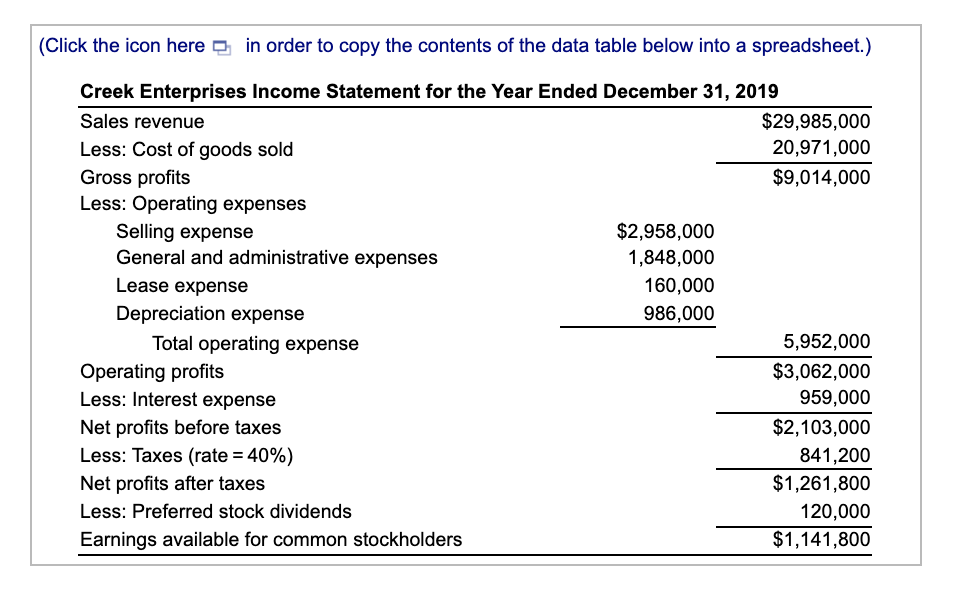

Common-size statement Analysis A common-cize income statement for Creek Enterprise '2018 aparting flows Lising the firm's 2019 income statement develop the 2018 commun-rize income statement and compare it to the 2018 statement. Which require further saysia and investigation? Cumplete the common-size income scalement for the year ending December 31, 2019 and compare it to the common-size income statement for the year ending December 2018: (Round to one cecimal place.) Creek Enterprises Common-Size Income Statement for the Year Ended December 31, 2018 and December 2019 2019 2018 Bal revenue 15 100.0 % 653 34.7% 12.6 % 6.5 03 3.6 LARS Cast of good and Gross profon Less Operating expenses Seling expense General and Administrave expand Les capere Deprecation expense Tocal operating experte Operating profits Less Interest expense Net profits before taxes Less: Taxes (rate = 40%) Net profits after LASS: Profamed stock dividenda 23.0 11.7% 1.5 "S 10.2% 41 6.1% 0.2 Earnings available for common stockholders 56 5.9% 100.0 % 65.3 34.7 % (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2018 Sales revenue ($35,047,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense 12.6 % General and administrative expenses 6.5 Lease expense 0.3 Depreciation expense 3.6 Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 23.0 11.7 % 1.5 10.2 % 4.1 6.1 % 0.2 5.9 % (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2019 Sales revenue $29,985,000 Less: Cost of goods sold 20,971,000 Gross profits $9,014,000 Less: Operating expenses Selling expense $2,958,000 General and administrative expenses 1,848,000 Lease expense 160,000 Depreciation expense 986,000 Total operating expense 5,952,000 Operating profits $3,062,000 Less: Interest expense 959,000 Net profits before taxes $2,103,000 Less: Taxes (rate = 40%) 841,200 Net profits after taxes $1,261,800 Less: Preferred stock dividends 120,000 Earnings available for common stockholders $1,141,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts