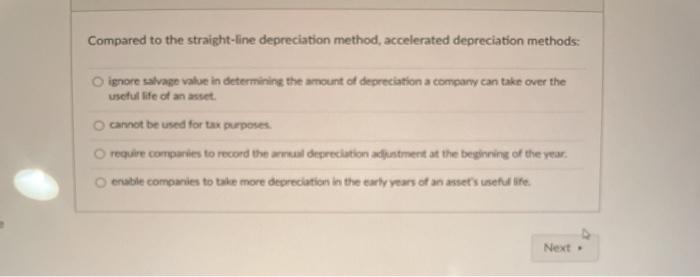

Question: Compared to the straight-line depreciation method, accelerated depreciation methods: Oignore salvage value in determining the amount of depreciation a company can take over the useful

Compared to the straight-line depreciation method, accelerated depreciation methods: Oignore salvage value in determining the amount of depreciation a company can take over the useful life of an asset cannot be used for tax purposes. require companies to record the depreciation adjustment at the beginning of the year, enable companies to take more depreciation in the early years of an asset's useful life. Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock