Crassula PLC has experienced exponential growth in demand for its products that means that it has...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

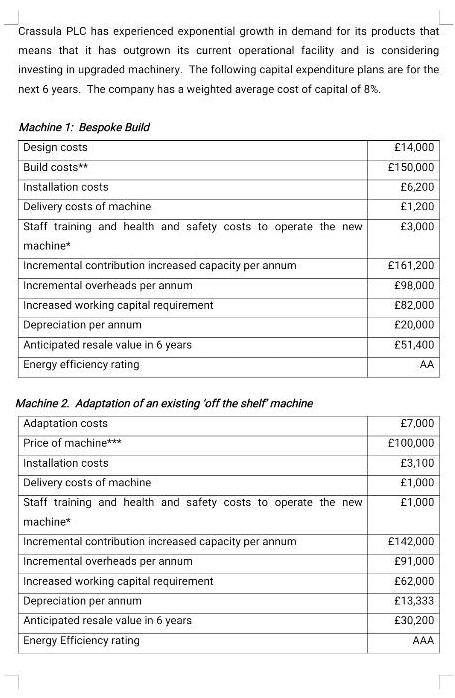

Crassula PLC has experienced exponential growth in demand for its products that means that it has outgrown its current operational facility and is considering investing in upgraded machinery. The following capital expenditure plans are for the next 6 years. The company has a weighted average cost of capital of 8%. Machine 1: Bespoke Build Design costs Build costs** Installation costs Delivery costs of machine Staff training and health and safety costs to operate the new machine* Incremental contribution increased capacity per annum Incremental overheads per annum Increased working capital requirement Depreciation per annum Anticipated resale value in 6 years Energy efficiency rating Machine 2. Adaptation of an existing off the shelf machine Adaptation costs Price of machine*** Installation costs Delivery costs of machine Staff training and health and safety costs to operate the new machine* Incremental contribution increased capacity per annum Incremental overheads per annum Increased working capital requirement Depreciation per annum Anticipated resale value in 6 years Energy Efficiency rating £14,000 £150,000 £6,200 £1,200 £3,000 £161,200 £98,000 £82,000 £20,000 £51,400 AA £7,000 £100,000 £3,100 £1,000 £1,000 £142,000 £91,000 £62,000 £13,333 £30,200 AAA The staff training and health and safety costs are a one off cost required before the machines are operational. ** The bespoke machine figures for build and installation are estimates provided by the contractors but are subject to potential cost increases. ***The price of the off the shelf machine is guaranteed for 6 months. Due to government growth strategies for industry Crassula PLC will pay no corporation tax on profits for the next 10 years. Required (show your workings for each answer): [14 marks] Write a report for Crassula PLC, clearly advising which proposal should be undertaken. Indicate any reservations regarding the methods used in your evaluation and discuss other strategic factors that Crassula PLC should consider. [10 marks] Explain why the NPV is considered the most theoretically superior of the four capex appraisal techniques used to evaluate this investment. Crassula PLC has experienced exponential growth in demand for its products that means that it has outgrown its current operational facility and is considering investing in upgraded machinery. The following capital expenditure plans are for the next 6 years. The company has a weighted average cost of capital of 8%. Machine 1: Bespoke Build Design costs Build costs** Installation costs Delivery costs of machine Staff training and health and safety costs to operate the new machine* Incremental contribution increased capacity per annum Incremental overheads per annum Increased working capital requirement Depreciation per annum Anticipated resale value in 6 years Energy efficiency rating Machine 2. Adaptation of an existing off the shelf machine Adaptation costs Price of machine*** Installation costs Delivery costs of machine Staff training and health and safety costs to operate the new machine* Incremental contribution increased capacity per annum Incremental overheads per annum Increased working capital requirement Depreciation per annum Anticipated resale value in 6 years Energy Efficiency rating £14,000 £150,000 £6,200 £1,200 £3,000 £161,200 £98,000 £82,000 £20,000 £51,400 AA £7,000 £100,000 £3,100 £1,000 £1,000 £142,000 £91,000 £62,000 £13,333 £30,200 AAA The staff training and health and safety costs are a one off cost required before the machines are operational. ** The bespoke machine figures for build and installation are estimates provided by the contractors but are subject to potential cost increases. ***The price of the off the shelf machine is guaranteed for 6 months. Due to government growth strategies for industry Crassula PLC will pay no corporation tax on profits for the next 10 years. Required (show your workings for each answer): [14 marks] Write a report for Crassula PLC, clearly advising which proposal should be undertaken. Indicate any reservations regarding the methods used in your evaluation and discuss other strategic factors that Crassula PLC should consider. [10 marks] Explain why the NPV is considered the most theoretically superior of the four capex appraisal techniques used to evaluate this investment.

Expert Answer:

Answer rating: 100% (QA)

In order to advise Crassula PLC on which proposal to undertake we need to calculate the Net Present Value NPV for each machine and then compare these values The NPV is calculated by finding the presen... View the full answer

Related Book For

Managerial Accounting Decision Making and Performance Management

ISBN: 978-0273764489

4th edition

Authors: Ray Proctor

Posted Date:

Students also viewed these finance questions

-

Read the case study and answer the question below with a one page response. What does a SWOT analysis reveal about the overall attractiveness of Under Armours situation? Founded in 1996 by former...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

This case study on project evaluation is applicable for beginning courses in corporate finance or finance strategy. Two alternative investment options are available to evaluate. Challenges are...

-

Jake Drewrey has total fixed monthly expenses of $ 1,340 and his gross monthly income is $3,875. What is his debt-to-income ratio? How does his ratio compare to the desired ratio?

-

A foundry form box with 25 kg of 200C hot sand is dumped into a bucket with 50 L water at 15C. Assuming no heat transfer with the surroundings and no boiling away of liquid water,...

-

A population has a mean of 25 and a standard deviation of 2. If it is sampled repeatedly with samples of size 49, what is the mean and standard deviation of the sample means? A uniform distribution...

-

What is the purpose of a declaration?

-

The Muck and Slurry merger has fallen through (see Section 33.2). But World Enterprises is determined to report earnings per share of $2.67. It therefore acquires the Wheelrim and Axle Company. You...

-

Hand written please 11B). A hot sphere with a surface area of 4.00m is in a large vacuum chamber so it can not cool by conduction or by convection - only by radiation. Inside the sphere is 100C...

-

Online Security Buddies provides consulting services to small businesses that require computer security but are too small to have their own IT person on staff. The business had the following account...

-

Your organization has a dedicated product testing team. The team was having a difficult time because they must wait for a product to be developed before they can start testing. That leaves them...

-

TAP purchased land on January 1 , 2 0 1 3 for $ 2 5 0 million. As of January 1 , 2 0 1 8 , the fair value was estimated to be $ 2 9 0 million. TAP purchased a trademark on January 1 , 2 0 1 6 for...

-

The fiscal year ends December 31 for Lake Hamilton Development. To provide funding for its Moonlight Bay project, LHD issued 7% bonds with a face amount of $600,000 on November 1, 2024. The bonds...

-

Prepare the bank reconciliation statement for the month ending June 30, 2019. Beckett Co. received its bank statement for the month ending June 30, 2019, and reconciled the statement balance to...

-

P1). A centrifugal pump, of 32" diameter, having the characteristics shown in Fig prob. 8 is used to pump water at 60F between two large open tanks through 1500 ft of 16-in.- diameter pipe. The...

-

Close Read Summary #2 Opal packs lightly for the trip, taking with her only two outfits and her teddy bear, whose name is Two Shoes. Vicky instructs Opal and Jacquie to say goodbye to their house as...

-

You are an owner of a casual clothing company Dress to Impress and have decided to branch into the athletic shoe market. You have not yet patented your designs. According to research done, you...

-

Periwinkle Company is a multinational organization. Its Parts Division is located in Lavender Land, while its Assembly Division is located in North Orchid. During the current year Periwinkle Companys...

-

The Alborg Company Ltd manufactures and sells doors and window frames to the building trade. It has been expanding rapidly over the last two years, experiencing an annual growth rate of 25%. The...

-

Charlesworth plc is a distributor of tiles to the building trade. The vast majority of these tiles are purchased in Eastern Europe and South-East Asia. It has been quite successful since it was set...

-

Shoes Ltd has operated in the retail sector for the past eight years. A summary of its financial statements for the year just ended is given below: Trading and profit and loss account £000...

-

Green, CPA, is considering audit risk at the financial statement level in planning the audit of National Federal Bank (NFB) Company's financial statements for the year ended December 31, 19X0. Audit...

-

For the following sets of circumstances, indicate whether the auditor would have a high or low risk of failing to detect these circumstances with appropriate audit procedures. Give reasons for your...

-

Using the audit risk model, calculate detection risk if the other risks are set at these levels. a. Individual audit risk of 5 percent. Inherent risk of 50 percent. Control risk of 40 percent. b....

Study smarter with the SolutionInn App