Question: Comparitve Income Statement Compute any missing amounts and comeplete the horizontal analysis. Liquidity and Solvency Measures Computations Number of days' saies in receivables Times interest

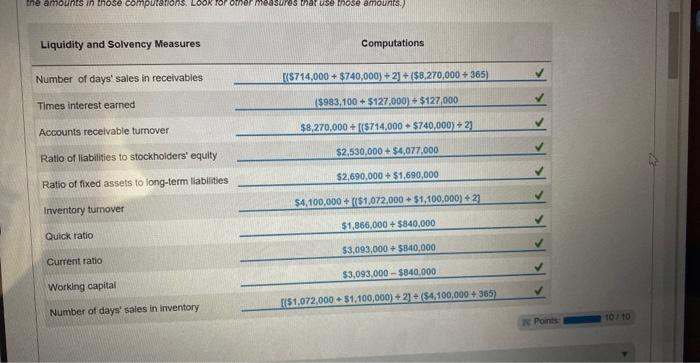

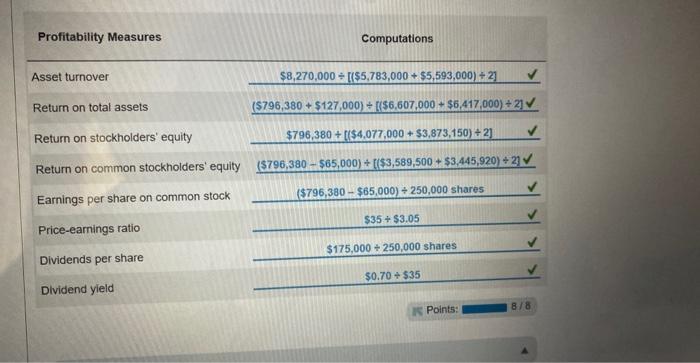

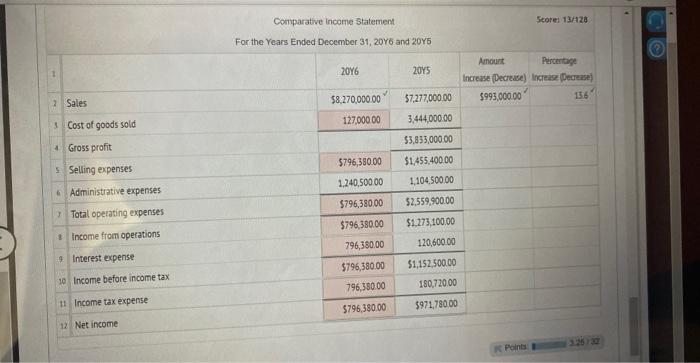

Liquidity and Solvency Measures Computations Number of days' saies in receivables Times interest earned Accounts receivable tumover Ratlo of liabillies to Ratio of fixed assets inventory tumover Quick ratio Current ratio Worklng capital \begin{tabular}{cc} \hline$4,100,000+(($1,072,000+$1,100,000)+2) & \\ \hline$1,866,000+$840,000 & \\ \hline$3,093,000+$840,000 & \\ \hline$3,093,000$840,000 & \\ \hline[($1,072,000+$1,100,000)+2]+($4,100,000+365) & \\ \hline \end{tabular} Number of days' sales in inventory Profitability Measures Computations Asset turnover Return on total assets Return on stockholders' equity Return on common stockholders' equity Earnings per share on common stock Price-earnings ratio Dividends per share Dlvidend yield Comparative income statement For the Years Ended December 31,20Y6 and 20Y5 1. Sales i. Cost of goods sold 4. Gross profit s. Selling expenses 6 Administrative expenses I Total operating expenses 4. Income from operations 9 Interest expense 10. Income before income tax it Income tax expense 12 Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts