Question: Company A has been operating in a stable condition with some financial radios being shown as follows: Total Assets: 1000 billion VND. Payout ratio is

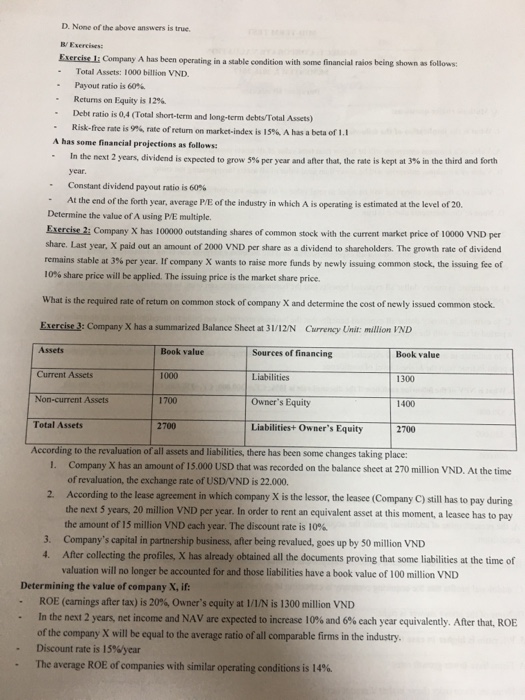

Company A has been operating in a stable condition with some financial radios being shown as follows: Total Assets: 1000 billion VND. Payout ratio is 60% Returns on Equity is 12%. Debt ratio is 0.4 (Total short-term and long-term debts/Total Assets) Risk-free rate is 9%, rate of return on market-index is 15%. A has a beta of 1.1 A hat some financial projections at follows: In the next 2 years, dividend is expected to grow 5% per year and after that, the rate is kept at 3% in the third and forth year. Constant dividend payout ratio is 60% At the end of the forth year, average P/E of the industry in which A is operating is estimated at the level of 20. Determine the value of A using P/E multiple. Company X has 100000 outstanding shares of common stock with the current market price of 10000 VND per share. Last year, X paid out an amount of 2000 VND per share as a dividend to shareholders. The growth rate of dividend remains stable at 3% per year. If company X wants to raise more funds by newly issuing common stock, the issuing fee of 10% share price will he applied. The issuing price is the market share price. What is the required rate of return on common stock of company X and determine the cost of newly issued common stock. Company X has a summarized Balance Sheet at 31/12/N Currency Unit: million VND According to the revaluation of all assets and liabilities, there has been some changes taking place: 1. Company X has an amount of 15.000 USD that was recorded on the balance sheet at 270 million VND. At the time of revaluation, the exchange rate of USD/VND is 22.000. 2. According to the lease agreement in which company X is the lessor, the leasee (Company C) still has to pay during the next 5 years. 20 million VND per year. In order to rent an equivalent asset at this moment, a leasee has to pay the amount of 15 million VND each year. I lie discount rate is 10%. 3. Company's capital in partnership business, after being revalued, goes up by 50 million VND 4. After collecting the profiles. X has already obtained all the documents proving that some liabilities at the time of valuation will no longer be accounted for and those liabilities have a book value of 100 million VND Determining the value of company X, if: ROE (earnings after tax) is 20% Owner's equity at 1/l/N is 1300 million VND In the next 2 years, net income and NAV are expected to increase 10% and 6% each year equivalently. After that, ROE of the company X will be equal to the average ratio of all comparable firms in the industry. Discount rate is 15% year The average ROE of companies with similar operating conditions is 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts