Question: Compare the options below using a present worth analysis and an interest rate of 8% per year. Remember, an overhaul cost extends an alternative to

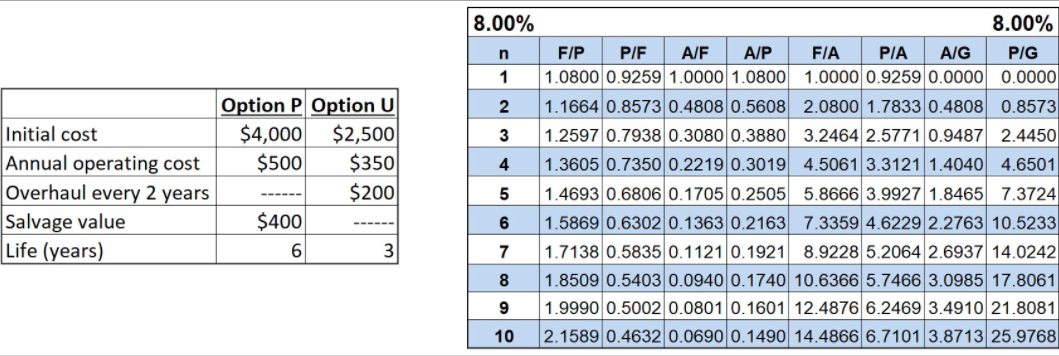

Compare the options below using a present worth analysis and an interest rate of 8% per year. Remember, an overhaul cost extends an alternative to it's expected useful life.

Compare the options below using a present worth analysis and an interest rate of 8% per year. Remember, an overhaul cost extends an alternative to it's expected useful life.

Part 1. Write a standard factor equation for the PW of Option P.

Part 2. Calculate the PW for Option P.

Part 3. Write a standard factor equation for the PW of Option U.

Part 4. Calculate the PW for Option U.

Option P Option U Initial cost $4,000 $2,500 Annual operating cost $500 $350 Overhaul every 2 years $200 Salvage value $400 Life (years) 6 3 8.00% 8.00% n F/P P/F A/F A/P FIA PIA AIG PIG 1 1.0800 0.9259 1.0000 1.0800 1.0000 0.9259 0.0000 0.0000 2 1.1664 0.8573 0.4808 0.5608 2.0800 1.7833 0.4808 0.8573 3 1.2597 0.7938 0.3080 0.3880 3.2464 2.5771 0.9487 2.4450 4 1.3605 0.7350 0.2219 0.3019 4.5061 3.3121 1.4040 4.6501 5 1.4693 0.6806 0.1705 0.2505 5.8666 3.9927 1.8465 7.3724 6 1.5869 0.6302 0.1363 0.2163 7.3359 4.6229 2.2763 10.5233 7 1.7138 0.5835 0.1121 0.1921 8.9228 5.2064 2.6937 14.0242 8 1.8509 0.5403 0.0940 0.1740 10.6366 5.7466 3.0985 17.8061 9 1.9990 0.5002 0.0801 0.1601 12.4876 6.2469 3.4910 21.8081 10 2.1589 0.4632 0.0690 0.1490 14.4866 6.7101 3.8713 25.9768 o on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts