Company defaulted on a $160,000 loan that was due on December 31, 2024. The bank has...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

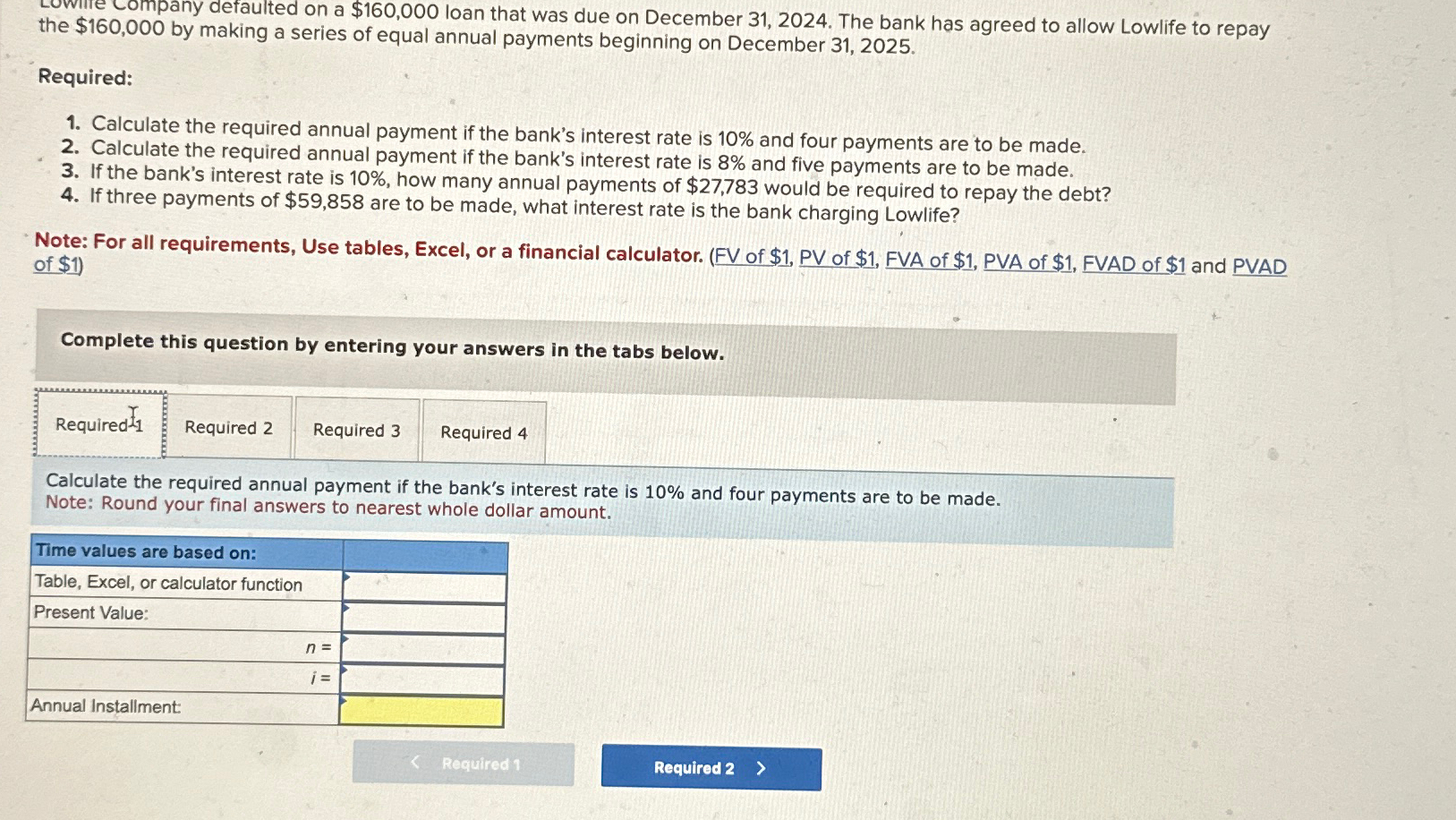

Company defaulted on a $160,000 loan that was due on December 31, 2024. The bank has agreed to allow Lowlife to repay the $160,000 by making a series of equal annual payments beginning on December 31, 2025. Required: 1. Calculate the required annual payment if the bank's interest rate is 10% and four payments are to be made. 2. Calculate the required annual payment if the bank's interest rate is 8% and five payments are to be made. 3. If the bank's interest rate is 10%, how many annual payments of $27,783 would be required to repay the debt? 4. If three payments of $59,858 are to be made, what interest rate is the bank charging Lowlife? Note: For all requirements, Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the required annual payment if the bank's interest rate is 10% and four payments are to be made. Note: Round your final answers to nearest whole dollar amount. Time values are based on: Table, Excel, or calculator function Present Value: n = = Annual Installment: < Required 1 Required 2 > Company defaulted on a $160,000 loan that was due on December 31, 2024. The bank has agreed to allow Lowlife to repay the $160,000 by making a series of equal annual payments beginning on December 31, 2025. Required: 1. Calculate the required annual payment if the bank's interest rate is 10% and four payments are to be made. 2. Calculate the required annual payment if the bank's interest rate is 8% and five payments are to be made. 3. If the bank's interest rate is 10%, how many annual payments of $27,783 would be required to repay the debt? 4. If three payments of $59,858 are to be made, what interest rate is the bank charging Lowlife? Note: For all requirements, Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the required annual payment if the bank's interest rate is 10% and four payments are to be made. Note: Round your final answers to nearest whole dollar amount. Time values are based on: Table, Excel, or calculator function Present Value: n = = Annual Installment: < Required 1 Required 2 >

Expert Answer:

Related Book For

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Posted Date:

Students also viewed these accounting questions

-

the perceptual process prospective. Case Study Case 3.1: Space Utilization Mr. Sherman Adder, assistant plant manager for Frame Manufacturing Company, is chairperson of the ad hoc committee for space...

-

Lowlife Company defaulted on a $250,000 loan that was due on December 31, 2021. The bank has agreed to allow Lowlife to repay the $250,000 by making a series of equal annual payments beginning on...

-

Lowlife Company defaulted on a $250,000 loan that was due on December 31, 2011. The bank has agreed to allow Lowlife to repay the $250,000 by making a series of equal annual payments beginning on...

-

The following is information for a perfectly price discriminating monopolist. Demand: P = 65 0.02Q Marginal revenue = P = 65 0.04Q Marginal cost = ATC = 4 Calculate the producer surplus for the...

-

If retailers and manufacturers are aware that consumers derive utility from "getting a good deal," they may be able to take advantage of this to increase their own profits. Can you find evidence that...

-

Is DNA a better form of forensic identification evidence than fingerprints? Why or why not?

-

Risk costs. The risks in carrying inventory are: a. Obsolescence; loss of product value resulting from a model or style change or technological development. b. Damage; inventory damaged while being...

-

Pastina Company manufactures and sells various types of pasta to grocery chains as private label brands. The company's fiscal year-end is December 31. The unadjusted trial balance as of December 31,...

-

Marked out of 1 P Flag question Determine the shareholder's equity of MCB Company if the Liabilities is OMR 37,250 and the Assets is OMR 42,500. a. OMR 32,750 b. OMR 5,250 c. OMR 42,500 d. None of...

-

If Mr. Watanabe was gambling in a state were gambling was not legal, discuss how the courts would treat the case?

-

A company determines that monthly sales S(t), in thousands of dollars, after t months of marketing a product is given by S(t) = 23-551 + 230t+ 160. a) Find S'(1), S'(2), and S'(4). b) Find S''(1),...

-

Dan is a 16 year-old who decided to skip his adolescent development class. If Dan was 19 years-old, this would be his choice, but because of his age, he has broken the law. What type of offence did...

-

You need to remove a bolt from a metal door. The maximum torque the bolt can withstand before starting to rotate is 7 = 70 N-m. You apply a wrench of m = 0.5 kg and 1 = 0.3 m long. You push down on...

-

Lesson 10.1: Emotional Intelligence Emotional Intelligence is a type of social intelligence that affords the individual the ability to monitor his own and others' emotions, to discriminate among...

-

Harriet??s annuity has a total cash value of $2000, and she has paid a total of $1,500 into it. Under a Section 1035 exchange, Harriet rolls the entire value of the annuity into a different annuity....

-

On the basis of the data on the three locations provided above, use a locational cost-volume analysisto determine the most suitable location for the IKEA facility in South Africa. As part of the...

-

Provide a few individual examples who revealed what aspects of emotional intelligence?

-

J-Matt, Inc., had pretax accounting income of $291,000 and taxable income of $300,000 in 2021. The only difference between accounting and taxable income is estimated product warranty costs of $9,000...

-

April Wood Products accounts receivable increased during the year by $4 million. What is the amount of cash April Wood Products received from customers during the reporting period if its sales were...

-

Locate the financial statements and related disclosure notes of FedEx Corporation for the fiscal year ended May 31, 2017. You can locate the report online at www.fedex.com. Use the information...

-

Here are the raw data for the ANES unique group of widows with three or more kids at home: Number of days read newspaper per week: 3, 2, 1, 7, 1, 0, 0, 0, 0, 2, 2 Use these raw data to construct a...

-

When someone rates a group at 10 on the ANES feeling thermometer, thats a pretty serious sign of dislike. I make the claim that the population of African American, female strong Democrats aged 17 to...

-

what the Central Limit Theorem is and why it is important

Study smarter with the SolutionInn App