Question: Company A 1 is a U . S . multinational that has net cash inflows of pounds and euros. Company B 2 is a U

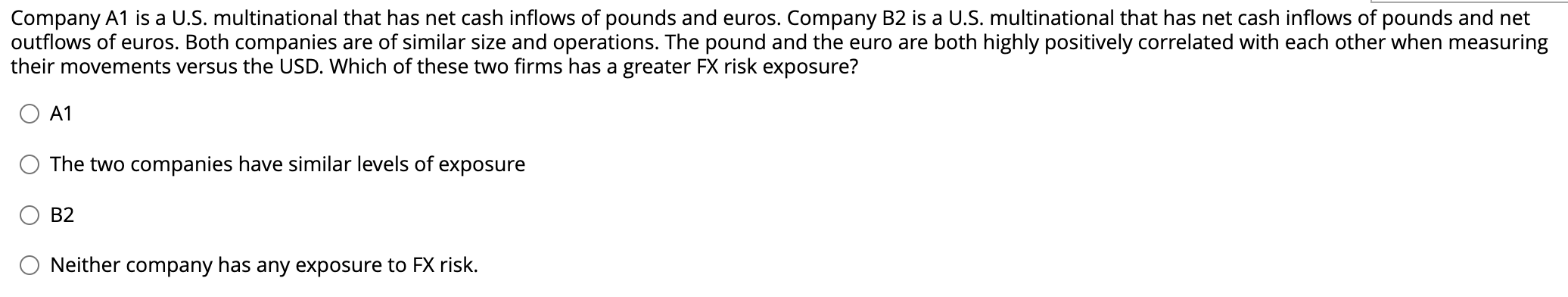

Company A is a US multinational that has net cash inflows of pounds and euros. Company B is a US multinational that has net cash inflows of pounds and net

outflows of euros. Both companies are of similar size and operations. The pound and the euro are both highly positively correlated with each other when measuring

their movements versus the USD. Which of these two firms has a greater FX risk exposure?

A

The two companies have similar levels of exposure

B

Neither company has any exposure to FX risk.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock