Question: Common-size statement analysis A common-size income statement for Creek Enterprises' 2018 operations follows B. Using the firm's 2019 income statement B. develop the 2019 common-size

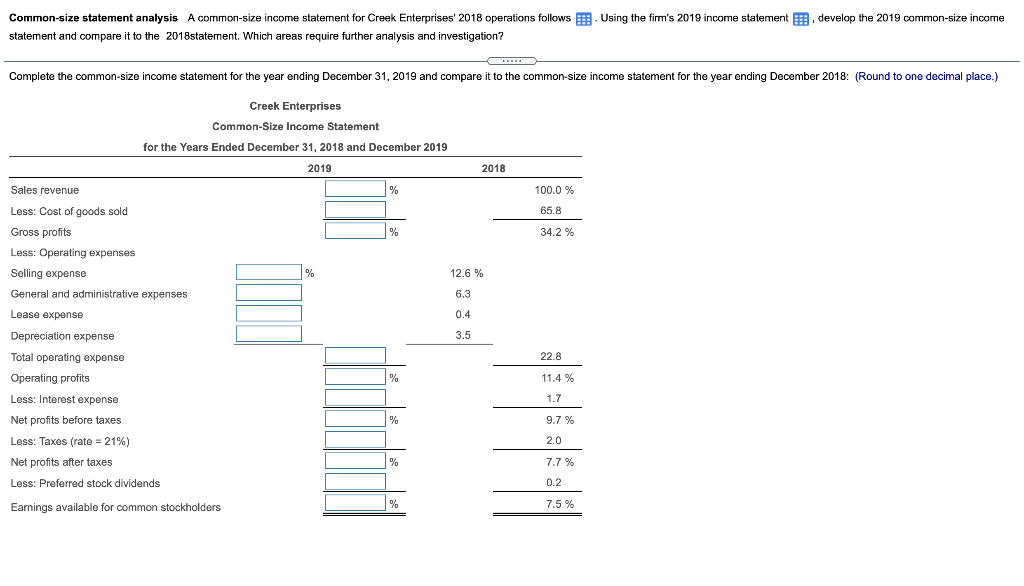

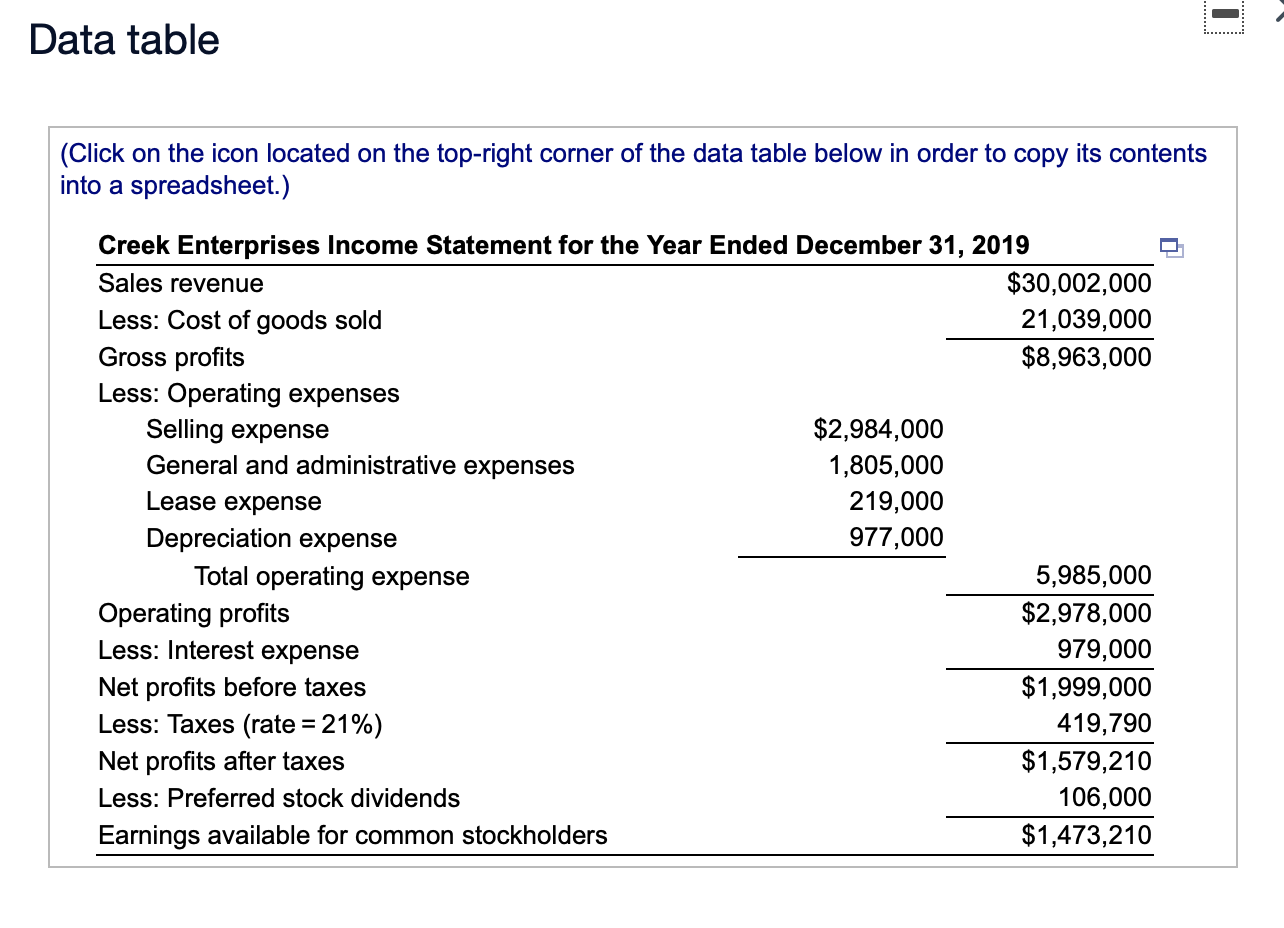

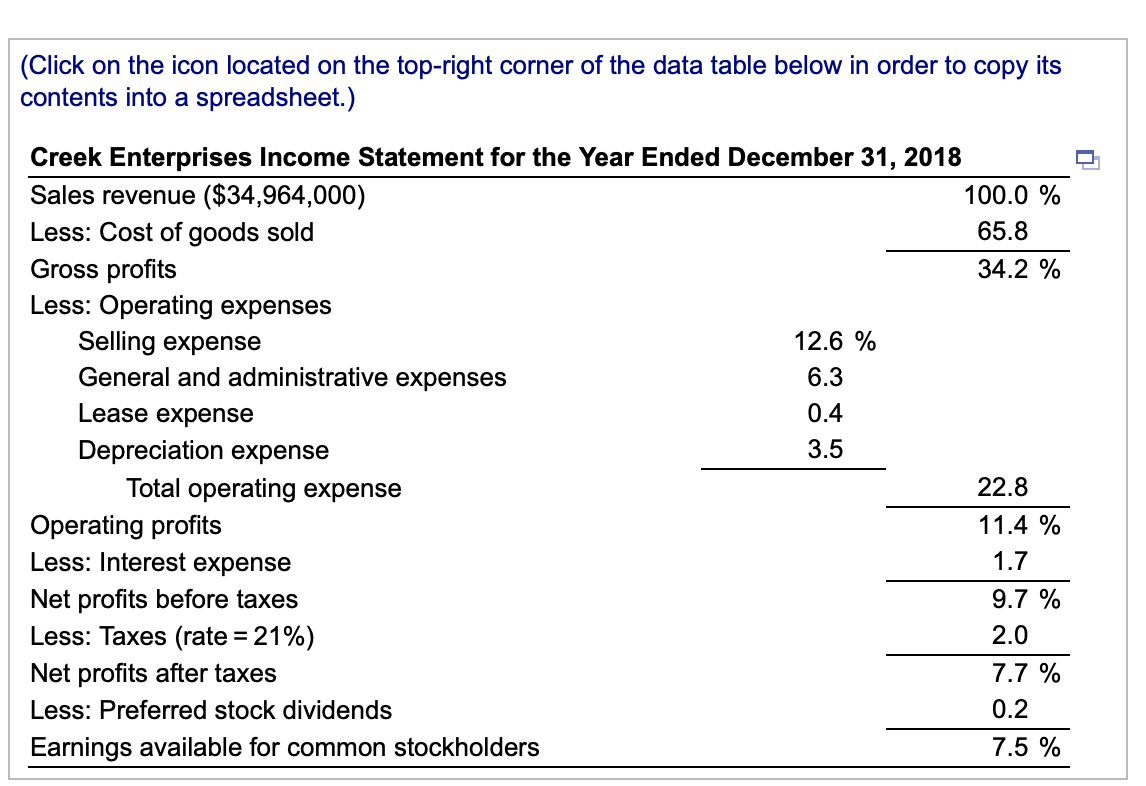

Common-size statement analysis A common-size income statement for Creek Enterprises' 2018 operations follows B. Using the firm's 2019 income statement B. develop the 2019 common-size income statement and compare it to the 2018statement. Which areas require further analysis and investigation? Complete the common-size income statement for the year ending December 31, 2019 and compare it to the common-size income statement for the year ending December 2018: (Round to one decimal place.) Creek Enterprises Common-Size Income Statement for the Years Ended December 31, 2018 and December 2019 2019 2018 Sales revenue % 100.0 % 65.8 % 34.2 % % 12.6 % 6.3 0.4 3.5 Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 21%) Net profits after taxes Less: Preferred stock dividends 22.8 % 11.4 % 1.7 % 9.7 % 2.0 % 7.7 % 0.2 % Earnings available for common stockholders 7.5 % - Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2019 Sales revenue $30,002,000 Less: Cost of goods sold 21,039,000 Gross profits $8,963,000 Less: Operating expenses Selling expense $2,984,000 General and administrative expenses 1,805,000 Lease expense 219,000 Depreciation expense 977,000 Total operating expense 5,985,000 Operating profits $2,978,000 Less: Interest expense 979,000 Net profits before taxes $1,999,000 Less: Taxes (rate = 21%) 419,790 Net profits after taxes $1,579,210 Less: Preferred stock dividends 106,000 Earnings available for common stockholders $1,473,210 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2018 Sales revenue ($34,964,000) 100.0 % Less: Cost of goods sold 65.8 Gross profits 34.2 % Less: Operating expenses Selling expense 12.6 % General and administrative expenses 6.3 Lease expense 0.4 Depreciation expense 3.5 Total operating expense 22.8 Operating profits 11.4 % Less: Interest expense 1.7 Net profits before taxes 9.7 % Less: Taxes (rate = 21%) 2.0 Net profits after taxes 7.7 % Less: Preferred stock dividends 0.2 Earnings available for common stockholders 7.5 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts