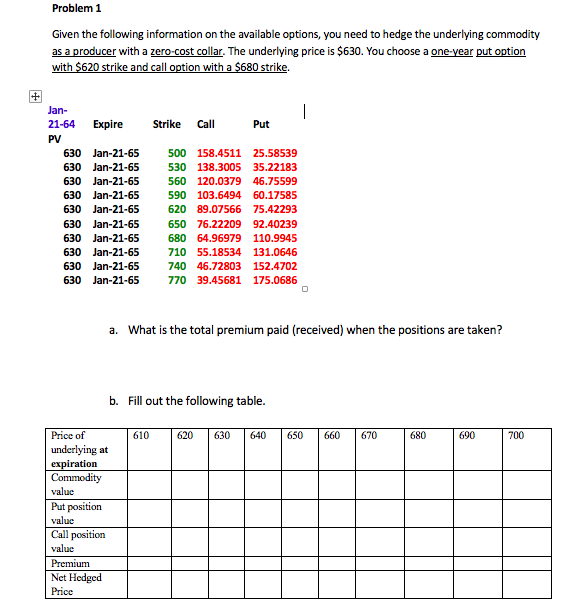

Question: Problem 1 Given the following information on the avabe options, you need to hedge the underlying commodity as a producer with a zero-cost collar. The

Problem 1 Given the following information on the avabe options, you need to hedge the underlying commodity as a producer with a zero-cost collar. The underlying price is $630. You choose a one-year put option Jan- 21-64 Expire Strike Call PV Put 630 Jan-21-65 630 Jan-21-65 630 Jan-21-65 630 Jan-21-65 630 Jan-21-65 630 Jan-21-65 630 Jan-21-65 630 Jan-21-65 630 Jan-21-65 630 Jan-21-65 500 158.4511 25.58539 530 138.3005 35.22183 560 120.0379 46.75599 590 103.6494 60.17585 620 89.07566 75.42293 650 76.22209 92.40239 680 64.96979 110.9945 710 55.18534 131.0646 740 46.72803 152.4702 770 39.45681 175.0686 a. What is the total premium paid (received) when the positions are taken? b. Fill out the following table Price of underlying at 610 620 630 640 650 660 670 680 690 700 value Put position value Call position value Net Hedged Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts