Question: Compare the two bonds below and state which bond is more sensitive to interest rate changes: Bond A: CR-4%, YTM-5%, Maturity - 5 years Bond

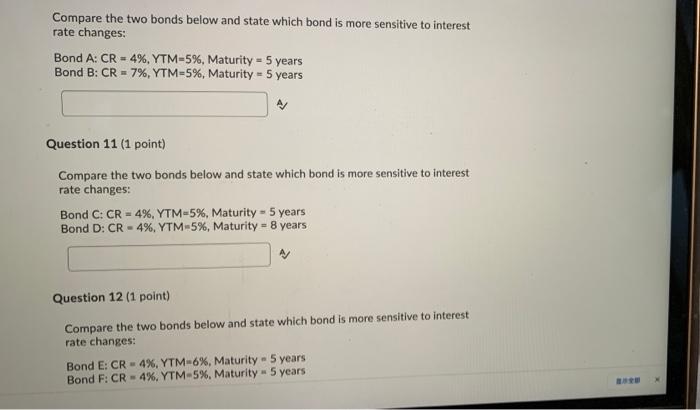

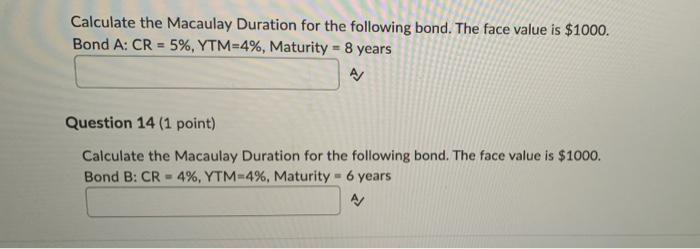

Compare the two bonds below and state which bond is more sensitive to interest rate changes: Bond A: CR-4%, YTM-5%, Maturity - 5 years Bond B: CR = 7%, YTM=5%, Maturity 5 years Question 11 (1 point) Compare the two bonds below and state which bond is more sensitive to interest rate changes: Bond C: CR - 4%, YTM-5%, Maturity - 5 years Bond D: CR - 4%, YTM-5%, Maturity = 8 years Question 12 (1 point) Compare the two bonds below and state which bond is more sensitive to interest rate changes: Bond E: CR-4%, YTM-6%, Maturity - 5 years Bond F: CR-4%, YTM-5%, Maturity - 5 years Calculate the Macaulay Duration for the following bond. The face value is $1000. Bond A: CR = 5%, YTM=4%, Maturity = 8 years A/ Question 14 (1 point) Calculate the Macaulay Duration for the following bond. The face value is $1000. Bond B: CR = 4%, YTM=4%, Maturity - 6 years A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts