Question: community objections. 4) meet enterprise objectives. Question 19 (2 points) Listen Assume a present value of equity of $1,716,969; an initial cash outlay of $1,600,000;

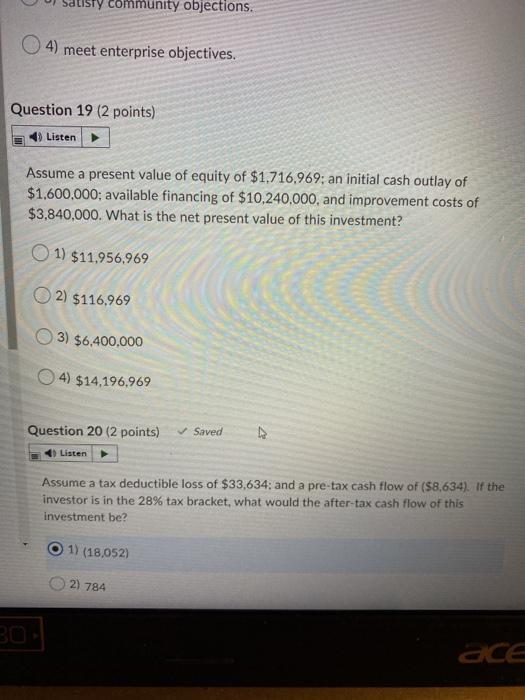

community objections. 4) meet enterprise objectives. Question 19 (2 points) Listen Assume a present value of equity of $1,716,969; an initial cash outlay of $1,600,000; available financing of $10,240,000, and improvement costs of $3,840,000. What is the net present value of this investment? 1) $11.956,969 2) $116,969 3) $6,400,000 4) $14,196,969 Question 20 (2 points) Saved Listen Assume a tax deductible loss of $33,634; and a pre-tax cash flow of ($8,634). If the investor is in the 28% tax bracket, what would the after-tax cash flow of this investment be? 1) (18,052) 2) 784 ACE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts