Question: - 4 Application Probleme (1) - Compatibility Mode - Seved to this PC . The S a int Heading Heading The 10. LO 19. Mr.

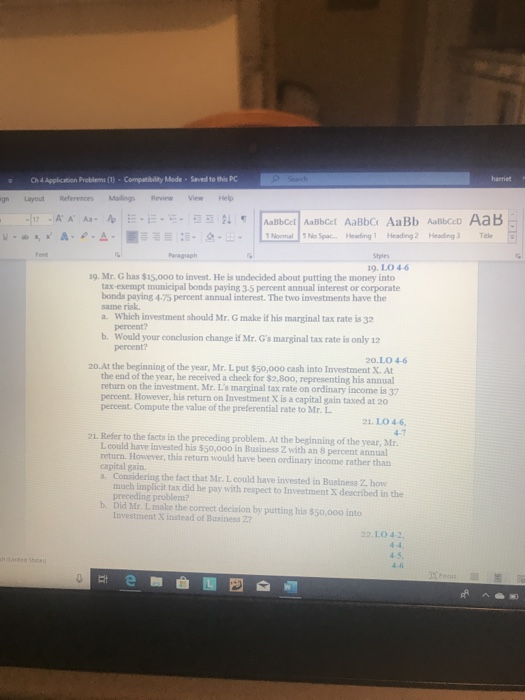

- 4 Application Probleme (1) - Compatibility Mode - Seved to this PC . The S a int Heading Heading The 10. LO 19. Mr. Gas $15.000 to invest. He is undecided about putting the money into tax exempt municipal bonds paying 35 percent annual interest or corporate bonds paying percent annual interest. The two investments have the amera Which investment should Mr. G make it his marginal tax rate is percent? b. Would your conclusion change if Mr. G's marginal tax rate is only 12 percent? 20.LO 46 20. At the beginning of the year, Mr. L put $50,000 cash into Investment X At the end of the year, he received a check for $2.800, representing his annual return on the investment. Mr. Ls marginal tax rate on ordinary income percent. How his return on Investment is a capital sain taxed at 20 percent Compute the value of the preferential rate to Mr. L. 21.1046 21. Refer to the facts in the preceding problem. At the beginning of the year Mr. L could have invested his 550.000 in Business with an 8 percent annual return. However, this return would have been ordinary income rather than Considering the fact that str.Lcould have invested in Bris bane chimit dhe pay with respect to intent de bed the Did tre the correct de ion by putt i to - 4 Application Probleme (1) - Compatibility Mode - Seved to this PC . The S a int Heading Heading The 10. LO 19. Mr. Gas $15.000 to invest. He is undecided about putting the money into tax exempt municipal bonds paying 35 percent annual interest or corporate bonds paying percent annual interest. The two investments have the amera Which investment should Mr. G make it his marginal tax rate is percent? b. Would your conclusion change if Mr. G's marginal tax rate is only 12 percent? 20.LO 46 20. At the beginning of the year, Mr. L put $50,000 cash into Investment X At the end of the year, he received a check for $2.800, representing his annual return on the investment. Mr. Ls marginal tax rate on ordinary income percent. How his return on Investment is a capital sain taxed at 20 percent Compute the value of the preferential rate to Mr. L. 21.1046 21. Refer to the facts in the preceding problem. At the beginning of the year Mr. L could have invested his 550.000 in Business with an 8 percent annual return. However, this return would have been ordinary income rather than Considering the fact that str.Lcould have invested in Bris bane chimit dhe pay with respect to intent de bed the Did tre the correct de ion by putt i to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts