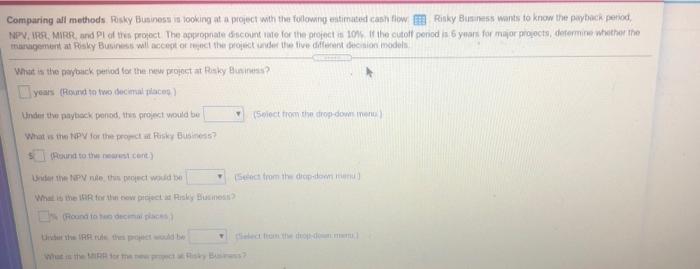

Question: Comparing all methods. Risky Business is looking at a project with the following estimated cash flow 2 Risky Business wants to know the payback period

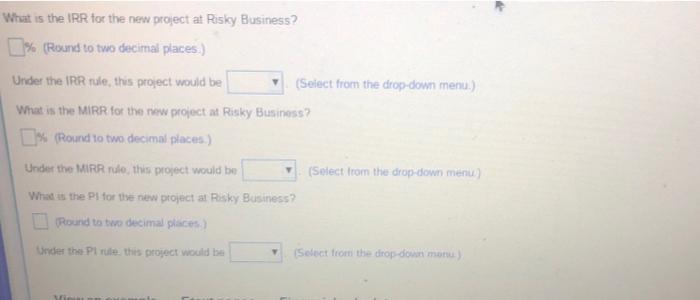

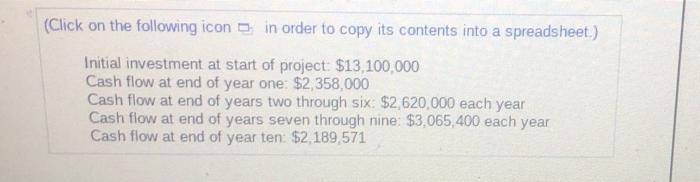

Comparing all methods. Risky Business is looking at a project with the following estimated cash flow 2 Risky Business wants to know the payback period NPV, IRR, MIRR and Prof project. The appropriate contate for the project is 10the cutol penodis 6 years for major projects, determine whether the margement Risky Business will accept out the project under the five different models What is the payback period for the new protetorky Business? yours (Round to two decimal place) Under the paytick Donod, this project would be (5oiect from the drop-down meno What is the NPV for the propisky Business? Round to the cont (Schach from the drop-down menul Pute this project would What is the forth bewegt ky binos Es und to complaces Lichtthere the home What is the IRR for the new project at Risky Business? 1% (Round to two decimal places) Under the IRR rule, this project would be (Select from the drop-down menu.) What is the MIRR for the new project at Risky Business? 1% (Round to two decimal places.) Under the MIRRO, this project would be (Select from the drop-down menu) What is the Pl for the new project at Risky Business? Round to be decimal places) Under the Plue this project would be Select from the drop-down mon) (Click on the following icon in order to copy its contents into a spreadsheet.) Initial investment at start of project $13,100,000 Cash flow at end of year one: $2,358,000 Cash flow at end of years two through six: $2,620,000 each year Cash flow at end of years seven through nine: $3,065,400 each year Cash flow at end of year ten: $2 189,571

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts