Question: Compatibility Mode. Seved Design Chapter Nine Quilt Search Layout References Mailings Review Dau-ueur expense Dunya Mohammed CM View Help - U CCOUILLS ICCCIVIC Share 18)

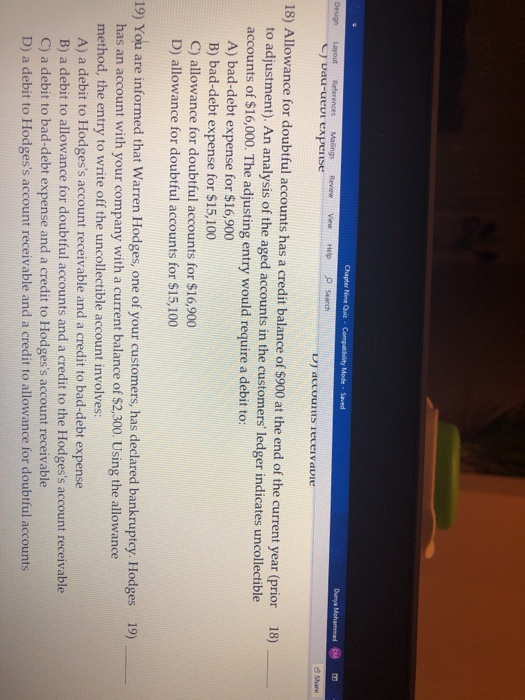

Compatibility Mode. Seved Design Chapter Nine Quilt Search Layout References Mailings Review Dau-ueur expense Dunya Mohammed CM View Help - U CCOUILLS ICCCIVIC Share 18) 18) Allowance for doubtful accounts has a credit balance of $900 at the end of the current year (prior to adjustment). An analysis of the aged accounts in the customers' ledger indicates uncollectible accounts of $16,000. The adjusting entry would require a debit to: A) bad-debt expense for $16,900 B) bad-debt expense for $15,100 C) allowance for doubtful accounts for $16,900 D) allowance for doubtful accounts for $15,100 19) 19) You are informed that Warren Hodges, one of your customers, has declared bankruptcy. Hodges has an account with your company with a current balance of $2,300. Using the allowance method, the entry to write off the uncollectible account involves: A) a debit to Hodges's account receivable and a credit to bad-debt expense B) a debit to allowance for doubtful accounts and a credit to the Hodges's account receivable C) a debit to bad-debt expense and a credit to Hodges's account receivable D) a debit to Hodges's account receivable and a credit to allowance for doubtful accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts