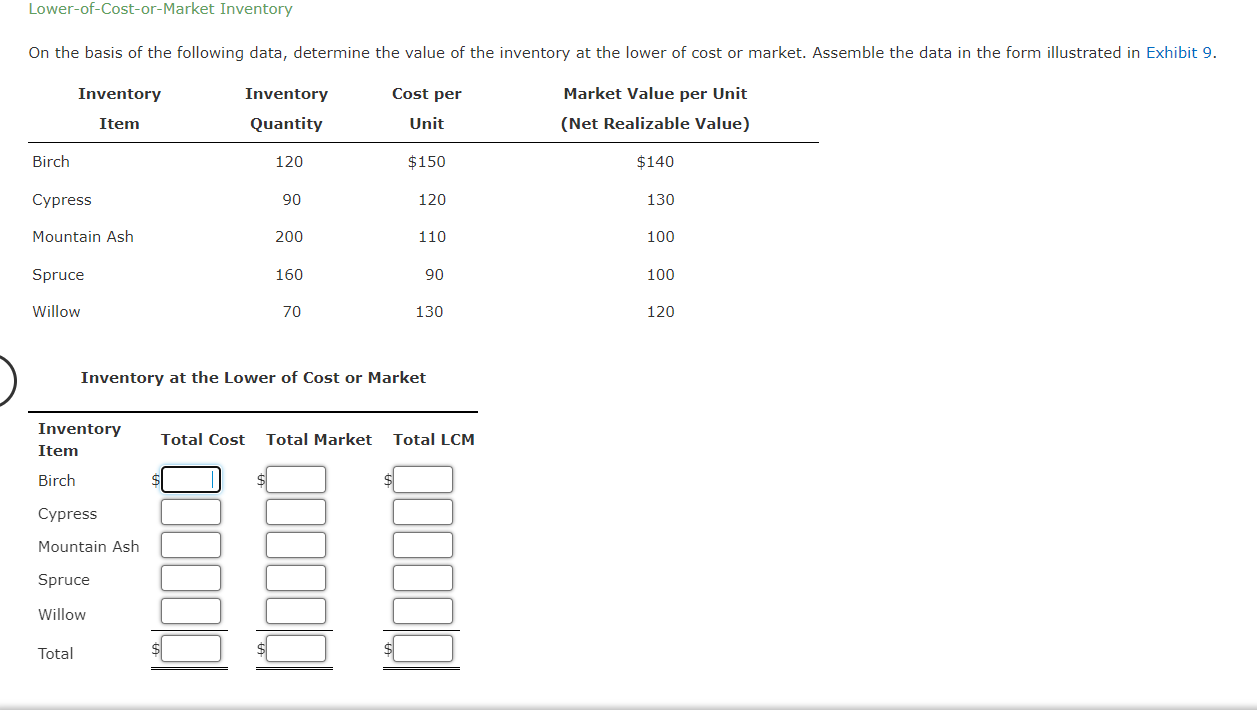

Question: Comparing Inventory MethodsLower - of - Cost - or - Market Inventory On the basis of the following data, determine the value of the inventory

Comparing Inventory MethodsLowerofCostorMarket Inventory

On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit

Inventory at the Lower of Cost or Market

Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results.

FIFO inventory

LIFO inventory

FIFO cost of merchandise sold

LIFO cost of merchandise sold

FIFO net income

LIFO net income

FIFO income taxes

LIFO income taxes

b Why would management prefer to use LIFO over FIFO in periods of rising prices?

The inventory value would be lower if LIFO rather than FIFO were used; thus, there is a tax advantage of using LIFO.Comparing Inventory Methods

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock