Question: Competency Prepare cash flow statements and analysis. Instructions Using the indirect method and a worksheet, prepare the statement of cash flows for Coopie Awards. Access

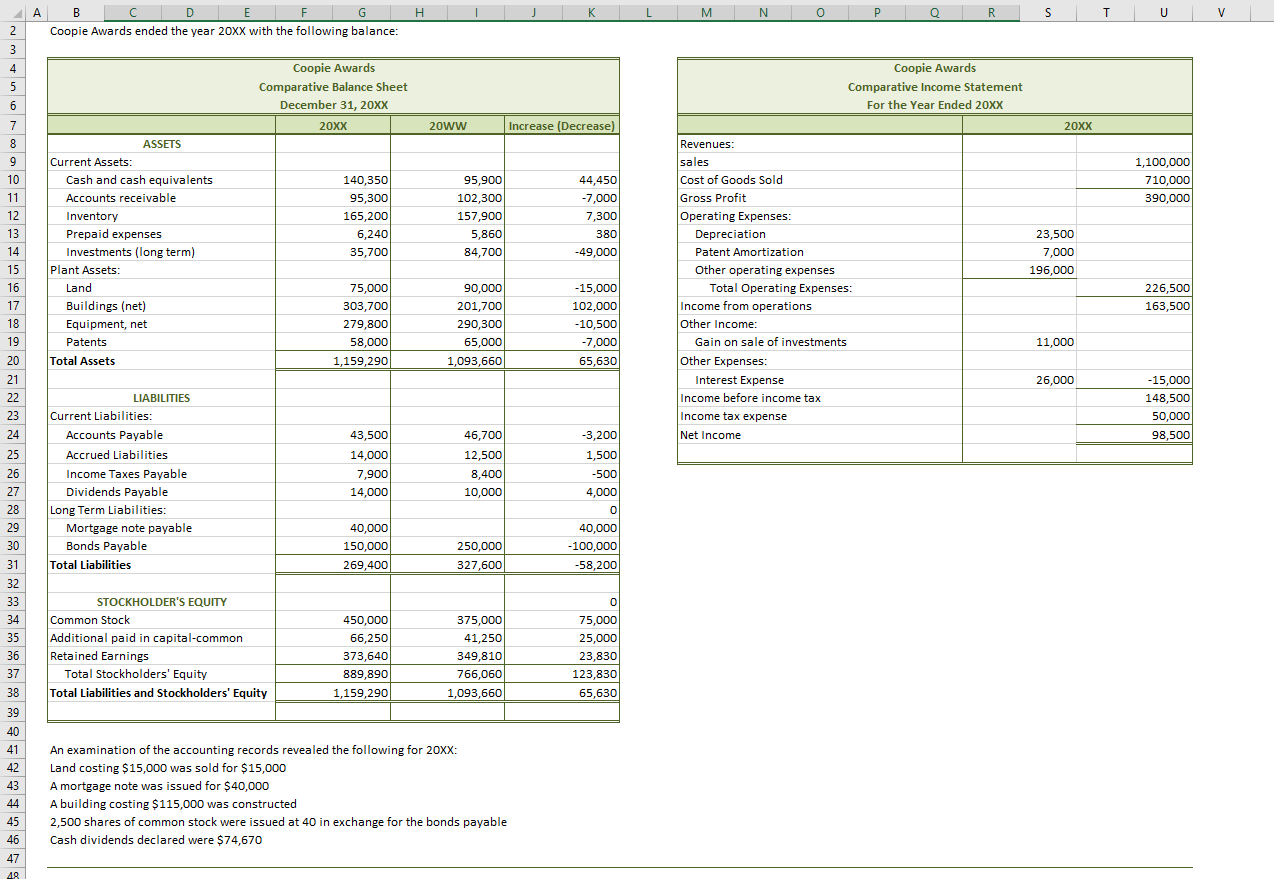

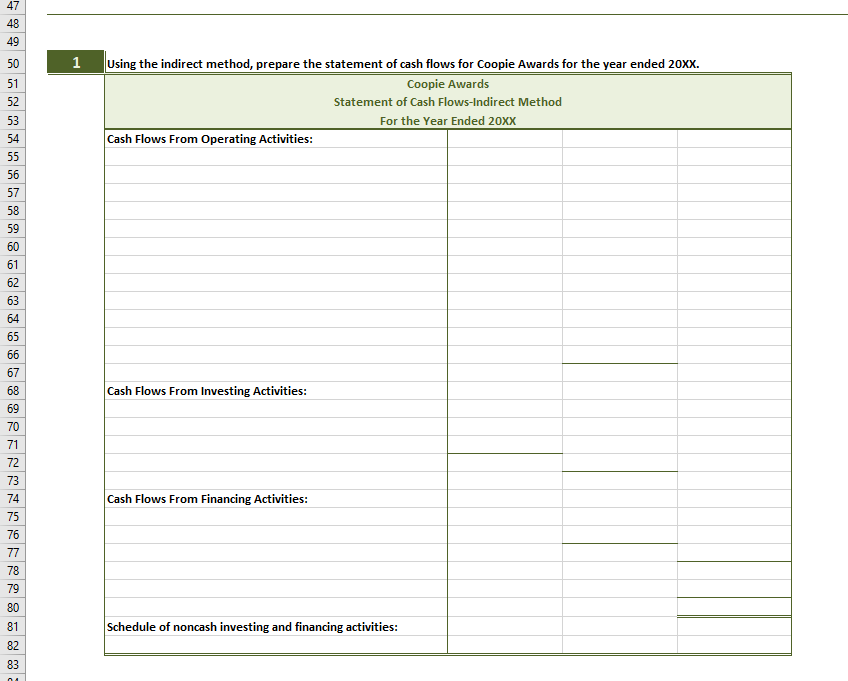

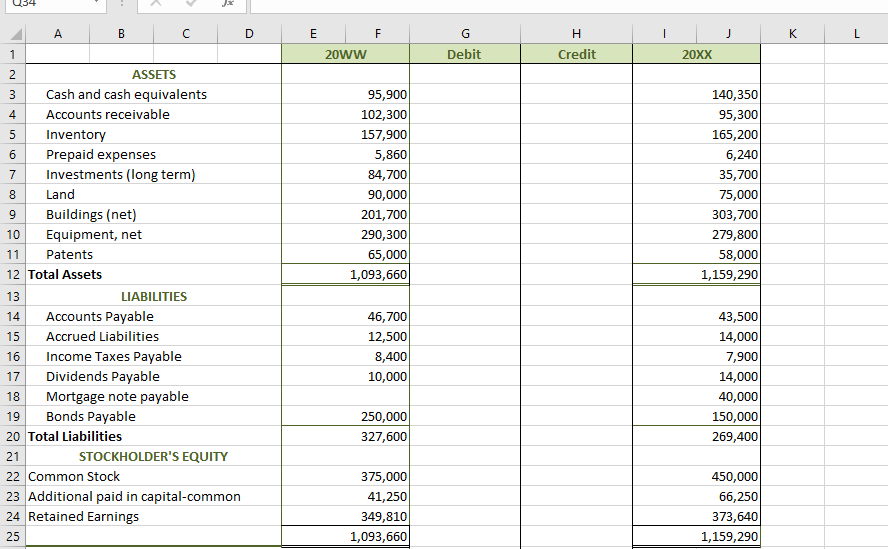

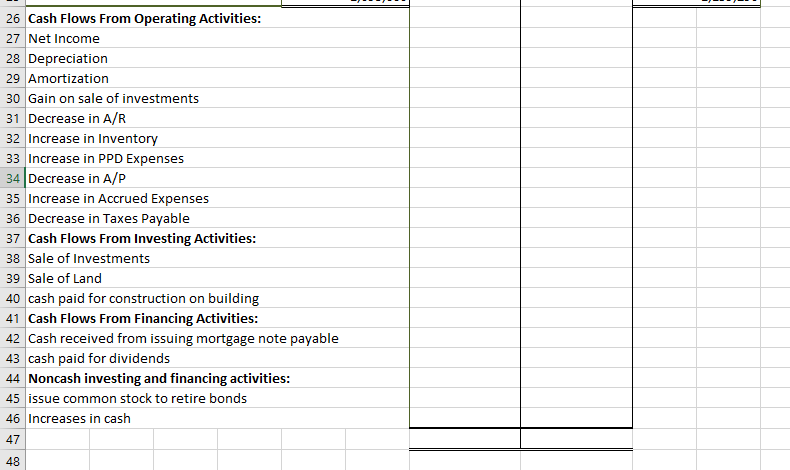

Competency Prepare cash flow statements and analysis. Instructions Using the indirect method and a worksheet, prepare the statement of cash flows for Coopie Awards. Access the financials and template to complete your work here. After completing the statement of cash flows, answer the following questions on the linked spreadsheet: 1. What is the cash conversion cycle for Coopie Awards? What does the cash conversion cycle indicate for Coopie Awards? 2. What can you surmise about the free cash flows for Coopie Awards? 3. What is the cash flow on assets for Coopie Awards? Explain what the cash flow on assets might indicate about Coopie Awards. Grading Rubrics - Click here to view the rubric for this assignment. 1. What is the Cash conversion Cycle for Coopie Awards? (show your work). What does the cash conversion cycle indicate for Coopie Awards? 2. What can you surmise about the free cash flows for Coopie Awards? 3. What is the Cash Flow on Assets for Coopie Awards? (show your work). What does the cash flow on assets indicate for Coopie Awards? Coopie Awards ended the year 20XX with the following balance: Land costing $15,000 was sold for $15,000 A mortgage note was issued for $40,000 A building costing $115,000 was constructed 2,500 shares of common stock were issued at 40 in exchange for the bonds payable Cash dividends declared were $74,670 1 Using the indirect method, prepare the statement of cash flows for Coopie Awards for the year ended 20x. Coopie Awards Statement of Cash Flows-Indirect Method For the Year Ended 20Xx Cash Flows From Operating Activities: Net Income Depreciation Amortization Gain on sale of investments Decrease in A/R Increase in Inventory Increase in PPD Expenses Decrease in A/P Increase in Accrued Expenses Decrease in Taxes Payable Cash Flows From Investing Activities: Sale of Investments Sale of Land cash paid for construction on building Cash Flows From Financing Activities: Cash received from issuing mortgage note payable cash paid for dividends Noncash investing and financing activities: issue common stock to retire bonds Increases in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts