Companies in the tire manufacturing business use a lot of property, plant, and equipment. Tyrell Rubber...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

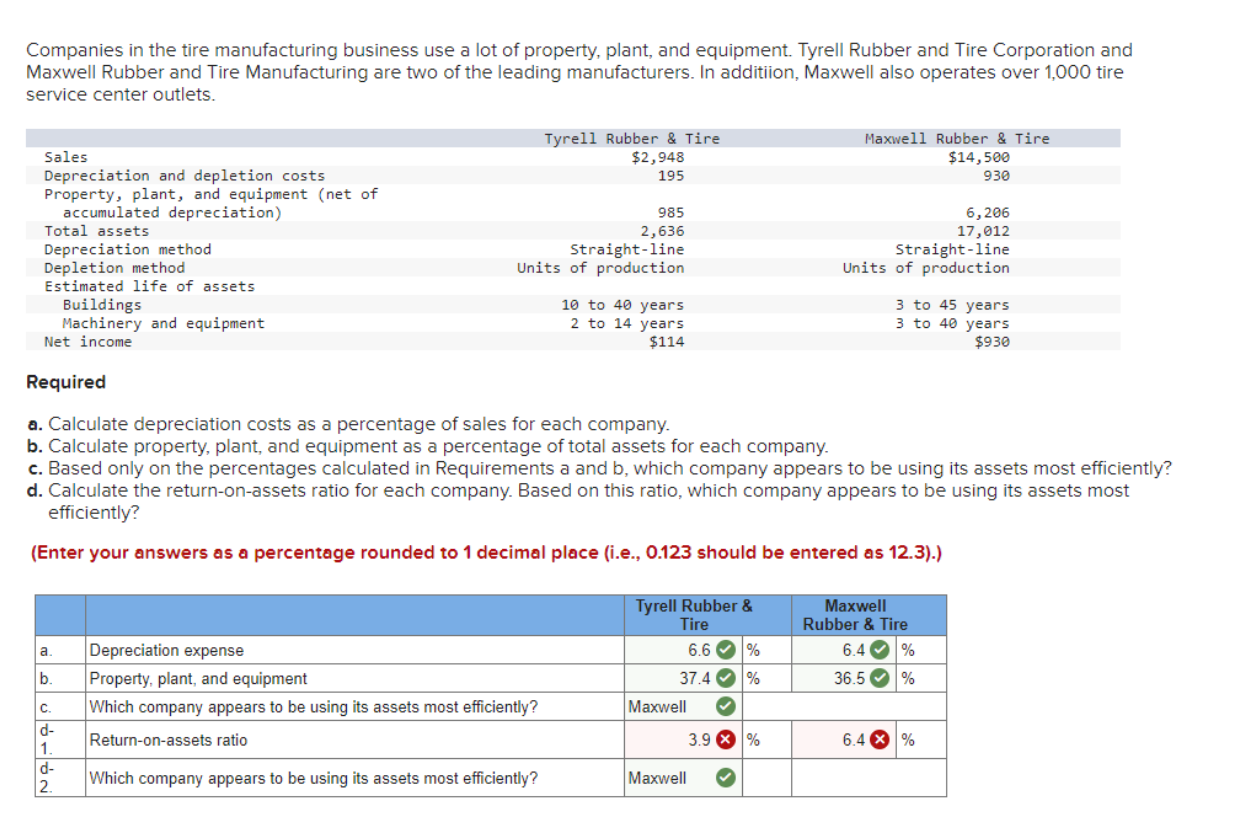

Companies in the tire manufacturing business use a lot of property, plant, and equipment. Tyrell Rubber and Tire Corporation and Maxwell Rubber and Tire Manufacturing are two of the leading manufacturers. In addition, Maxwell also operates over 1,000 tire service center outlets. Sales Depreciation and depletion costs Property, plant, and equipment (net of accumulated depreciation) Total assets Depreciation method Depletion method Estimated life of assets Buildings Machinery and equipment Net income Required Tyrell Rubber & Tire $2,948 195 985 2,636 Straight-line Units of production 10 to 40 years 2 to 14 years $114 a. Calculate depreciation costs as a percentage of sales for each company. b. Calculate property, plant, and equipment as a percentage of total assets for each company. Maxwell Rubber & Tire $14,500 930 6,206 17,012 Straight-line Units of production 3 to 45 years 3 to 40 years $930 c. Based only on the percentages calculated in Requirements a and b, which company appears to be using its assets most efficiently? d. Calculate the return-on-assets ratio for each company. Based on this ratio, which company appears to be using its assets most efficiently? (Enter your answers as a percentage rounded to 1 decimal place (i.e., 0.123 should be entered as 12.3).) Tyrell Rubber & Tire a. Depreciation expense b. Property, plant, and equipment 6.6 % 37.4% 36.5 Maxwell Rubber & Tire 6.4% % C. d- 1. Which company appears to be using its assets most efficiently? Return-on-assets ratio Maxwell 3.9 % 6.4 % d- 2. Which company appears to be using its assets most efficiently? Maxwell Companies in the tire manufacturing business use a lot of property, plant, and equipment. Tyrell Rubber and Tire Corporation and Maxwell Rubber and Tire Manufacturing are two of the leading manufacturers. In addition, Maxwell also operates over 1,000 tire service center outlets. Sales Depreciation and depletion costs Property, plant, and equipment (net of accumulated depreciation) Total assets Depreciation method Depletion method Estimated life of assets Buildings Machinery and equipment Net income Required Tyrell Rubber & Tire $2,948 195 985 2,636 Straight-line Units of production 10 to 40 years 2 to 14 years $114 a. Calculate depreciation costs as a percentage of sales for each company. b. Calculate property, plant, and equipment as a percentage of total assets for each company. Maxwell Rubber & Tire $14,500 930 6,206 17,012 Straight-line Units of production 3 to 45 years 3 to 40 years $930 c. Based only on the percentages calculated in Requirements a and b, which company appears to be using its assets most efficiently? d. Calculate the return-on-assets ratio for each company. Based on this ratio, which company appears to be using its assets most efficiently? (Enter your answers as a percentage rounded to 1 decimal place (i.e., 0.123 should be entered as 12.3).) Tyrell Rubber & Tire a. Depreciation expense b. Property, plant, and equipment 6.6 % 37.4% 36.5 Maxwell Rubber & Tire 6.4% % C. d- 1. Which company appears to be using its assets most efficiently? Return-on-assets ratio Maxwell 3.9 % 6.4 % d- 2. Which company appears to be using its assets most efficiently? Maxwell

Expert Answer:

Related Book For

Fundamental Financial Accounting Concepts

ISBN: 9781260786583

11th Edition

Authors: Thomas P. Edmonds

Posted Date:

Students also viewed these accounting questions

-

Companies in the tire manufacturing business use a lot of property, plant, and equipment. Cooper Tire & Rubber Company . . . is a leading manufacturer and marketer of replacement tires. It is the...

-

Companies in the coal mining business use a lot of property, plant, and equipment. Not only is there the significant investment they must make in the equipment used to extract and process the coal,...

-

Read the case study of Statistics regarding the Lawler Grocery Store chain. The use of the sign test is demonstrated in this case study. In your opinion, what is the biggest benefit of the sign test?...

-

Consider the system represented in state variable form y = Cx + Du, where C = [1 -4], and D = [0]. 0 15

-

A car with mass M moving at 4.65m/s speed collides with a car twice as massive that is travelling in the same direction but at 1/3 of the first car's speed. If the two vehicles entangled together...

-

Given the following network for a stock repurchase project with outside consulting resource demands, construct a modified Gantt AOA chart with resources and a resource load diagram. Suggest how to...

-

A contractor purchased a dump truck for $98,500. This price included freight. Sales tax was 7.5%. The useful life of this dump truck is 8 years and the salvage value is estimated at $10,000. What is...

-

Discuss in the detail the Balance Sheet. What is shown on the Balance Sheet? Why is the Balance Sheet important to a hospitality firm?

-

1- Define and explain Business Process Remodelling? Why BPMN is important for businesses discuss with example (05 marks) 2-What is the principle of cardinality in date base modelling? Explain the...

-

give the Definitions/description of the following specialization structural engineering geotechnical engineering construction engineering transportation engineering water resources engineering

-

Taxable income Taxable income 0 - 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 335,000 335,001 - 10,000,000 10,000,001 - 15,000,000 15,000,001 - 18,333,333 18,333,334 + Output area: Taxes: 15%...

-

address each of the following questions: According to your log, to what type of media are you most exposed? Did this surprise you? Why or why not? If you could only access one form of media for the...

-

The end of year balances in the adjusted trial balance for Dynamic Weight Loss are as follows: Accounts Payable: $52,996 Accounts Receivable: $182,703 Accumulated Depreciation - Equipment: $173,182...

-

Are Tesla or Tata motors using any of the five major process management tools for strategy execution? How would you assess the effectiveness of these tools?

-

-4 1 9. Let A = Find A-1, (A") and verify that (A")= (A-1)".

-

In 1951, DuPont began using the chemical perfluorooctanoic acid to manufacture Teflon. Due to the dangerous nature of the chemical, DuPont was given special instructions by its supplier to dispose of...

-

In 2014, political consulting firm Cambridge Analytica developed an app designed to create digital profiles of individuals via their information. Cambridge Analytica collected the data by inviting...

-

One critical-thinking skill is a heightened awareness of the danger of reaching a conclusion prior to acquiring missing information that were it known would have a reasonable probability of altering...

Study smarter with the SolutionInn App