Question: Comparative Balance Sheets, an Income Statement and some additional information for Mutton Meat's are shown below. Mutton reports on a fiscal year ending 31

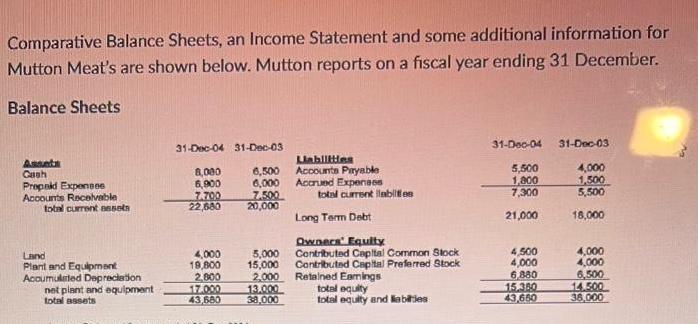

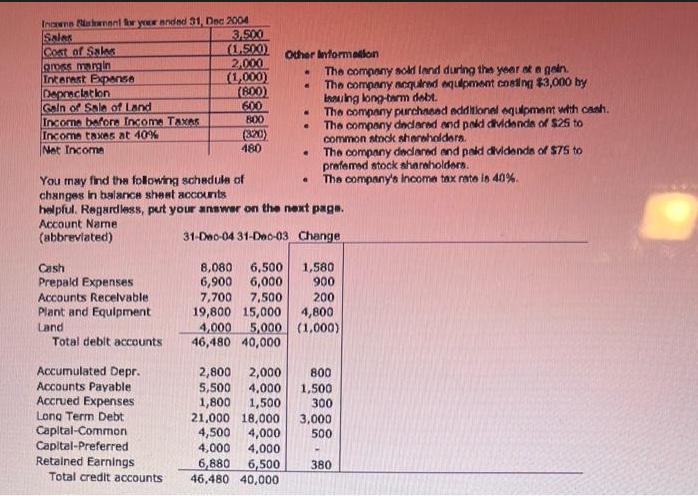

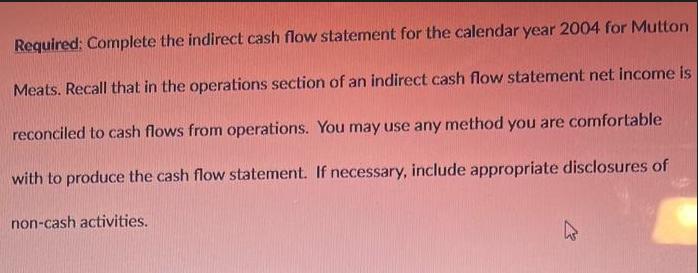

Comparative Balance Sheets, an Income Statement and some additional information for Mutton Meat's are shown below. Mutton reports on a fiscal year ending 31 December. Balance Sheets Assets Cash Prepaid Expensee Accounts Receivable total current assets Land Plant and Equipment Accumulated Depreciation net plant and equipment total assets 31-Dec-04 31-Dec-03 8,000 6,900 7.700 22,680 4,000 19,800 2,800 17.000 43,680 6,500 6,000 7.500 20,000 5,000 15,000 Liabilities Accounts Payable Accrued Expenses total current labiles Long Term Debt Owners' Equity Contributed Capital Common Stock Contributed Capital Preferred Stock 2,000 Retained Earnings 13.000 total equity 38,000 total equity and liabiles 31-Dec-04 31-Dec-03 5,500 4,000 1,800 1,500 7,300 5,500 21,000 18,000 4,500 4,000 6,880 15.380 43,650 4,000 4,000 6,500 14.500 36,000 Incene Riskanent for your anded 31, Dec 2004 Sales Cost of Sales gross margin Interest Expense Depreciation Gain of Sale of Land Income before Income TaxAS Income taxes at 40% Net Income Cash Prepaid Expenses Accounts Receivable Plant and Equipment Land Total debit accounts Accumulated Depr. Accounts Payable Accrued Expenses Long Term Debt Capital-Common Capital-Preferred Retained Earnings 3,500 (1.500) 2,000 (1,000) (800) 600 Total credit accounts 800 (320) 480 Other Information . You may find the following schedule of changes in balance sheet accounts helpful. Regardless, put your answer on the next page. Account Name (abbreviated) 31-Dec-04 31-Dec-03 Change 4,500 4,000 4,000 4,000 e 6,880 6,500 46,480 40,000 . The company sold land during the year at a gein. The company acquired equipment coeling $3,000 by Inauing long-term debt. a The company purchased additional equipment with cash. The company declared and paid dividende of $25 to common stock shareholders. The company declared and paid dividends of $75 to prefemed stock shareholders. The company's income tax rate is 40%. 8,080 6,500 1,580 6,900 6,000 900 7,700 7,500 200 19,800 15,000 4,800 4,000 5,000 (1,000) 46,480 40,000 2,800 2,000 800 5,500 4,000 1,500 1,800 1,500 300 21,000 18,000 3,000 500 380 Required: Complete the indirect cash flow statement for the calendar year 2004 for Mutton Meats. Recall that in the operations section of an indirect cash flow statement net income is reconciled to cash flows from operations. You may use any method you are comfortable with to produce the cash flow statement. If necessary, include appropriate disclosures of non-cash activities.

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Mutton Meats Inc Indirect Cash Flow Statement for the Year Ended December 31 2004 Cash flows from operating activities Net income 480 Adjustments to reconcile net income to net cash provided by operat... View full answer

Get step-by-step solutions from verified subject matter experts