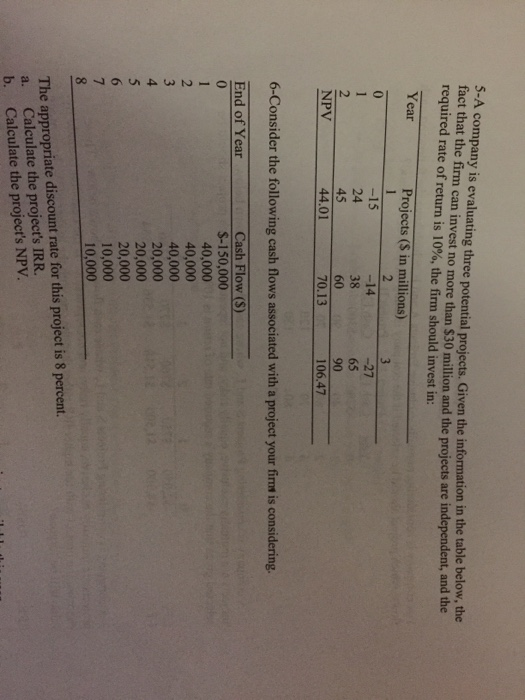

Question: - company is evaluating three potential projects. Given the information in the table below.me fact that the firm can invest no more than 30 million

- company is evaluating three potential projects. Given the information in the table below.me fact that the firm can invest no more than 30 million and the projects are independent, anu required rate of return is 10%, the firm should invest in: Year Projects (S in millions) -15 24 45 44.01 --14 38 60 70.13 -27 65 90 106.47 NPV 6-Consider the following cash flows associated with a project your fims is considering, End of Year auw- Cash Flow (S) S-150,000 40,000 40,000 40,000 20,000 20,000 20,000 10,000 10,000 The appropriate discount rate for this project is 8 percent. Calculate the project's IRR. b. Calculate the project's NPV. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts